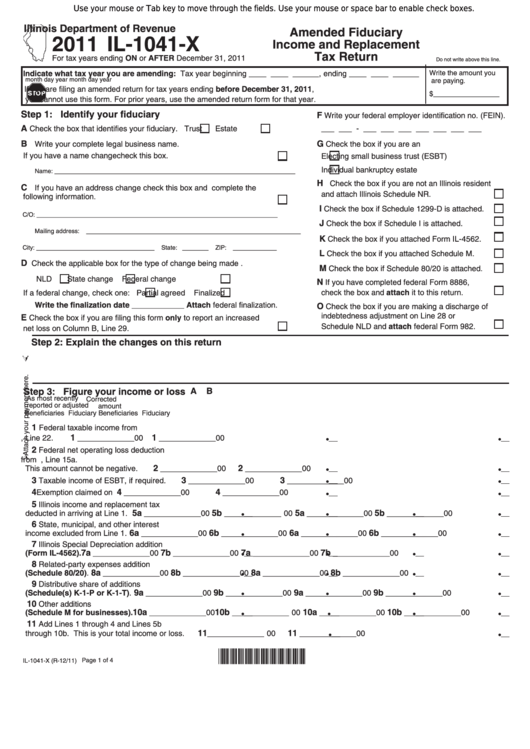

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

Amended Fiduciary

2011 IL-1041-X

Income and Replacement

Tax Return

For tax years ending ON or AFTER December 31, 2011

Do not write above this line.

Indicate what tax year you are amending: Tax year beginning ____ ____ ______, ending ____ ____ ______

Write the amount you

month

day

year

month

day

year

are paying.

If you are filing an amended return for tax years ending before December 31, 2011,

$_________________

you cannot use this form. For prior years, use the amended return form for that year.

Step 1: Identify your fiduciary

F

Write your federal employer identification no. (FEIN).

A

Check the box that identifies your fiduciary.

Trust

Estate

___ ___ - ___ ___ ___ ___ ___ ___ ___

B

G

Write your complete legal business name.

Check the box if you are an

If you have a name change check this box.

Electing small business trust (ESBT)

Individual bankruptcy estate

_______________________________________________________

Name:

H

Check the box if you are not an Illinois resident

C

If you have an address change check this box and complete the

and attach Illinois Schedule NR.

following information.

I

Check the box if Schedule 1299-D is attached.

_______________________________________________________

C/O:

J

Check the box if Schedule I is attached.

_________________________________________________

Mailing address:

K

Check the box if you attached Form IL-4562.

___________________________

______

__________

City:

State:

ZIP:

L

Check the box if you attached Schedule M.

D

Check the applicable box for the type of change being made .

M

Check the box if Schedule 80/20 is attached.

NLD

State change

Federal change

N

If you have completed federal Form 8886,

check the box and attach it to this return.

If a federal change, check one:

Partial agreed

Finalized

Write the finalization date ____________ Attach federal finalization.

O

Check the box if you are making a discharge of

indebtedness adjustment on Line 28 or

E

Check the box if you are filing this form only to report an increased

Schedule NLD and attach federal Form 982.

net loss on Column B, Line 29.

Step 2: Explain the changes on this return

Step 3: Figure your income or loss

A

B

As most recently

Corrected

reported or adjusted

amount

Beneficiaries

Fiduciary

Beneficiaries

Fiduciary

1

Federal taxable income from

1

1

U.S. Form 1041, Line 22.

_____________ 00

_____________ 00

2

Federal net operating loss deduction

from U.S. Form 1041, Line 15a.

2

2

This amount cannot be negative.

_____________ 00

_____________ 00

3

3

3

Taxable income of ESBT, if required.

_____________ 00

_____________ 00

4

4

4

Exemption claimed on U.S. Form 1041.

_____________ 00

_____________ 00

5

Illinois income and replacement tax

5a

5b

5a

5b

deducted in arriving at Line 1.

_____________ 00

_____________ 00

_____________ 00

_____________ 00

6

State, municipal, and other interest

6a

6b

6a

6b

income excluded from Line 1.

_____________ 00

_____________ 00

_____________ 00

_____________ 00

7

Illinois Special Depreciation addition

7a

7b

7a

7b

(Form IL-4562).

_____________ 00

_____________ 00

_____________ 00

_____________ 00

8

Related-party expenses addition

8a

8b

8a

8b

(Schedule 80/20).

_____________ 00

_____________ 00

_____________ 00

_____________ 00

9

Distributive share of additions

9a

9b

9a

9b

(Schedule(s) K-1-P or K-1-T).

_____________ 00

_____________ 00

_____________ 00

_____________ 00

10

Other additions

10a

10b

10a

10b

(Schedule M for businesses).

_____________ 00

_____________ 00

_____________ 00

_____________ 00

11

Add Lines 1 through 4 and Lines 5b

11

11

through 10b. This is your total income or loss.

_____________ 00

_____________ 00

*164101110*

Page 1 of 4

IL-1041-X (R-12/11)

1

1 2

2 3

3 4

4