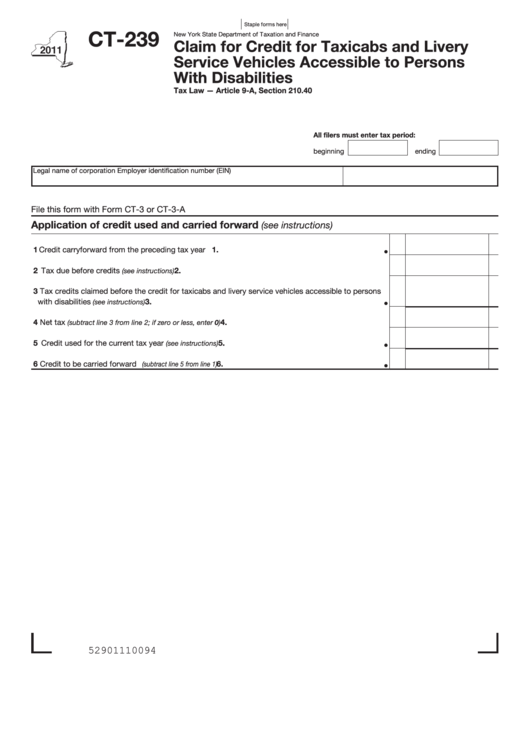

Form Ct-239 - Claim For Credit For Taxicabs And Livery Service Vehicles Accessible To Persons With Disabilities - 2011

ADVERTISEMENT

Staple forms here

CT-239

New York State Department of Taxation and Finance

Claim for Credit for Taxicabs and Livery

Service Vehicles Accessible to Persons

With Disabilities

Tax Law — Article 9-A, Section 210.40

All filers must enter tax period:

beginning

ending

Legal name of corporation

Employer identification number (EIN)

File this form with Form CT-3 or CT-3-A

Application of credit used and carried forward

(see instructions)

1 Credit carryforward from the preceding tax year ..............................................................................

1.

2 Tax due before credits

................................................................................................

2.

(see instructions)

3 Tax credits claimed before the credit for taxicabs and livery service vehicles accessible to persons

3.

with disabilities

......................................................................................................

(see instructions)

4 Net tax

...........................................................................

4.

(subtract line 3 from line 2; if zero or less, enter 0)

5 Credit used for the current tax year

..........................................................................

5.

(see instructions)

6 Credit to be carried forward

6.

...........................................................................

(subtract line 5 from line 1)

52901110094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2