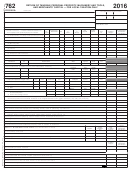

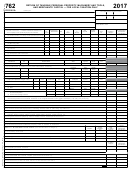

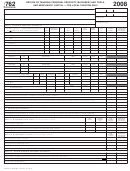

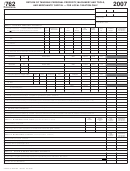

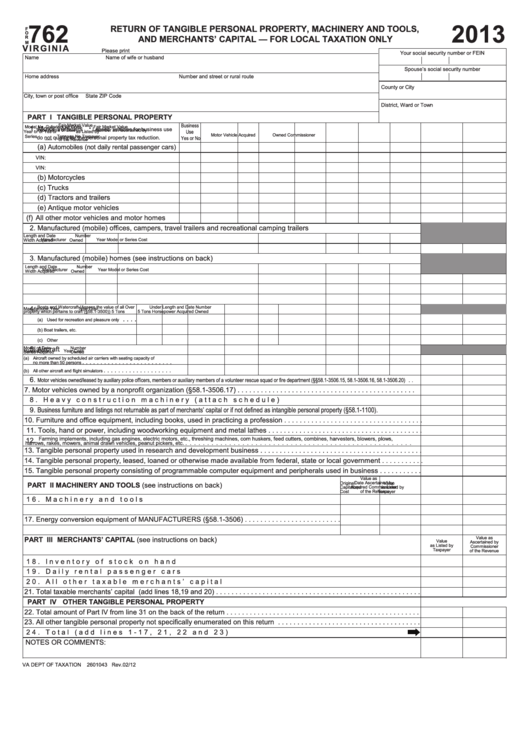

Form 762 - Return Of Tangible Personal Property, Machinery And Tools, And Merchants' Capital - For Local Taxation Only

ADVERTISEMENT

762

2013

RETURN OF TANGIBLE PERSONAL PROPERTY, MACHINERY AND TOOLS,

F

O

AND MERCHANTS’ CAPITAL — FOR LOCAL TAXATION ONLY

R

M

V I R G I N I A

Please print

Your social security number or FEIN

Name

Name of wife or husband

Spouse’s social security number

Home address

Number and street or rural route

County or City

City, town or post office

State

ZIP Code

District, Ward or Town

PART I TANGIBLE PERSONAL PROPERTY

Business

Fair Market Value

1. Motor vehicles

Model

No. Cylinders

Air Cond.

Fair Market Value

* Leased vehicles for business use

Trade Name of

Date

Number

as Ascertained by

Use

Year

or

or

Yes or

as Listed by

Motor Vehicle

Acquired

Owned

Commissioner

Series

Tonnage

No

Taxpayer

do not qualify for the personal property tax reduction.

Yes or No

of the Revenue

(a)

Automobiles (not daily rental passenger cars)

VIN:

VIN:

(b) Motorcycles

(c) Trucks

(d) Tractors and trailers

(e) Antique motor vehicles

(f) All other motor vehicles and motor homes

2. Manufactured (mobile) offices, campers, travel trailers and recreational camping trailers

Length and

Date

Number

Manufacturer

Year

Model or Series

Cost

Width

Acquired

Owned

3. Manufactured (mobile) homes (see instructions on back)

Length and

Date

Number

Manufacturer

Year

Model or Series

Cost

Width

Acquired

Owned

4.

Boats and Watercraft (Assess the value of all

Over

Under

Length and

Date

Number

Manufacturer

Year

Type

Cost

property which pertains to craft (§58.1-3500))

5 Tons

5 Tons

Horsepower

Acquired

Owned

. . . .

(a) Used for recreation and pleasure only

. . . . . . . . . . . . . .

(b) Boat trailers, etc.

. . . . . . . . . . . . . . . . . . . .

(c) Other

5. Aircraft

Model or

Date

Number

Manufacturer

Year

Cost

Series

Acquired

Owned

(a) Aircraft owned by scheduled air carriers with seating capacity of

no more than 50 persons . . . . . . . . . . . . . . . . . . . . . . . . .

(b) All other aircraft and flight simulators . . . . . . . . . . . . . . . . . . .

6.

Motor vehicles owned/leased by auxiliary police officers, members or auxiliary members of a volunteer rescue squad or fire department (§§58.1-3506.15, 58.1-3506.16, 58.1-3506.20) . .

7. Motor vehicles owned by a nonprofit organization (§58.1-3506.17) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8. Heavy construction machinery (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9. Business furniture and listings not returnable as part of merchants’ capital or if not defined as intangible personal property (§58.1-1100). . . . . . . . . . .

10. Furniture and office equipment, including books, used in practicing a profession . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11. Tools, hand or power, including woodworking equipment and metal lathes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Farming implements, including gas engines, electric motors, etc., threshing machines, corn huskers, feed cutters, combines, harvesters, blowers, plows,

12.

harrows, rakes, mowers, animal drawn vehicles, peanut pickers, etc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13. Tangible personal property used in research and development business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14. Tangible personal property, leased, loaned or otherwise made available from federal, state or local government . . . . . . . . . . .

15. Tangible personal property consisting of programmable computer equipment and peripherals used in business . . . . . . . . . . .

Value as

Date

Original

Value

Ascertained by

PART II MACHINERY AND TOOLS (see instructions on back)

Acquired

Capitalized

as Listed by

Commissioner

Cost

Taxpayer

of the Revenue

16. Machinery and tools . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17. Energy conversion equipment of MANUFACTURERS (§58.1-3506) . . . . . . . . . . . . . . . . . . . . . . . . .

PART III MERCHANTS’ CAPITAL (see instructions on back)

Value as

Value

Ascertained by

as Listed by

Commissioner

Taxpayer

of the Revenue

18. Inventory of stock on hand . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19. Daily rental passenger cars . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20. All other taxable merchants’ capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21. Total taxable merchants’ capital (add lines 18,19 and 20) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

PART IV OTHER TANGIBLE PERSONAL PROPERTY

22. Total amount of Part IV from line 31 on the back of the return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23. All other tangible personal property not specifically enumerated on this return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24. Total (add lines 1-17, 21, 22 and 23) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

NOTES OR COMMENTS:

VA DEPT OF TAXATION 2601043 Rev.02/12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2