Form Cd-418 - Cooperative Or Mutual Association - 2011

ADVERTISEMENT

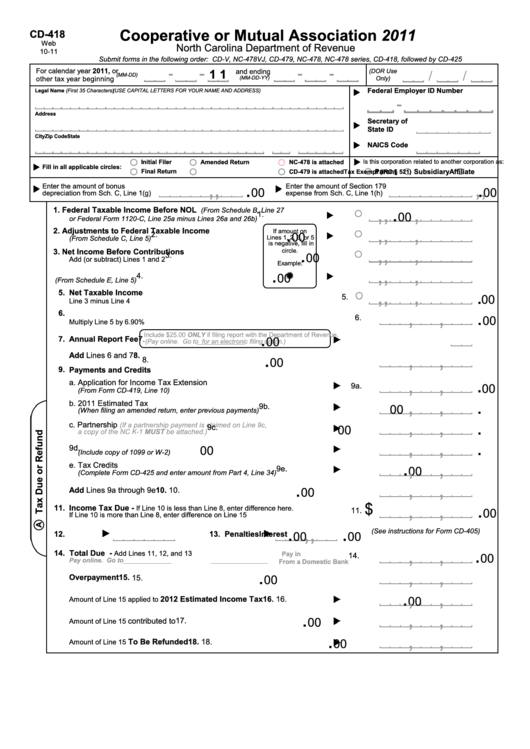

Cooperative or Mutual Association 2011

CD-418

Web

North Carolina Department of Revenue

10-11

Submit forms in the following order: CD-V, NC-478VJ, CD-479, NC-478, NC-478 series, CD-418, followed by CD-425

For calendar year 2011, or

1 1

and ending

(DOR Use

(MM-DD)

other tax year beginning

(MM-DD-YY)

Only)

Federal Employer ID Number

Legal Name (First 35 Characters)

(USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

Address

Secretary of

State ID

City

State

Zip Code

NAICS Code

Is this corporation related to another corporation as:

Initial Filer

Amended Return

NC-478 is attached

Fill in all applicable circles:

Final Return

Parent

Subsidiary

Affiliate

Tax Exempt (IRC § 521)

CD-479 is attached

,

,

,

,

.

.

Enter the amount of bonus

Enter the amount of Section 179

00

00

depreciation from Sch. C, Line 1(g)

expense from Sch. C, Line 1(h)

.

,

,

,

1. Federal Taxable Income Before NOL

(From Schedule B, Line 27

1.

00

or Federal Form 1120-C, Line 25a minus Lines 26a and 26b)

.

,

,

,

2. Adjustments to Federal Taxable Income

If amount on

2.

00

Lines 1, 2, 3, or 5

(From Schedule C, Line 5)

is negative, fill in

.

,

,

,

3. Net Income Before Contributions

circle.

00

3.

Add (or subtract) Lines 1 and 2

Example:

.

,

,

,

4. Contributions

4.

00

(From Schedule E, Line 5)

.

,

,

,

5.

Net Taxable Income

5.

00

Line 3 minus Line 4

,

,

.

6.

N.C. Net Income Tax

6.

00

Multiply Line 5 by 6.90%

.

Include $25.00 ONLY if filing report with the Department of Revenue.

7.

Annual Report Fee

7.

00

(Pay online. Go to for an electronic filing option.)

.

,

,

8.

Add Lines 6 and 7

8.

00

9.

Payments and Credits

.

,

,

a. Application for Income Tax Extension

9a.

00

(From Form CD-419, Line 10)

,

,

.

b. 2011 Estimated Tax

9b.

00

(When filing an amended return, enter previous payments)

,

,

.

c. Partnership

(If a partnership payment is claimed on Line 9c,

9c.

00

a copy of the NC K-1 MUST be attached.)

,

,

.

d. Nonresident Withholding

9d.

00

(Include copy of 1099 or W-2)

.

,

,

e. Tax Credits

9e.

00

(Complete Form CD-425 and enter amount from Part 4, Line 34)

,

,

.

00

10.

Add Lines 9a through 9e

10.

,

,

.

$

11.

Income Tax Due -

If Line 10 is less than Line 8, enter difference here.

11.

00

If Line 10 is more than Line 8, enter difference on Line 15

,

.

,

.

(See instructions for Form CD-405)

12.

Interest

00

13. Penalties

00

,

,

.

14. Total Due -

Add Lines 11, 12, and 13

Pay in U.S. Currency

14.

00

Pay online. Go to and click on Electronic Services.

From a Domestic Bank

.

,

,

15.

Overpayment

00

15.

,

,

.

16.

2012 Estimated Income Tax

16.

00

Amount of Line 15 applied to

.

,

,

00

17.

contributed to N.C. Nongame and Endangered Wildlife Fund

17.

Amount of Line 15

,

,

.

00

18.

To Be Refunded

18.

Amount of Line 15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4