Click here to print a blank form

Try I-File

Reset Form

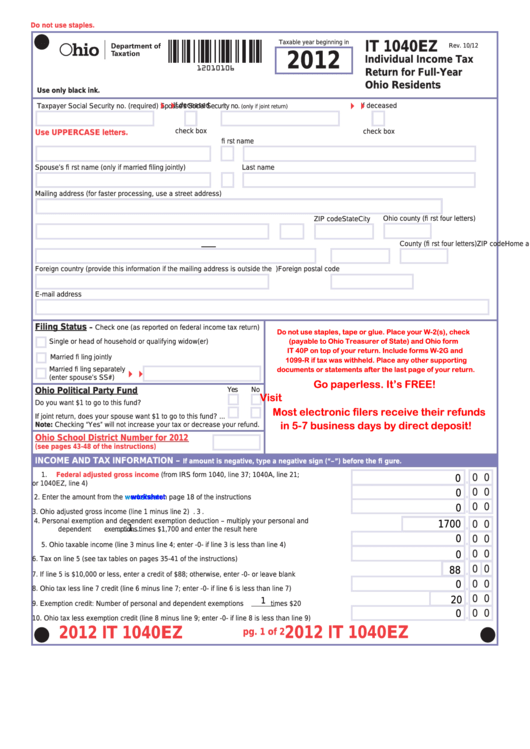

Do not use staples.

Taxable year beginning in

IT 1040EZ

Rev. 10/12

2012

Individual Income Tax

12010106

Return for Full-Year

Ohio Residents

Use only black ink.

If deceased

Spouse’s Social Security no.

If deceased

Taxpayer Social Security no. (required)

(only if joint return)

check box

check box

Use UPPERCASE letters.

Your fi rst name

M.I.

Last name

Spouse’s fi rst name (only if married fi ling jointly)

M.I.

Last name

Mailing address (for faster processing, use a street address)

Ohio county (fi rst four letters)

City

State

ZIP code

Home address (if different from mailing address) – do NOT show city or state

ZIP code

County (fi rst four letters)

Foreign country (provide this information if the mailing address is outside the U.S.)

Foreign postal code

E-mail address

Filing Status

– Check one (as reported on federal income tax return)

Do not use staples, tape or glue. Place your W-2(s), check

(payable to Ohio Treasurer of State) and Ohio form

Single or head of household or qualifying widow(er)

IT 40P on top of your return. Include forms W-2G and

Married fi ling jointly

1099-R if tax was withheld. Place any other supporting

documents or statements after the last page of your return.

Married fi ling separately

(enter spouse’s SS#)

Go paperless. It’s FREE!

Yes

No

Ohio Political Party Fund

Visit tax.ohio.gov to try Ohio I-File.

Do you want $1 to go to this fund? ..........................................

Most electronic filers receive their refunds

If joint return, does your spouse want $1 to go to this fund? ...

in 5-7 business days by direct deposit!

Note: Checking “Yes” will not increase your tax or decrease your refund.

Ohio School District Number for 2012

(see pages 43-48 of the instructions)

INCOME AND TAX INFORMATION –

If amount is negative, type a negative sign (“–”) before the fi gure.

1.

Federal adjusted gross income

(from IRS form 1040, line 37; 1040A, line 21;

0 0

0

.

or 1040EZ, line 4) ........................................................................................................................... 1.

0 0

0

.

2. Enter the amount from the

worksheet

worksheet

on page 18 of the instructions ........................................... 2.

0 0

0

.

3. Ohio adjusted gross income (line 1 minus line 2) ........................................................................... 3.

4. Personal exemption and dependent exemption deduction – multiply your personal and

1700

0 0

.

1

dependent exemptions

times $1,700 and enter the result here .......................................... 4.

0

0 0

.

5. Ohio taxable income (line 3 minus line 4; enter -0- if line 3 is less than line 4) .............................. 5.

0 0

0

.

6. Tax on line 5 (see tax tables on pages 35-41 of the instructions) ................................................... 6.

0 0

88

.

7. If line 5 is $10,000 or less, enter a credit of $88; otherwise, enter -0- or leave blank ..................... 7.

0

0 0

.

8. Ohio tax less line 7 credit (line 6 minus line 7; enter -0- if line 6 is less than line 7) ....................... 8.

0 0

20

.

1

9. Exemption credit: Number of personal and dependent exemptions

times $20 .................. 9.

0

0 0

.

10. Ohio tax less exemption credit (line 8 minus line 9; enter -0- if line 8 is less than line 9) ............. 10.

2012 IT 1040EZ

2012 IT 1040EZ

pg. 1 of 2

Click Here for the 2012 Instruction Booklet

1

1 2

2 3

3 4

4 5

5