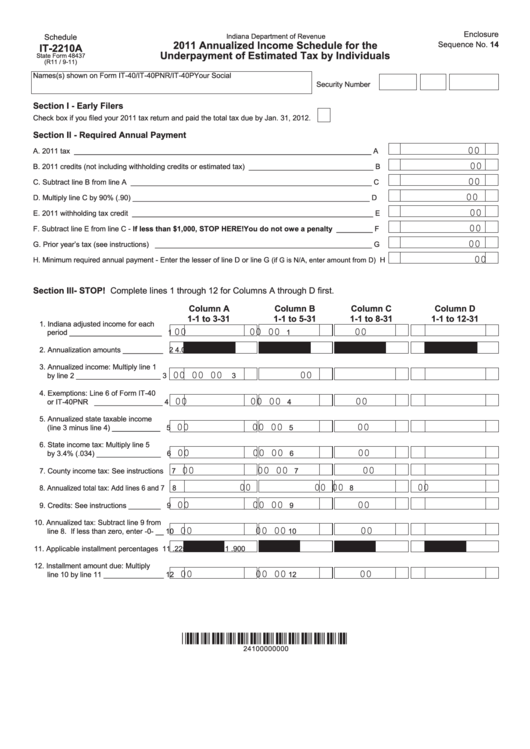

Enclosure

Indiana Department of Revenue

Schedule

2011 Annualized Income Schedule for the

Sequence No. 14

IT-2210A

Underpayment of Estimated Tax by Individuals

State Form 48437

(R11 / 9-11)

Names(s) shown on Form IT-40/IT-40PNR/IT-40P

Your Social

Security Number

Section I - Early Filers

Check box if you filed your 2011 tax return and paid the total tax due by Jan. 31, 2012.

Section II - Required Annual Payment

00

A. 2011 tax __________________________________________________________________________

A

00

B. 2011 credits (not including withholding credits or estimated tax) _______________________________

B

00

C. Subtract line B from line A ____________________________________________________________

C

00

D. Multiply line C by 90% (.90) ___________________________________________________________

D

00

E. 2011 withholding tax credit ____________________________________________________________

E

00

F. Subtract line E from line C - If less than $1,000, STOP HERE! You do not owe a penalty _________

F

00

G. Prior year’s tax (see instructions) ______________________________________________________

G

00

H. Minimum required annual payment - Enter the lesser of line D or line G

(if G is N/A, enter amount from D)

H

Section III - STOP! Complete lines 1 through 12 for Columns A through D first.

Column A

Column B

Column C

Column D

1-1 to 3-31

1-1 to 5-31

1-1 to 8-31

1-1 to 12-31

1. Indiana adjusted income for each

00

00

00

00

period _______________________

1

1

2. Annualization amounts __________

2

4.0

2.4

1.5

2

1.0

3. Annualized income: Multiply line 1

00

00

00

00

by line 2 _____________________

3

3

4. Exemptions: Line 6 of Form IT-40

00

00

00

00

or IT-40PNR _________________

4

4

5. Annualized state taxable income

00

00

00

00

(line 3 minus line 4) ____________

5

5

6. State income tax: Multiply line 5

00

00

00

00

by 3.4% (.034) ________________

6

6

00

00

00

00

7. County income tax: See instructions

7

7

00

00

00

00

8. Annualized total tax: Add lines 6 and 7

8

8

00

00

00

00

9. Credits: See instructions ________

9

9

10. Annualized tax: Subtract line 9 from

00

00

00

00

line 8. If less than zero, enter -0- __

10

10

11. Applicable installment percentages

11

.225

.450

.675 11

.900

12. Installment amount due: Multiply

00

00

00

00

line 10 by line 11 _______________

12

12

*24100000000*

24100000000

1

1 2

2 3

3 4

4 5

5