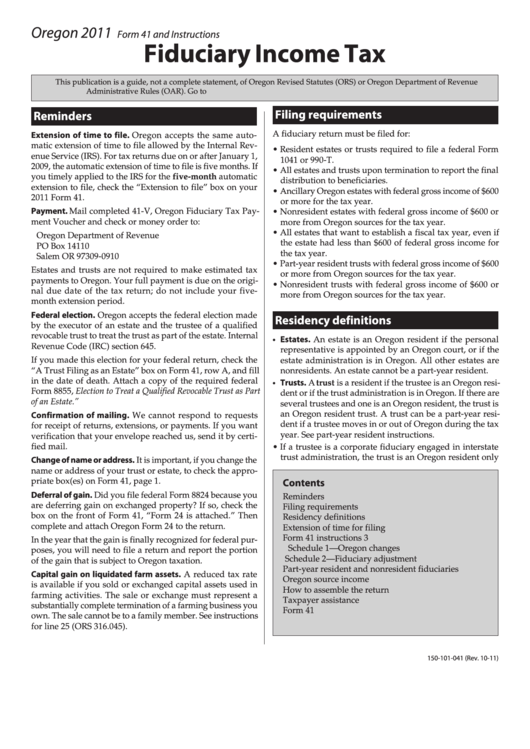

Oregon 2011

Form 41 and Instructions

Fiduciary Income Tax

This publication is a guide, not a complete statement, of Oregon Revised Statutes (ORS) or Oregon Department of Revenue

Administrative Rules (OAR). Go to for ORS and OAR cites.

Filing requirements

Reminders

A fiduciary return must be filed for:

Extension of time to file. Oregon accepts the same auto-

matic extension of time to file allowed by the Internal Rev-

• Resident estates or trusts required to file a federal Form

enue Service (IRS). For tax returns due on or after January 1,

1041 or 990-T.

2009, the automatic extension of time to file is five months. If

• All estates and trusts upon termination to report the final

you timely applied to the IRS for the five-month automatic

distribution to beneficiaries.

extension to file, check the “Extension to file” box on your

• Ancillary Oregon estates with federal gross income of $600

2011 Form 41.

or more for the tax year.

Payment. Mail completed 41-V, Oregon Fiduciary Tax Pay-

• Nonresident estates with federal gross income of $600 or

ment Voucher and check or money order to:

more from Oregon sources for the tax year.

• All estates that want to establish a fiscal tax year, even if

Oregon Department of Revenue

the estate had less than $600 of federal gross income for

PO Box 14110

the tax year.

Salem OR 97309-0910

• Part-year resident trusts with federal gross income of $600

Estates and trusts are not required to make estimated tax

or more from Oregon sources for the tax year.

payments to Oregon. Your full payment is due on the origi-

• Nonresident trusts with federal gross income of $600 or

nal due date of the tax return; do not include your five-

more from Oregon sources for the tax year.

month extension period.

Federal election. Oregon accepts the federal election made

Residency definitions

by the executor of an estate and the trustee of a qualified

revocable trust to treat the trust as part of the estate. Internal

• Estates. An estate is an Oregon resident if the personal

Revenue Code (IRC) section 645.

representative is appointed by an Oregon court, or if the

If you made this election for your federal return, check the

estate administration is in Oregon. All other estates are

“A Trust Filing as an Estate” box on Form 41, row A, and fill

nonresidents. An estate cannot be a part-year resident.

in the date of death. Attach a copy of the required federal

• Trusts. A trust is a resident if the trustee is an Oregon resi-

Form 8855, Election to Treat a Qualified Revocable Trust as Part

dent or if the trust administration is in Oregon. If there are

of an Estate.”

several trustees and one is an Oregon resident, the trust is

an Oregon resident trust. A trust can be a part-year resi-

Confirmation of mailing. We cannot respond to requests

dent if a trustee moves in or out of Oregon during the tax

for receipt of returns, extensions, or payments. If you want

year. See part-year resident instructions.

verification that your envelope reached us, send it by certi-

fied mail.

• If a trustee is a corporate fiduciary engaged in interstate

trust administration, the trust is an Oregon resident only

Change of name or address. It is important, if you change the

name or address of your trust or estate, to check the appro-

priate box(es) on Form 41, page 1.

Contents

Deferral of gain. Did you file federal Form 8824 because you

Reminders ........................................................................1

are deferring gain on exchanged property? If so, check the

Filing requirements .........................................................1

box on the front of Form 41, “Form 24 is attached.” Then

Residency definitions ......................................................1

complete and attach Oregon Form 24 to the return.

Extension of time for filing ............................................2

Form 41 instructions ......................................................3

In the year that the gain is finally recognized for federal pur-

Schedule 1—Oregon changes ......................................4

poses, you will need to file a return and report the portion

Schedule 2—Fiduciary adjustment ............................4

of the gain that is subject to Oregon taxation.

Part-year resident and nonresident fiduciaries ...........5

Capital gain on liquidated farm assets. A reduced tax rate

Oregon source income ....................................................6

is available if you sold or exchanged capital assets used in

How to assemble the return ...........................................6

farming activities. The sale or exchange must represent a

Taxpayer assistance .........................................................6

substantially complete termination of a farming business you

Form 41 .............................................................................7

own. The sale cannot be to a family member. See instructions

for line 25 (ORS 316.045).

150-101-041 (Rev. 10-11)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8