Ira/qualified Plan Distribution Request Form (Sample)

ADVERTISEMENT

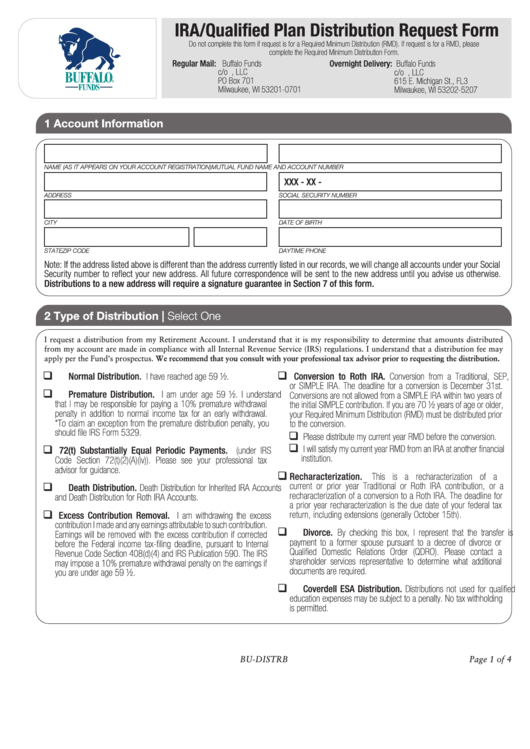

IRA/Qualified Plan Distribution Request Form

Do not complete this form if request is for a Required Minimum Distribution (RMD). If request is for a RMD, please

complete the Required Minimum Distribution Form.

Regular Mail: Buffalo Funds

Overnight Delivery: Buffalo Funds

c/o U.S. Bancorp Fund Services, LLC

c/o U.S. Bancorp Fund Services, LLC

PO Box 701

615 E. Michigan St., FL3

Milwaukee, WI 53201-0701

Milwaukee, WI 53202-5207

1 Account Information

NAME (AS IT APPEARS ON YOUR ACCOUNT REGISTRATION)

MUTUAL FUND NAME AND ACCOUNT NUMBER

XXX - XX -

ADDRESS

SOCIAL SECURITY NUMBER

CITY

DATE OF BIRTH

STATE

ZIP CODE

DAYTIME PHONE

Note: If the address listed above is different than the address currently listed in our records, we will change all accounts under your Social

Security number to reflect your new address. All future correspondence will be sent to the new address until you advise us otherwise.

Distributions to a new address will require a signature guarantee in Section 7 of this form.

2 Type of Distribution | Select One

I request a distribution from my Retirement Account. I understand that it is my responsibility to determine that amounts distributed

from my account are made in compliance with all Internal Revenue Service (IRS) regulations. I understand that a distribution fee may

apply per the Fund’s prospectus. We recommend that you consult with your professional tax advisor prior to requesting the distribution.

N ormal Distribution. I have reached age 59 ½.

Conversion to Roth IRA. Conversion from a Traditional, SEP,

or SIMPLE IRA. The deadline for a conversion is December 31st.

P remature Distribution. I am under age 59 ½. I understand

Conversions are not allowed from a SIMPLE IRA within two years of

that I may be responsible for paying a 10% premature withdrawal

the initial SIMPLE contribution. If you are 70 ½ years of age or older,

penalty in addition to normal income tax for an early withdrawal.

your Required Minimum Distribution (RMD) must be distributed prior

*To claim an exception from the premature distribution penalty, you

to the conversion.

should file IRS Form 5329.

Please distribute my current year RMD before the conversion.

I will satisfy my current year RMD from an IRA at another financial

72(t) Substantially Equal Periodic Payments. (under IRS

institution.

Code Section 72(t)(2)(A)(iv)). Please see your professional tax

advisor for guidance.

Recharacterization.

This is a recharacterization of a

current or prior year Traditional or Roth IRA contribution, or a

D eath Distribution. Death Distribution for Inherited IRA Accounts

recharacterization of a conversion to a Roth IRA. The deadline for

and Death Distribution for Roth IRA Accounts.

a prior year recharacterization is the due date of your federal tax

return, including extensions (generally October 15th).

Excess Contribution Removal. I am withdrawing the excess

contribution I made and any earnings attributable to such contribution.

D ivorce. By checking this box, I represent that the transfer is

Earnings will be removed with the excess contribution if corrected

payment to a former spouse pursuant to a decree of divorce or

before the Federal income tax-filing deadline, pursuant to Internal

Qualified Domestic Relations Order (QDRO). Please contact a

Revenue Code Section 408(d)(4) and IRS Publication 590. The IRS

shareholder services representative to determine what additional

may impose a 10% premature withdrawal penalty on the earnings if

documents are required.

you are under age 59 ½.

C overdell ESA Distribution. Distributions not used for qualified

education expenses may be subject to a penalty. No tax withholding

is permitted.

BU-DISTRB

Page 1 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4