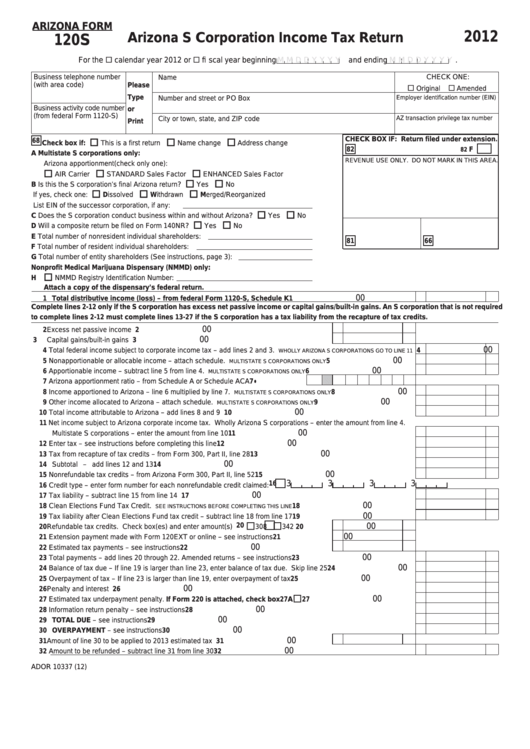

ARIZONA FORM

2012

Arizona S Corporation Income Tax Return

120S

For the

calendar year 2012 or

fi scal year beginning

M M D D Y Y Y Y

and ending

M M D D Y Y Y Y

.

Business telephone number

Name

CHECK ONE:

(with area code)

Please

Original

Amended

Type

Employer identification number (EIN)

Number and street or PO Box

Business activity code number

or

(from federal Form 1120-S)

AZ transaction privilege tax number

City or town, state, and ZIP code

Print

CHECK BOX IF: Return filed under extension.

68 Check box if:

This is a first return

Name change

Address change

82

F

82

A

Multistate S corporations only:

REVENUE USE ONLY. DO NOT MARK IN THIS AREA.

Arizona apportionment (check only one):

AIR Carrier

STANDARD Sales Factor

ENHANCED Sales Factor

B

Is this the S corporation’s final Arizona return?

Yes

No

If yes, check one:

Dissolved

Withdrawn

Merged/Reorganized

List EIN of the successor corporation, if any:

C

Does the S corporation conduct business within and without Arizona?

Yes

No

D

Will a composite return be filed on Form 140NR?

Yes

No

E

Total number of nonresident individual shareholders:

81

66

F

Total number of resident individual shareholders:

G Total number of entity shareholders (See instructions, page 3):

Nonprofit Medical Marijuana Dispensary (NMMD) only:

H

NMMD Registry Identification Number:

Attach a copy of the dispensary’s federal return.

00

1 Total distributive income (loss) – from federal Form 1120-S, Schedule K ................................................................

1

Complete lines 2-12 only if the S corporation has excess net passive income or capital gains/built-in gains. An S corporation that is not required

to complete lines 2-12 must complete lines 13-27 if the S corporation has a tax liability from the recapture of tax credits.

00

2 Excess net passive income ..................................................................................................

2

00

3 Capital gains/built-in gains ....................................................................................................

3

00

4 Total federal income subject to corporate income tax – add lines 2 and 3.

4

WHOLLY ARIZONA S CORPORATIONS GO TO LINE 11

00

5 Nonapportionable or allocable income – attach schedule.

............................................

5

MULTISTATE S CORPORATIONS ONLY

00

6 Apportionable income – subtract line 5 from line 4.

.......................................................

6

MULTISTATE S CORPORATIONS ONLY

•

7 Arizona apportionment ratio – from Schedule A or Schedule ACA ..........................

7

00

8 Income apportioned to Arizona – line 6 multiplied by line 7.

..........................................

8

MULTISTATE S CORPORATIONS ONLY

00

9 Other income allocated to Arizona – attach schedule.

..................................................

9

MULTISTATE S CORPORATIONS ONLY

00

10 Total income attributable to Arizona – add lines 8 and 9 .................................................................................................. 10

11 Net income subject to Arizona corporate income tax. Wholly Arizona S corporations – enter the amount from line 4.

00

Multistate S corporations – enter the amount from line 10 ...............................................................................................

11

00

12 Enter tax – see instructions before completing this line.................................................................................................... 12

00

13 Tax from recapture of tax credits – from Form 300, Part II, line 28................................................................................... 13

00

14 Subtotal – add lines 12 and 13 ......................................................................................................................................... 14

00

15 Nonrefundable tax credits – from Arizona Form 300, Part II, line 52 ................................................................................ 15

3

3

3

3

16 Credit type – enter form number for each nonrefundable credit claimed: 16

00

17 Tax liability – subtract line 15 from line 14 ........................................................................................................................ 17

00

18 Clean Elections Fund Tax Credit.

............................................................. 18

SEE INSTRUCTIONS BEFORE COMPLETING THIS LINE

00

19 Tax liability after Clean Elections Fund tax credit – subtract line 18 from line 17 ............................................................. 19

20 Refundable tax credits. Check box(es) and enter amount(s) ............ 20

00

308

342

20

00

21 Extension payment made with Form 120EXT or online – see instructions ...........................

21

00

22 Estimated tax payments – see instructions ..........................................................................

22

00

23 Total payments – add lines 20 through 22. Amended returns – see instructions ............................................................. 23

00

24 Balance of tax due – If line 19 is larger than line 23, enter balance of tax due. Skip line 25 ........................................... 24

00

25 Overpayment of tax – If line 23 is larger than line 19, enter overpayment of tax.............................................................. 25

00

26 Penalty and interest .......................................................................................................................................................... 26

00

27 Estimated tax underpayment penalty. If Form 220 is attached, check box ...................................................... 27A

27

00

28 Information return penalty – see instructions .................................................................................................................... 28

00

29 TOTAL DUE – see instructions....................................................................................Payment must accompany return

29

00

30 OVERPAYMENT – see instructions.................................................................................................................................. 30

00

31 Amount of line 30 to be applied to 2013 estimated tax .........................................................

31

00

32 Amount to be refunded – subtract line 31 from line 30 ..................................................................................................... 32

ADOR 10337 (12)

1

1 2

2