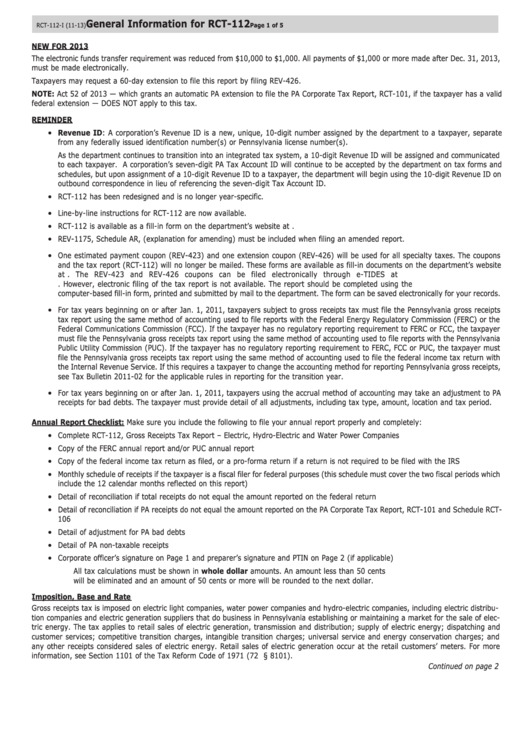

General Information For Rct-112

ADVERTISEMENT

General Information for RCT-112

RCT-112-I (11-13)

Page 1 of 5

NEW FOR 2013

The electronic funds transfer requirement was reduced from $10,000 to $1,000. All payments of $1,000 or more made after Dec. 31, 2013,

must be made electronically.

Taxpayers may request a 60-day extension to file this report by filing REV-426.

NOTE: Act 52 of 2013 — which grants an automatic PA extension to file the PA Corporate Tax Report, RCT-101, if the taxpayer has a valid

federal extension — DOES NOT apply to this tax.

REMINDER

• Revenue ID: A corporation’s Revenue ID is a new, unique, 10-digit number assigned by the department to a taxpayer, separate

from any federally issued identification number(s) or Pennsylvania license number(s).

As the department continues to transition into an integrated tax system, a 10-digit Revenue ID will be assigned and communicated

to each taxpayer. A corporation’s seven-digit PA Tax Account ID will continue to be accepted by the department on tax forms and

schedules, but upon assignment of a 10-digit Revenue ID to a taxpayer, the department will begin using the 10-digit Revenue ID on

outbound correspondence in lieu of referencing the seven-digit Tax Account ID.

• RCT-112 has been redesigned and is no longer year-specific.

• Line-by-line instructions for RCT-112 are now available.

• RCT-112 is available as a fill-in form on the department’s website at

• REV-1175, Schedule AR, (explanation for amending) must be included when filing an amended report.

• One estimated payment coupon (REV-423) and one extension coupon (REV-426) will be used for all specialty taxes. The coupons

and the tax report (RCT-112) will no longer be mailed. These forms are available as fill-in documents on the department’s website

at The REV-423 and REV-426 coupons can be filed electronically through e-TIDES at

However, electronic filing of the tax report is not available. The report should be completed using the

computer-based fill-in form, printed and submitted by mail to the department. The form can be saved electronically for your records.

• For tax years beginning on or after Jan. 1, 2011, taxpayers subject to gross receipts tax must file the Pennsylvania gross receipts

tax report using the same method of accounting used to file reports with the Federal Energy Regulatory Commission (FERC) or the

Federal Communications Commission (FCC). If the taxpayer has no regulatory reporting requirement to FERC or FCC, the taxpayer

must file the Pennsylvania gross receipts tax report using the same method of accounting used to file reports with the Pennsylvania

Public Utility Commission (PUC). If the taxpayer has no regulatory reporting requirement to FERC, FCC or PUC, the taxpayer must

file the Pennsylvania gross receipts tax report using the same method of accounting used to file the federal income tax return with

the Internal Revenue Service. If this requires a taxpayer to change the accounting method for reporting Pennsylvania gross receipts,

see Tax Bulletin 2011-02 for the applicable rules in reporting for the transition year.

• For tax years beginning on or after Jan. 1, 2011, taxpayers using the accrual method of accounting may take an adjustment to PA

receipts for bad debts. The taxpayer must provide detail of all adjustments, including tax type, amount, location and tax period.

Annual Report Checklist: Make sure you include the following to file your annual report properly and completely:

• Complete RCT-112, Gross Receipts Tax Report – Electric, Hydro-Electric and Water Power Companies

• Copy of the FERC annual report and/or PUC annual report

• Copy of the federal income tax return as filed, or a pro-forma return if a return is not required to be filed with the IRS

• Monthly schedule of receipts if the taxpayer is a fiscal filer for federal purposes (this schedule must cover the two fiscal periods which

include the 12 calendar months reflected on this report)

• Detail of reconciliation if total receipts do not equal the amount reported on the federal return

• Detail of reconciliation if PA receipts do not equal the amount reported on the PA Corporate Tax Report, RCT-101 and Schedule RCT-

106

• Detail of adjustment for PA bad debts

• Detail of PA non-taxable receipts

• Corporate officer’s signature on Page 1 and preparer’s signature and PTIN on Page 2 (if applicable)

All tax calculations must be shown in whole dollar amounts. An amount less than 50 cents

will be eliminated and an amount of 50 cents or more will be rounded to the next dollar.

Imposition, Base and Rate

Gross receipts tax is imposed on electric light companies, water power companies and hydro-electric companies, including electric distribu-

tion companies and electric generation suppliers that do business in Pennsylvania establishing or maintaining a market for the sale of elec-

tric energy. The tax applies to retail sales of electric generation, transmission and distribution; supply of electric energy; dispatching and

customer services; competitive transition charges, intangible transition charges; universal service and energy conservation charges; and

any other receipts considered sales of electric energy. Retail sales of electric generation occur at the retail customers’ meters. For more

information, see Section 1101 of the Tax Reform Code of 1971 (72 P.S. § 8101).

Continued on page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5