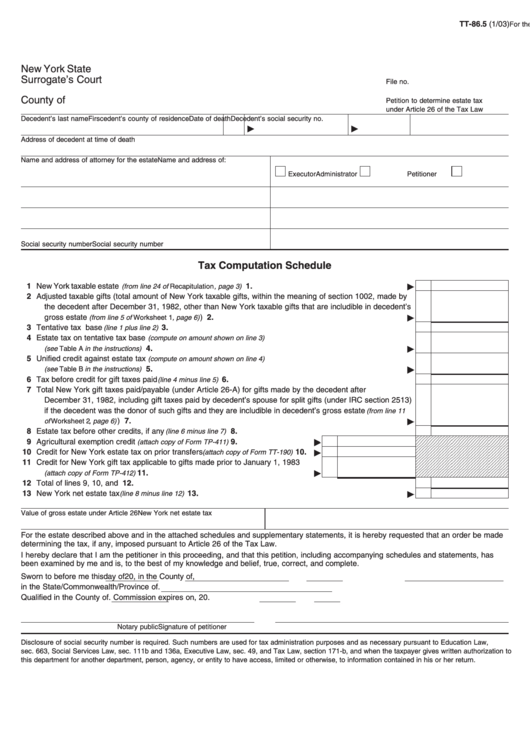

Form Tt-86.5 - Tax Computation Schedule

ADVERTISEMENT

TT-86.5 (1/03)

For the estate of an individual who died after December 31, 1982, and before May 26, 1990

New York State

Surrogate’s Court

File no.

County of

Petition to determine estate tax

under Article 26 of the Tax Law

Decedent’s last name

First

M.I.

Decedent’s county of residence Date of death

Decedent’s social security no.

Address of decedent at time of death

Name and address of attorney for the estate

Name and address of:

Executor

Administrator

Petitioner

Social security number

Social security number

Tax Computation Schedule

1 New York taxable estate

..........................................................................

1.

(from line 24 of Recapitulation , page 3)

2 Adjusted taxable gifts (total amount of New York taxable gifts, within the meaning of section 1002, made by

the decedent after December 31, 1982, other than New York taxable gifts that are includible in decedent’s

gross estate

) .............................................................................................

2.

(from line 5 of Worksheet 1 , page 6)

3 Tentative tax base

...................................................................................................................

3.

(line 1 plus line 2)

4 Estate tax on tentative tax base

(compute on amount shown on line 3)

........................................................................................................................

4.

(see Table A in the instructions)

5 Unified credit against estate tax

(compute on amount shown on line 4)

........................................................................................................................

5.

(see Table B in the instructions)

6 Tax before credit for gift taxes paid

.....................................................................................

6.

(line 4 minus line 5)

7 Total New York gift taxes paid/payable (under Article 26-A) for gifts made by the decedent after

December 31, 1982, including gift taxes paid by decedent’s spouse for split gifts (under IRC section 2513)

if the decedent was the donor of such gifts and they are includible in decedent’s gross estate

(from line 11

) ...................................................................................................................................

7.

of Worksheet 2 , page 6)

8 Estate tax before other credits, if any

...................................................................................

8.

(line 6 minus line 7)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

9 Agricultural exemption credit

......................................

9.

(attach copy of Form TP-411)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

10 Credit for New York estate tax on prior transfers

........

10.

(attach copy of Form TT-190)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

11 Credit for New York gift tax applicable to gifts made prior to January 1, 1983

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

.................................................................................

11.

(attach copy of Form TP-412)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

12 Total of lines 9, 10, and 11 .................................................................................................................................. 12.

13 New York net estate tax

.....................................................................................................

13.

(line 8 minus line 12)

Value of gross estate under Article 26

New York net estate tax

For the estate described above and in the attached schedules and supplementary statements, it is hereby requested that an order be made

determining the tax, if any, imposed pursuant to Article 26 of the Tax Law.

I hereby declare that I am the petitioner in this proceeding, and that this petition, including accompanying schedules and statements, has

been examined by me and is, to the best of my knowledge and belief, true, correct, and complete.

Sworn to before me this

day of

20

, in the County of

,

in the State/Commonwealth/Province of

.

Qualified in the County of

. Commission expires on

, 20

.

Notary public

Signature of petitioner

Disclosure of social security number is required. Such numbers are used for tax administration purposes and as necessary pursuant to Education Law,

sec. 663, Social Services Law, sec. 111b and 136a, Executive Law, sec. 49, and Tax Law, section 171-b, and when the taxpayer gives written authorization to

this department for another department, person, agency, or entity to have access, limited or otherwise, to information contained in his or her return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11