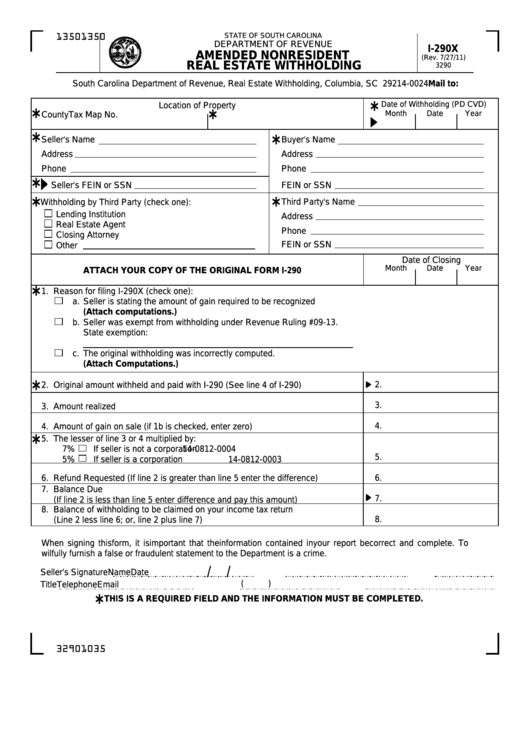

Form I-290x - Amended Nonresident Real Estate Withholding

ADVERTISEMENT

STATE OF SOUTH CAROLINA

1350

1350

DEPARTMENT OF REVENUE

I-290X

AMENDED NONRESIDENT

(Rev. 7/27/11)

REAL ESTATE WITHHOLDING

3290

Mail to:

South Carolina Department of Revenue, Real Estate Withholding, Columbia, SC 29214-0024

Date of Withholding (PD CVD)

Location of Property

*

*

*

Month

Date

Year

County

Tax Map No.

*

*

Seller's Name

Buyer's Name

Address

Address

Phone

Phone

*

Seller's FEIN or SSN

FEIN or SSN

*

*

Withholding by Third Party (check one):

Third Party's Name

Lending Institution

Address

Real Estate Agent

Phone

Closing Attorney

FEIN or SSN

Other

Date of Closing

Month

Date

Year

ATTACH YOUR COPY OF THE ORIGINAL FORM I-290

*

1. Reason for filing I-290X (check one):

a.

Seller is stating the amount of gain required to be recognized

(Attach computations.)

b.

Seller was exempt from withholding under Revenue Ruling #09-13.

State exemption:

c.

The original withholding was incorrectly computed.

(Attach Computations.)

*

2.

2. Original amount withheld and paid with I-290 (See line 4 of I-290)

3.

3. Amount realized

4.

4. Amount of gain on sale (if 1b is checked, enter zero)

*

5. The lesser of line 3 or 4 multiplied by:

7%

If seller is not a corporation

14-0812-0004

5.

5%

If seller is a corporation

14-0812-0003

6.

6. Refund Requested (If line 2 is greater than line 5 enter the difference)

7. Balance Due

7.

(If line 2 is less than line 5 enter difference and pay this amount)

8. Balance of withholding to be claimed on your income tax return

8.

(Line 2 less line 6; or, line 2 plus line 7)

When signing this form, it is important that the information contained in your report be correct and complete. To

wilfully furnish a false or fraudulent statement to the Department is a crime.

/

/

Seller's Signature

Name

Date

(

)

Title

Telephone

Email

*

THIS IS A REQUIRED FIELD AND THE INFORMATION MUST BE COMPLETED.

32901035

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2