Reset Form

WT 8655

Prescribed 7/12

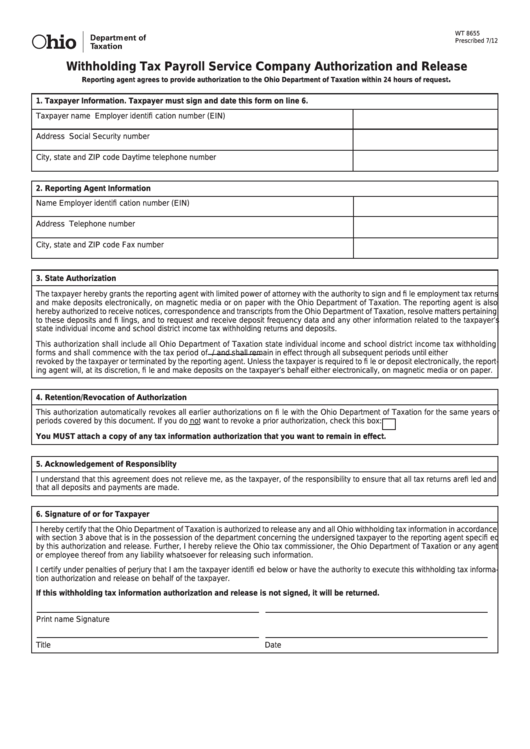

Withholding Tax Payroll Service Company Authorization and Release

.

Reporting agent agrees to provide authorization to the Ohio Department of Taxation within 24 hours of request

1. Taxpayer Information. Taxpayer must sign and date this form on line 6.

Taxpayer name

Employer identifi cation number (EIN)

Address

Social Security number

City, state and ZIP code

Daytime telephone number

2. Reporting Agent Information

Name

Employer identifi cation number (EIN)

Address

Telephone number

City, state and ZIP code

Fax number

3. State Authorization

The taxpayer hereby grants the reporting agent with limited power of attorney with the authority to sign and fi le employment tax returns

and make deposits electronically, on magnetic media or on paper with the Ohio Department of Taxation. The reporting agent is also

hereby authorized to receive notices, correspondence and transcripts from the Ohio Department of Taxation, resolve matters pertaining

to these deposits and fi lings, and to request and receive deposit frequency data and any other information related to the taxpayer’s

state individual income and school district income tax withholding returns and deposits.

This authorization shall include all Ohio Department of Taxation state individual income and school district income tax withholding

forms and shall commence with the tax period of

/

and shall remain in effect through all subsequent periods until either

revoked by the taxpayer or terminated by the reporting agent. Unless the taxpayer is required to fi le or deposit electronically, the report-

ing agent will, at its discretion, fi le and make deposits on the taxpayer’s behalf either electronically, on magnetic media or on paper.

4. Retention/Revocation of Authorization

This authorization automatically revokes all earlier authorizations on fi le with the Ohio Department of Taxation for the same years or

periods covered by this document. If you do not want to revoke a prior authorization, check this box:

You MUST attach a copy of any tax information authorization that you want to remain in effect.

5. Acknowledgement of Responsiblity

I understand that this agreement does not relieve me, as the taxpayer, of the responsibility to ensure that all tax returns are fi led and

that all deposits and payments are made.

6. Signature of or for Taxpayer

I hereby certify that the Ohio Department of Taxation is authorized to release any and all Ohio withholding tax information in accordance

with section 3 above that is in the possession of the department concerning the undersigned taxpayer to the reporting agent specifi ed

by this authorization and release. Further, I hereby relieve the Ohio tax commissioner, the Ohio Department of Taxation or any agent

or employee thereof from any liability whatsoever for releasing such information.

I certify under penalties of perjury that I am the taxpayer identifi ed below or have the authority to execute this withholding tax informa-

tion authorization and release on behalf of the taxpayer.

If this withholding tax information authorization and release is not signed, it will be returned.

Print name

Signature

Title

Date

1

1