Form Il-501 - Payment Coupon

Download a blank fillable Form Il-501 - Payment Coupon in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form Il-501 - Payment Coupon with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

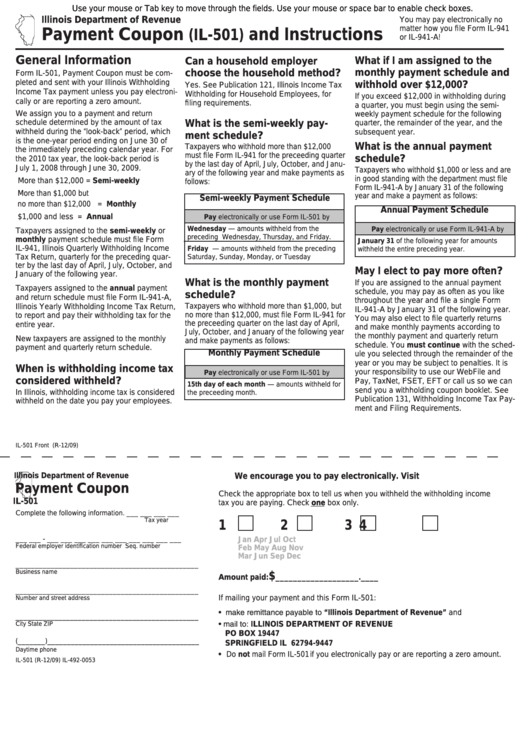

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

You may pay electronically no

matter how you file Form IL-941

Payment Coupon

and Instructions

(IL-501)

or IL-941-A!

General Information

What if I am assigned to the

Can a household employer

monthly payment schedule and

choose the household method?

Form IL-501, Payment Coupon must be com-

pleted and sent with your Illinois Withholding

withhold over $12,000?

Yes. See Publication 121, Illinois Income Tax

Income Tax payment unless you pay electroni-

Withholding for Household Employees, for

If you exceed $12,000 in withholding during

cally or are reporting a zero amount.

filing requirements.

a quarter, you must begin using the semi-

We assign you to a payment and return

weekly payment schedule for the following

schedule determined by the amount of tax

What is the semi-weekly pay-

quarter, the remainder of the year, and the

withheld during the “look-back” period, which

subsequent year.

ment schedule?

is the one-year period ending on June 30 of

What is the annual payment

Taxpayers who withhold more than $12,000

the immediately preceding calendar year. For

must file Form IL-941 for the preceeding quarter

schedule?

the 2010 tax year, the look-back period is

by the last day of April, July, October, and Janu-

July 1, 2008 through June 30, 2009.

Taxpayers who withhold $1,000 or less and are

ary of the following year and make payments as

in good standing with the department must file

More than $12,000

=

Semi-weekly

follows:

Form IL-941-A by January 31 of the following

More than $1,000 but

year and make a payment as follows:

Semi-weekly Payment Schedule

no more than $12,000 =

Monthly

Annual Payment Schedule

$1,000 and less

=

Annual

Pay electronically or use Form IL-501 by

Wednesday — amounts withheld from the

Pay electronically or use Form IL-941-A by

Taxpayers assigned to the semi-weekly or

preceding Wednesday, Thursday, and Friday.

monthly payment schedule must file Form

January 31 of the following year for amounts

IL-941, Illinois Quarterly Withholding Income

Friday — amounts withheld from the preceding

withheld the entire preceding year.

Tax Return, quarterly for the preceding quar-

Saturday, Sunday, Monday, or Tuesday

ter by the last day of April, July, October, and

May I elect to pay more often?

January of the following year.

What is the monthly payment

If you are assigned to the annual payment

Taxpayers assigned to the annual payment

schedule, you may pay as often as you like

schedule?

and return schedule must file Form IL-941-A,

throughout the year and file a single Form

Illinois Yearly Withholding Income Tax Return,

Taxpayers who withhold more than $1,000, but

IL-941-A by January 31 of the following year.

no more than $12,000, must file Form IL-941 for

to report and pay their withholding tax for the

You may also elect to file quarterly returns

the preceeding quarter on the last day of April,

entire year.

and make monthly payments according to

July, October, and January of the following year

the monthly payment and quarterly return

New taxpayers are assigned to the monthly

and make payments as follows:

schedule. You must continue with the sched-

payment and quarterly return schedule.

ule you selected through the remainder of the

Monthly Payment Schedule

year or you may be subject to penalties. It is

When is withholding income tax

your responsibility to use our WebFile and

Pay electronically or use Form IL-501 by

considered withheld?

Pay, TaxNet, FSET, EFT or call us so we can

15th day of each month — amounts withheld for

send you a withholding coupon booklet. See

In Illinois, withholding income tax is considered

the preceeding month.

Publication 131, Withholding Income Tax Pay-

withheld on the date you pay your employees.

ment and Filing Requirements.

IL-501 Front (R-12/09)

Illinois Department of Revenue

We encourage you to pay electronically. Visit tax.illinois.gov

Payment Coupon

Check the appropriate box to tell us when you withheld the withholding income

IL-501

tax you are paying. Check

one

box only.

Complete the following information.

___ ___ ___ ___

Tax year

1

2

3

4

___ ___ - ___ ___ ___ ___ ___ ___ ___ ___ ___ ___

Jan

Apr

Jul

Oct

Federal employer identification number

Seq. number

Feb

May

Aug

Nov

Mar

Jun

Sep

Dec

_______________________________________________

Business name

$

Amount paid:

___________________.____

_______________________________________________

If mailing your payment and this Form IL-501:

Number and street address

• make remittance payable to “Illinois Department of Revenue” and

_______________________________________________

• mail to:

ILLINOIS DEPARTMENT OF REVENUE

City

State

ZIP

PO BOX 19447

(_______)_______________________________________

SPRINGFIELD IL 62794-9447

Daytime phone

• Do not mail Form IL-501 if you electronically pay or are reporting a zero amount.

IL-501 (R-12/09) IL-492-0053

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2