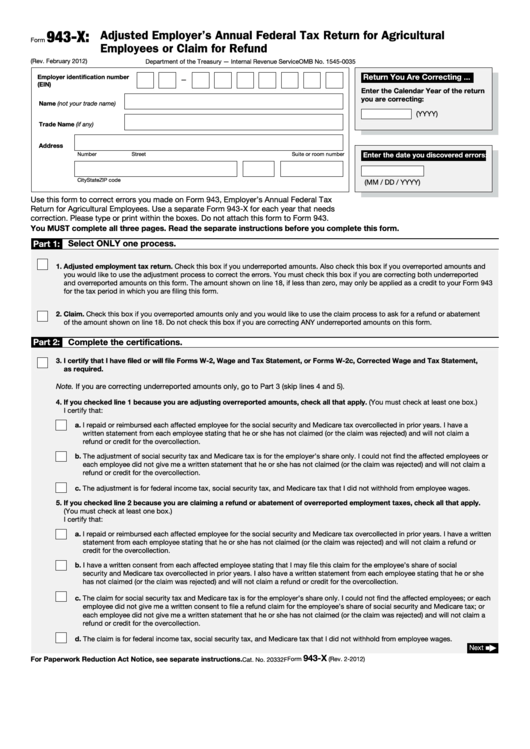

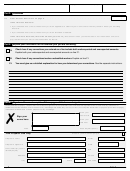

943-X:

Adjusted Employer’s Annual Federal Tax Return for Agricultural

Form

Employees or Claim for Refund

(Rev. February 2012)

Department of the Treasury — Internal Revenue Service

OMB No. 1545-0035

Return You Are Correcting ...

Employer identification number

—

(EIN)

Enter the Calendar Year of the return

you are correcting:

Name (not your trade name)

(YYYY)

Trade Name (if any)

Address

Number

Street

Suite or room number

Enter the date you discovered errors:

City

State

ZIP code

(MM / DD / YYYY)

Use this form to correct errors you made on Form 943, Employer’s Annual Federal Tax

Return for Agricultural Employees. Use a separate Form 943-X for each year that needs

correction. Please type or print within the boxes. Do not attach this form to Form 943.

You MUST complete all three pages. Read the separate instructions before you complete this form.

Select ONLY one process.

Part 1:

1. Adjusted employment tax return. Check this box if you underreported amounts. Also check this box if you overreported amounts and

you would like to use the adjustment process to correct the errors. You must check this box if you are correcting both underreported

and overreported amounts on this form. The amount shown on line 18, if less than zero, may only be applied as a credit to your Form 943

for the tax period in which you are filing this form.

2. Claim. Check this box if you overreported amounts only and you would like to use the claim process to ask for a refund or abatement

of the amount shown on line 18. Do not check this box if you are correcting ANY underreported amounts on this form.

Part 2:

Complete the certifications.

3. I certify that I have filed or will file Forms W-2, Wage and Tax Statement, or Forms W-2c, Corrected Wage and Tax Statement,

as required.

Note. If you are correcting underreported amounts only, go to Part 3 (skip lines 4 and 5).

4. If you checked line 1 because you are adjusting overreported amounts, check all that apply. (You must check at least one box.)

I certify that:

a. I repaid or reimbursed each affected employee for the social security and Medicare tax overcollected in prior years. I have a

written statement from each employee stating that he or she has not claimed (or the claim was rejected) and will not claim a

refund or credit for the overcollection.

b. The adjustment of social security tax and Medicare tax is for the employer’s share only. I could not find the affected employees or

each employee did not give me a written statement that he or she has not claimed (or the claim was rejected) and will not claim a

refund or credit for the overcollection.

c. The adjustment is for federal income tax, social security tax, and Medicare tax that I did not withhold from employee wages.

5. If you checked line 2 because you are claiming a refund or abatement of overreported employment taxes, check all that apply.

(You must check at least one box.)

I certify that:

a. I repaid or reimbursed each affected employee for the social security and Medicare tax overcollected in prior years. I have a written

statement from each employee stating that he or she has not claimed (or the claim was rejected) and will not claim a refund or

credit for the overcollection.

b. I have a written consent from each affected employee stating that I may file this claim for the employee’s share of social

security and Medicare tax overcollected in prior years. I also have a written statement from each employee stating that he or she

has not claimed (or the claim was rejected) and will not claim a refund or credit for the overcollection.

c. The claim for social security tax and Medicare tax is for the employer’s share only. I could not find the affected employees; or each

employee did not give me a written consent to file a refund claim for the employee’s share of social security and Medicare tax; or

each employee did not give me a written statement that he or she has not claimed (or the claim was rejected) and will not claim a

refund or credit for the overcollection.

d. The claim is for federal income tax, social security tax, and Medicare tax that I did not withhold from employee wages.

Next

▶

■

943-X

For Paperwork Reduction Act Notice, see separate instructions.

Form

(Rev. 2-2012)

Cat. No. 20332F

1

1 2

2 3

3 4

4