Form Cd-405 - Corporation Tax Return - 2011

ADVERTISEMENT

c

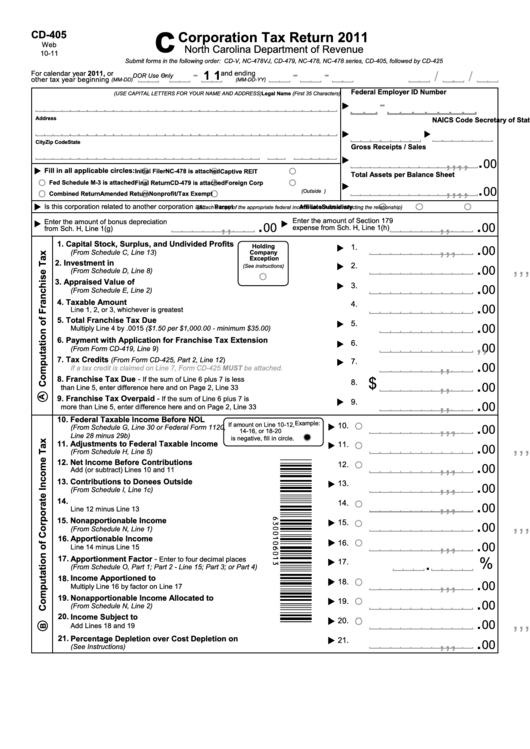

CD-405

Corporation Tax Return 2011

Web

North Carolina Department of Revenue

10-11

Submit forms in the following order: CD-V, NC-478VJ, CD-479, NC-478, NC-478 series, CD-405, followed by CD-425

1 1

For calendar year 2011, or

and ending

DOR Use Only

other tax year beginning

(MM-DD)

(MM-DD-YY)

Federal Employer ID Number

Legal Name (First 35 Characters)

(USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

Address

Secretary of State ID

NAICS Code

City

State

Zip Code

Gross Receipts / Sales

,

,

,

,

.

00

Fill in all applicable circles:

Initial Filer

NC-478 is attached

Captive REIT

Total Assets per Balance Sheet

,

,

,

,

.

Fed Schedule M-3 is attached

Final Return

CD-479 is attached

Foreign Corp

00

(Outside U.S.)

Combined Return

Amended Return

Nonprofit/Tax Exempt

Is this corporation related to another corporation as:

Parent

Subsidiary

Affiliate

(Attach a copy of the appropriate federal income tax schedule reflecting the relationship)

,

,

,

,

.

.

Enter the amount of Section 179

Enter the amount of bonus depreciation

00

00

expense from Sch. H, Line 1(h)

from Sch. H, Line 1(g)

,

,

,

.

1. Capital Stock, Surplus, and Undivided Profits

Holding

1.

00

(From Schedule C, Line 13)

Company

,

,

,

.

Exception

2. Investment in N.C. Tangible Property

2.

00

(See instructions)

(From Schedule D, Line 8)

,

,

,

.

3. Appraised Value of N.C. Tangible Property

3.

00

(From Schedule E, Line 2)

,

,

,

.

4. Taxable Amount

4.

00

Line 1, 2, or 3, whichever is greatest

,

,

.

5. Total Franchise Tax Due

5.

00

Multiply Line 4 by .0015 ($1.50 per $1,000.00 - minimum $35.00)

,

,

.

6. Payment with Application for Franchise Tax Extension

6.

00

(From Form CD-419, Line 9)

,

,

.

7. Tax Credits

(From Form CD-425, Part 2, Line 12)

7.

00

If a tax credit is claimed on Line 7, Form CD-425 MUST be attached.

,

,

.

$

8. Franchise Tax Due -

If the sum of Line 6 plus 7 is less

8.

00

than Line 5, enter difference here and on Page 2, Line 33

,

,

.

9. Franchise Tax Overpaid -

If the sum of Line 6 plus 7 is

9.

00

more than Line 5, enter difference here and on Page 2, Line 33

,

,

,

.

10. Federal Taxable Income Before NOL

Example:

If amount on Line 10-12,

10.

00

(From Schedule G, Line 30 or Federal Form 1120,

14-16, or 18-20

Line 28 minus 29b)

,

,

,

.

is negative, fill in circle.

11. Adjustments to Federal Taxable Income

11.

00

(From Schedule H, Line 5)

,

,

,

.

12. Net Income Before Contributions

12.

00

Add (or subtract) Lines 10 and 11

,

,

,

.

13. Contributions to Donees Outside N.C.

13.

00

(From Schedule I, Line 1c)

,

,

,

.

14. N.C. Taxable Income

14.

00

Line 12 minus Line 13

,

,

,

.

15. Nonapportionable Income

15.

00

(From Schedule N, Line 1)

,

,

,

.

16.

Apportionable Income

16.

00

Line 14 minus Line 15

.

%

17.

Apportionment Factor -

Enter to four decimal places

17.

(From Schedule O, Part 1; Part 2 - Line 15; Part 3; or Part 4)

,

,

,

.

18.

Income Apportioned to N.C.

18.

00

Multiply Line 16 by factor on Line 17

,

,

,

.

19.

Nonapportionable Income Allocated to N.C.

19.

00

(From Schedule N, Line 2)

,

,

,

.

20.

Income Subject to N.C. Tax

20.

00

Add Lines 18 and 19

,

,

,

.

21.

Percentage Depletion over Cost Depletion on N.C. Property

21.

00

(See Instructions)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6