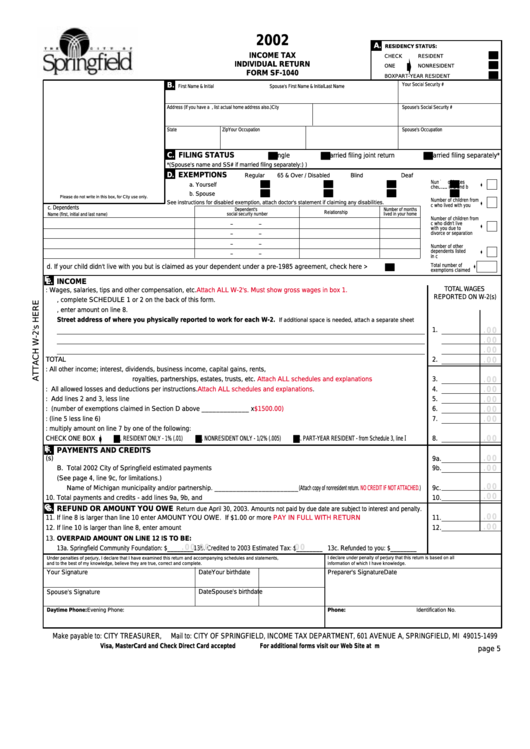

Form Sf-1040 - Income Tax Individual Return - 2002

ADVERTISEMENT

2002

A.

RESIDENCY STATUS:

INCOME TAX

CHECK

RESIDENT

INDIVIDUAL RETURN

ONE

NONRESIDENT

FORM SF-1040

BOX

PART-YEAR RESIDENT

B.

Your Social Security #

First Name & Initial

Spouse's First Name & Initial

Last Name

Spouse's Social Security #

Address (If you have a P.O. Box, list actual home address also.)

City

State

Zip

Your Occupation

Spouse's Occupation

C.

FILING STATUS

Single

Married filing joint return

Married filing separately*

*(Spouse's name and SS# if married filing separately:)

)

D.

EXEMPTIONS

Regular

65 & Over / Disabled

Blind

Deaf

Number of boxes

a. Yourself

checked in a and b

b. Spouse

Please do not write in this box, for City use only.

Number of children from

See instructions for disabled exemption, attach doctor's statement if claiming any disabilities.

c who lived with you

c. Dependents

Dependent's

Number of months

Relationship

Name (first, initial and last name)

social security number

lived in your home

Number of children from

c who didn't live

–

–

with you due to

divorce or separation

–

–

–

–

Number of other

dependents listed

–

–

in c

Total number of

d. If your child didn't live with you but is claimed as your dependent under a pre-1985 agreement, check here >

exemptions claimed

E.

E.

INCOME

TOTAL WAGES

1. TOTAL W-2 INCOME: Wages, salaries, tips and other compensation, etc.

Attach ALL W-2's. Must show gross wages in box 1.

REPORTED ON W-2(s)

A. NONRESIDENT - If applicable, complete SCHEDULE 1 or 2 on the back of this form.

B. PART-YEAR RESIDENT - Complete SCHEDULE 3 on back of this form, enter amount on line 8.

Street address of where you physically reported to work for each W-2.

If additional space is needed, attach a separate sheet

1.

. 00

. 00

. 00

2. TOTAL W-2 INCOME

TOTAL

2.

. 00

3. ADDITIONS TO INCOME: All other income; interest, dividends, business income, capital gains, rents,

. 00

royalties, partnerships, estates, trusts, etc.

Attach ALL schedules and

explanations...........................

3.

. 00

4. DEDUCTIONS FROM INCOME: All allowed losses and deductions per instructions.

Attach ALL schedules and explanations

.

4.

5. ADJUSTED INCOME: Add lines 2 and 3, less line 4....................................................................................................................

5.

. 00

. 00

6. EXEMPTIONS: (number of exemptions claimed in Section D above _____________ x

$1500.00)

............................................

6.

. 00

7. TAXABLE INCOME: (line 5 less line 6) ..........................................................................................................................................

7.

8. TAX: multiply amount on line 7 by one of the following:

. 00

I

CHECK ONE BOX

A. RESIDENT ONLY - 1% (.01)

B. NONRESIDENT ONLY - 1/2% (.005)

C. PART-YEAR RESIDENT - from Schedule 3, line

.........

8.

F.

F.

PAYMENTS AND CREDITS

. 00

9. A. Springfield tax withheld from W-2(s).........................................................................................................................................

9a.

. 00

B. Total 2002 City of Springfield estimated payments ..................................................................................................................

9b.

C. Credit for income tax liability paid to another Michigan municipality or by a partnership. (See page 4, line 9c, for limitations.)

. 00

Name of Michigan municipality and/or partnership. _______________________(Attach copy of nonresident return.

NO CREDIT IF NOT

ATTACHED.)

9c.

. 00

10. Total payments and credits - add lines 9a, 9b, and 9c ...................................................................................................................

10.

G.

G.

REFUND OR AMOUNT YOU OWE

Return due April 30, 2003. Amounts not paid by due date are subject to interest and penalty.

. 00

11. If line 8 is larger than line 10 enter AMOUNT YOU OWE. If $1.00 or more

PAY IN FULL WITH

RETURN..................................

11.

. 00

12. If line 10 is larger than line 8, enter amount OVERPAID................................................................................................................

12.

13. OVERPAID AMOUNT ON LINE 12 IS TO BE:

. 00

. 00

. 00

13a. Springfield Community Foundation: $________ 13b. Credited to 2003 Estimated Tax: $________ 13c. Refunded to you: $________

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements,

I declare under penalty of perjury that this return is based on all

and to the best of my knowledge, believe they are true, correct and complete.

information of which I have knowledge.

Your Signature

Date

Your birthdate

Preparer's Signature

Date

Spouse's Signature

Date

Spouse's birthdate

Daytime Phone:

Evening Phone:

Phone:

Identification No.

Make payable to: CITY TREASURER,

Mail to: CITY OF SPRINGFIELD, INCOME TAX DEPARTMENT, 601 AVENUE A, SPRINGFIELD, MI 49015-1499

Visa, MasterCard and Check Direct Card accepted

For additional forms visit our Web Site at

page 5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2