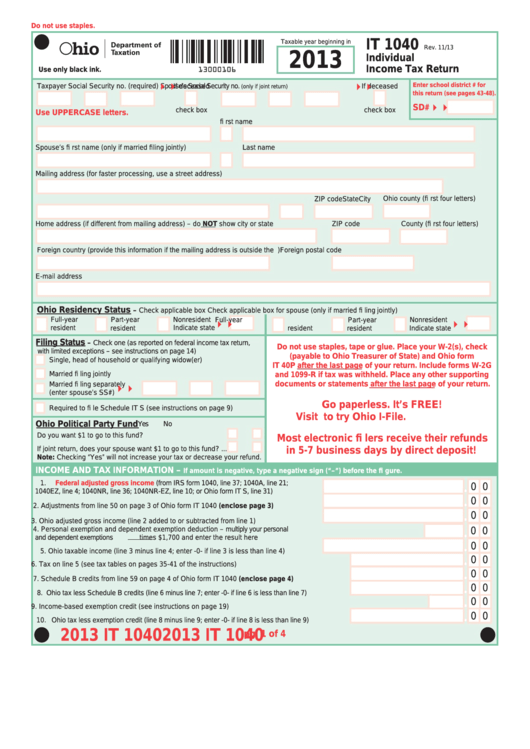

Do not use staples.

IT 1040

Taxable year beginning in

Rev. 11/13

2013

Individual

13000106

Income Tax Return

Use only black ink.

Enter school district # for

Taxpayer Social Security no. (required)

Spouse’s Social Security no.

If deceased

If deceased

(only if joint return)

this return (see pages 43-48).

SD#

check box

check box

Use UPPERCASE letters.

Your fi rst name

M.I.

Last name

Spouse’s fi rst name (only if married fi ling jointly)

M.I.

Last name

Mailing address (for faster processing, use a street address)

Ohio county (fi rst four letters)

City

State

ZIP code

ZIP code

County (fi rst four letters)

Home address (if different from mailing address) – do NOT show city or state

Foreign country (provide this information if the mailing address is outside the U.S.)

Foreign postal code

E-mail address

Ohio Residency Status

– Check applicable box

Check applicable box for spouse (only if married fi ling jointly)

Full-year

Nonresident

Part-year

Full-year

Part-year

Nonresident

Indicate state

resident

resident

resident

resident

Indicate state

Filing Status

– Check one (as reported on federal income tax return,

Do not use staples, tape or glue. Place your W-2(s), check

with limited exceptions – see instructions on page 14)

(payable to Ohio Treasurer of State) and Ohio form

Single, head of household or qualifying widow(er)

IT 40P after the last page of your return. Include forms W-2G

Married fi ling jointly

and 1099-R if tax was withheld. Place any other supporting

Married fi ling separately

documents or statements after the last page of your return.

(enter spouse’s SS#)

Go paperless. It’s FREE!

Required to fi le Schedule IT S (see instructions on page 9)

Visit tax.ohio.gov to try Ohio I-File.

Ohio Political Party Fund

Yes

No

Do you want $1 to go to this fund? ..........................................

Most electronic fi lers receive their refunds

If joint return, does your spouse want $1 to go to this fund? ...

in 5-7 business days by direct deposit!

Note: Checking “Yes” will not increase your tax or decrease your refund.

INCOME AND TAX INFORMATION –

If amount is negative, type a negative sign (“–”) before the fi gure.

1.

Federal adjusted gross income

(from IRS form 1040, line 37; 1040A, line 21;

0 0

.

1040EZ, line 4; 1040NR, line 36; 1040NR-EZ, line 10; or Ohio form IT S, line 31) ............... 1.

0 0

.

2. Adjustments from line 50 on page 3 of Ohio form IT 1040 (enclose page 3) ................. 2.

0 0

.

3. Ohio adjusted gross income (line 2 added to or subtracted from line 1) .......................... 3.

4. Personal exemption and dependent exemption deduction – multiply your personal

0 0

.

and dependent exemptions

times $1,700 and enter the result here ...................... 4.

0 0

.

5. Ohio taxable income (line 3 minus line 4; enter -0- if line 3 is less than line 4) ............... 5.

0 0

.

6. Tax on line 5 (see tax tables on pages 35-41 of the instructions) .................................................. 6.

0 0

.

7. Schedule B credits from line 59 on page 4 of Ohio form IT 1040 (enclose page 4) ..................... 7.

0 0

.

8. Ohio tax less Schedule B credits (line 6 minus line 7; enter -0- if line 6 is less than line 7) ...................8.

0 0

.

9. Income-based exemption credit (see instructions on page 19) ..................................................... 9.

0 0

.

10. Ohio tax less exemption credit (line 8 minus line 9; enter -0- if line 8 is less than line 9) ...................10.

2013 IT 1040

2013 IT 1040

pg. 1 of 4

1

1 2

2 3

3 4

4