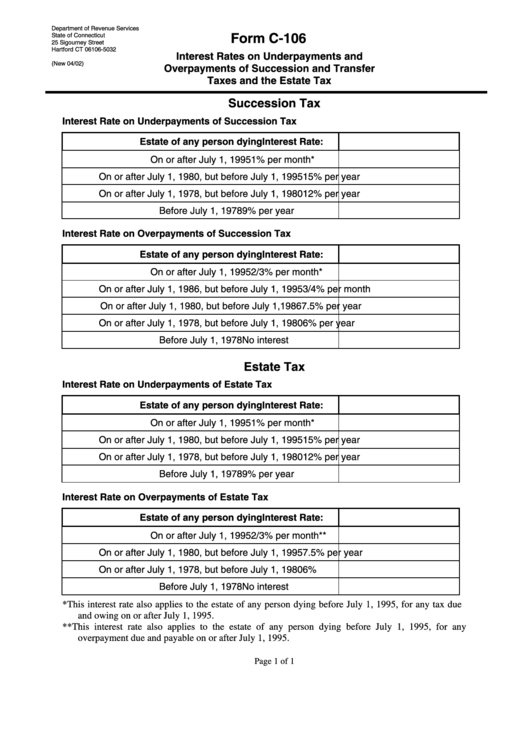

Form C-106 - Interest Rates On Underpayments And Overpayments Of Succession And Transfer Taxes And The Estate Tax

ADVERTISEMENT

Department of Revenue Services

State of Connecticut

Form C-106

25 Sigourney Street

Hartford CT 06106-5032

Interest Rates on Underpayments and

(New 04/02)

Overpayments of Succession and Transfer

Taxes and the Estate Tax

Succession Tax

Interest Rate on Underpayments of Succession Tax

Estate of any person dying

Interest Rate:

On or after July 1, 1995

1% per month*

On or after July 1, 1980, but before July 1, 1995

15% per year

On or after July 1, 1978, but before July 1, 1980

12% per year

Before July 1, 1978

9% per year

Interest Rate on Overpayments of Succession Tax

Estate of any person dying

Interest Rate:

On or after July 1, 1995

2/3% per month*

On or after July 1, 1986, but before July 1, 1995

3/4% per month

On or after July 1, 1980, but before July 1,1986

7.5% per year

On or after July 1, 1978, but before July 1, 1980

6% per year

Before July 1, 1978

No interest

Estate Tax

Interest Rate on Underpayments of Estate Tax

Estate of any person dying

Interest Rate:

On or after July 1, 1995

1% per month*

On or after July 1, 1980, but before July 1, 1995

15% per year

On or after July 1, 1978, but before July 1, 1980

12% per year

Before July 1, 1978

9% per year

Interest Rate on Overpayments of Estate Tax

Estate of any person dying

Interest Rate:

On or after July 1, 1995

2/3% per month**

On or after July 1, 1980, but before July 1, 1995

7.5% per year

On or after July 1, 1978, but before July 1, 1980

6%

Before July 1, 1978

No interest

*

This interest rate also applies to the estate of any person dying before July 1, 1995, for any tax due

and owing on or after July 1, 1995.

** This interest rate also applies to the estate of any person dying before July 1, 1995, for any

overpayment due and payable on or after July 1, 1995.

Page 1 of 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1