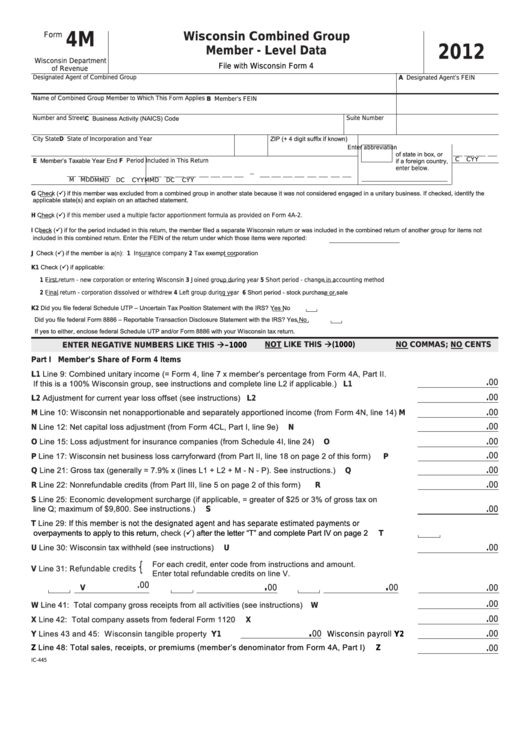

Form

4M

Wisconsin Combined Group

2012

Member - Level Data

Wisconsin Department

File with Wisconsin Form 4

of Revenue

Designated Agent of Combined Group

A Designated Agent’s FEIN

Name of Combined Group Member to Which This Form Applies

B Member’s FEIN

C Business Activity (NAICS) Code

Number and Street

Suite Number

ZIP (+ 4 digit suffix if known)

City

State

D State of Incorporation

and

Year

Enter abbreviation

of state in box, or

E Member’s Taxable Year End

C

C

Y

Y

if a foreign country,

F Period Included in This Return

enter below.

M M

D

D

M M

D

D

C

C

Y

Y

M M

D

D

C

C

Y

Y

Check

()

if this member was excluded from a combined group in another state because it was not considered engaged in a unitary business. If checked, identify the

G

applicable state(s) and explain on an attached statement.

Check

()

H

if this member used a multiple factor apportionment formula as provided on Form 4A-2.

Check

()

if for the period included in this return, the member filed a separate Wisconsin return or was included in the combined return of another group for items not

I

included in this combined return. Enter the FEIN of the return under which those items were reported:

Check

()

if the member is a(n): 1

Tax exempt corporation

J

Insurance company

2

K1 Check

()

if applicable:

1

First return - new corporation or entering Wisconsin

3

Joined group during year

5

Short period - change in accounting method

Short period - stock purchase or sale

2

Final return - corporation dissolved or withdrew

4

Left group during year

6

K2 Did you file federal Schedule UTP – Uncertain Tax Position Statement with the IRS?

Yes

No

Did you file federal Form 8886 – Reportable Transaction Disclosure Statement with the IRS?

Yes

No

If yes to either, enclose federal Schedule UTP and/or Form 8886 with your Wisconsin tax return.

(1000)

–1000

NOT LIKE THIS

ENTER NEGATIVE NUMBERS LIKE THIS

NO COMMAS; NO CENTS

Part I

Member’s Share of Form 4 Items

L1 Line 9: Combined unitary income (= Form 4, line 7 x member’s percentage from Form 4A, Part II.

If this is a 100% Wisconsin group, see instructions and complete line L2 if applicable.) . . . . . . . . . . . L1

.00

L2 Adjustment for current year loss offset (see instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . L2

.00

Line 10: Wisconsin net nonapportionable and separately apportioned income (from Form 4N, line 14) M

.00

M

Line 12: Net capital loss adjustment (from Form 4CL, Part I, line 9e) . . . . . . . . . . . . . . . . . . . . . . . . .

.00

N

N

Line 15: Loss adjustment for insurance companies (from Schedule 4I, line 24). . . . . . . . . . . . . . . . . .

.00

O

O

Line 17: Wisconsin net business loss carryforward (from Part II, line 18 on page 2 of this form) . . . .

.00

P

P

Line 21: Gross tax (generally = 7.9% x (lines L1 + L2 + M - N - P). See instructions.) . . . . . . . . . . . . .

.00

Q

Q

Line 22: Nonrefundable credits (from Part III, line 5 on page 2 of this form) . . . . . . . . . . . . . . . . . . . .

.00

R

R

Line 25: Economic development surcharge (if applicable, = greater of $25 or 3% of gross tax on

S

line Q; maximum of $9,800. See instructions.). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

S

Line 29:

T

If this member is not the designated agent and has separate estimated payments or

overpayments to apply to this return,

check

() after the letter “T” and complete Part IV on page

2. . . . .

T

Line 30: Wisconsin tax withheld (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

U

U

For each credit, enter code from instructions and amount.

{

Line 31: Refundable credits

V

Enter total refundable credits on line V.

.00

.

.

00

00

.00

V

Line 41: Total company gross receipts from all activities (see instructions). . . . . . . . . . . . . . . . . . . . .

.00

W

W

Line 42: Total company assets from federal Form 1120 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

X

X

.

Lines 43 and 45: Wisconsin tangible property Y1

00

.00

Y

Wisconsin payroll Y2

Line 48: Total sales, receipts, or premiums (member’s denominator from Form 4A, Part I) . . . . .

Z

Z

.00

IC-445

1

1 2

2