2011

OREGON

Form 10 and Instructions for

Underpayment of Estimated Tax

General information

Oregon law requires withholding or estimated tax payments as income is earned. Interest is charged if you underpay or are

late. Use this form to determine if you owe underpayment interest.

For more information on who must pay estimated taxes, see Form 40 ESV instructions.

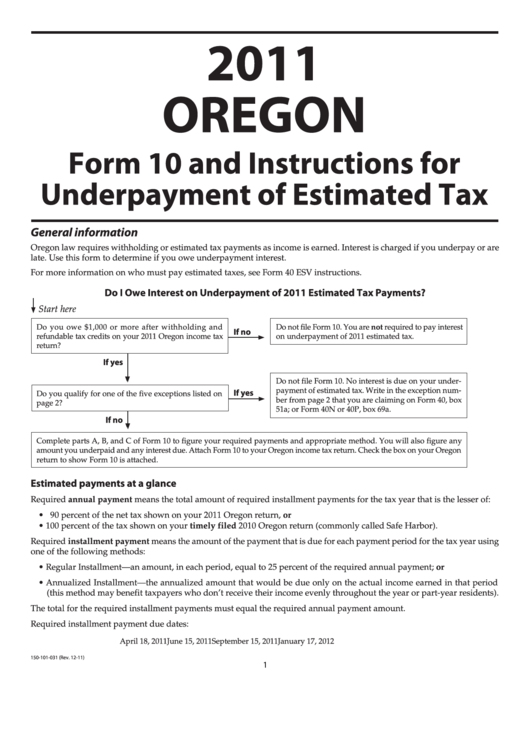

Do I Owe Interest on Underpayment of 2011 Estimated Tax Payments?

Start here

Do you owe $1,000 or more after withholding and

Do not file Form 10. You are not required to pay interest

If no

refundable tax credits on your 2011 Oregon income tax

on underpayment of 2011 estimated tax.

return?

If yes

Do not file Form 10. No interest is due on your under-

payment of estimated tax. Write in the exception num-

If yes

Do you qualify for one of the five exceptions listed on

ber from page 2 that you are claiming on Form 40, box

page 2?

51a; or Form 40N or 40P, box 69a.

If no

Complete parts A, B, and C of Form 10 to figure your required payments and appropriate method. You will also figure any

amount you underpaid and any interest due. Attach Form 10 to your Oregon income tax return. Check the box on your Oregon

return to show Form 10 is attached.

Estimated payments at a glance

Required annual payment means the total amount of required installment payments for the tax year that is the lesser of:

• 90 percent of the net tax shown on your 2011 Oregon return, or

• 100 percent of the tax shown on your timely filed 2010 Oregon return (commonly called Safe Harbor).

Required installment payment means the amount of the payment that is due for each payment period for the tax year using

one of the following methods:

• Regular Installment—an amount, in each period, equal to 25 percent of the required annual payment; or

• Annualized Installment—the annualized amount that would be due only on the actual income earned in that period

(this method may benefit taxpayers who don’t receive their income evenly throughout the year or part-year residents).

The total for the required installment payments must equal the required annual payment amount.

Required installment payment due dates:

April 18, 2011

June 15, 2011

September 15, 2011

January 17, 2012

150-101-031 (Rev. 12-11)

1

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8