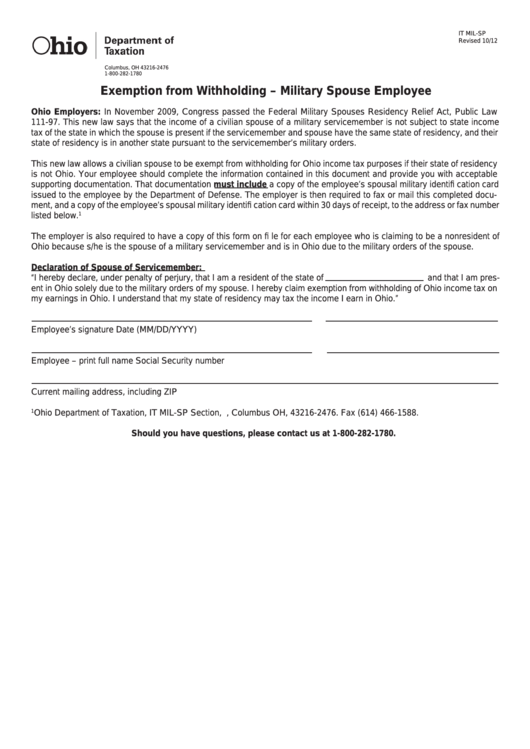

IT MIL-SP

Revised 10/12

Reset Form

P.O. Box 2476

Columbus, OH 43216-2476

1-800-282-1780

Exemption from Withholding – Military Spouse Employee

Ohio Employers: In November 2009, Congress passed the Federal Military Spouses Residency Relief Act, Public Law

111-97. This new law says that the income of a civilian spouse of a military servicemember is not subject to state income

tax of the state in which the spouse is present if the servicemember and spouse have the same state of residency, and their

state of residency is in another state pursuant to the servicemember’s military orders.

This new law allows a civilian spouse to be exempt from withholding for Ohio income tax purposes if their state of residency

is not Ohio. Your employee should complete the information contained in this document and provide you with acceptable

supporting documentation. That documentation must include a copy of the employee’s spousal military identifi cation card

issued to the employee by the Department of Defense. The employer is then required to fax or mail this completed docu-

ment, and a copy of the employee’s spousal military identifi cation card within 30 days of receipt, to the address or fax number

1

listed below.

The employer is also required to have a copy of this form on fi le for each employee who is claiming to be a nonresident of

Ohio because s/he is the spouse of a military servicemember and is in Ohio due to the military orders of the spouse.

Declaration of Spouse of Servicemember:

“I hereby declare, under penalty of perjury, that I am a resident of the state of

and that I am pres-

ent in Ohio solely due to the military orders of my spouse. I hereby claim exemption from withholding of Ohio income tax on

my earnings in Ohio. I understand that my state of residency may tax the income I earn in Ohio.”

Employee’s signature

Date (MM/DD/YYYY)

Employee – print full name

Social Security number

Current mailing address, including ZIP

1

Ohio Department of Taxation, IT MIL-SP Section, P.O. Box 2476, Columbus OH, 43216-2476. Fax (614) 466-1588.

Should you have questions, please contact us at 1-800-282-1780.

1

1