Form Ct-259 - Claim For Fuel Cell Electric Generating Equipment Credit - 2011

ADVERTISEMENT

Staple forms here

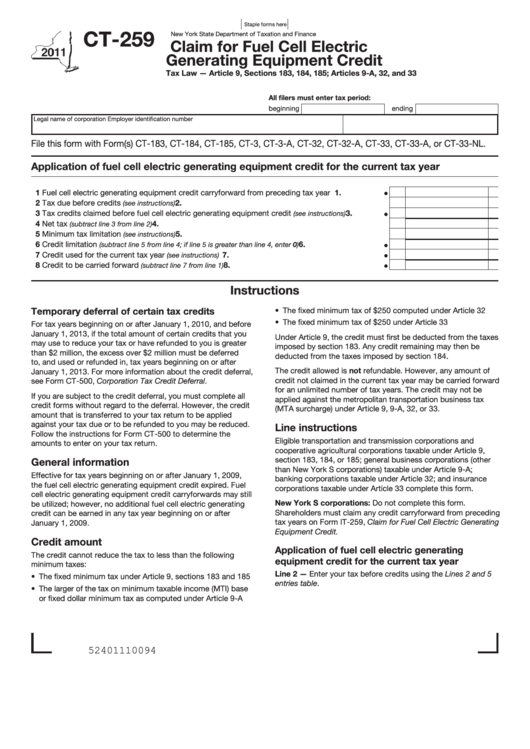

CT-259

New York State Department of Taxation and Finance

Claim for Fuel Cell Electric

Generating Equipment Credit

Tax Law — Article 9, Sections 183, 184, 185; Articles 9-A, 32, and 33

All filers must enter tax period:

beginning

ending

Legal name of corporation

Employer identification number

File this form with Form(s) CT-183, CT-184, CT-185, CT-3, CT-3-A, CT-32, CT-32-A, CT-33, CT-33-A, or CT-33-NL.

Application of fuel cell electric generating equipment credit for the current tax year

1 Fuel cell electric generating equipment credit carryforward from preceding tax year ......................

1.

2 Tax due before credits

...............................................................................................

2.

(see instructions)

3 Tax credits claimed before fuel cell electric generating equipment credit

...............

3.

(see instructions)

4 Net tax

..........................................................................................................

4.

(subtract line 3 from line 2)

5 Minimum tax limitation

5.

...............................................................................................

(see instructions)

6 Credit limitation

6.

.....................................

(subtract line 5 from line 4; if line 5 is greater than line 4, enter 0)

7 Credit used for the current tax year

.........................................................................

7.

(see instructions)

8 Credit to be carried forward

.......................................................................

8.

(subtract line 7 from line 1)

Instructions

Temporary deferral of certain tax credits

• The fixed minimum tax of $250 computed under Article 32

• The fixed minimum tax of $250 under Article 33

For tax years beginning on or after January 1, 2010, and before

January 1, 2013, if the total amount of certain credits that you

Under Article 9, the credit must first be deducted from the taxes

may use to reduce your tax or have refunded to you is greater

imposed by section 183. Any credit remaining may then be

than $2 million, the excess over $2 million must be deferred

deducted from the taxes imposed by section 184.

to, and used or refunded in, tax years beginning on or after

The credit allowed is not refundable. However, any amount of

January 1, 2013. For more information about the credit deferral,

credit not claimed in the current tax year may be carried forward

see Form CT-500, Corporation Tax Credit Deferral.

for an unlimited number of tax years. The credit may not be

If you are subject to the credit deferral, you must complete all

applied against the metropolitan transportation business tax

credit forms without regard to the deferral. However, the credit

(MTA surcharge) under Article 9, 9-A, 32, or 33.

amount that is transferred to your tax return to be applied

against your tax due or to be refunded to you may be reduced.

Line instructions

Follow the instructions for Form CT-500 to determine the

Eligible transportation and transmission corporations and

amounts to enter on your tax return.

cooperative agricultural corporations taxable under Article 9,

section 183, 184, or 185; general business corporations (other

General information

than New York S corporations) taxable under Article 9-A;

Effective for tax years beginning on or after January 1, 2009,

banking corporations taxable under Article 32; and insurance

the fuel cell electric generating equipment credit expired. Fuel

corporations taxable under Article 33 complete this form.

cell electric generating equipment credit carryforwards may still

New York S corporations: Do not complete this form.

be utilized; however, no additional fuel cell electric generating

Shareholders must claim any credit carryforward from preceding

credit can be earned in any tax year beginning on or after

tax years on Form IT-259, Claim for Fuel Cell Electric Generating

January 1, 2009.

Equipment Credit.

Credit amount

Application of fuel cell electric generating

The credit cannot reduce the tax to less than the following

equipment credit for the current tax year

minimum taxes:

Line 2 — Enter your tax before credits using the Lines 2 and 5

• The fixed minimum tax under Article 9, sections 183 and 185

entries table.

• The larger of the tax on minimum taxable income (MTI) base

or fixed dollar minimum tax as computed under Article 9-A

52401110094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2