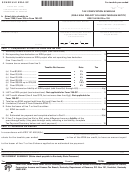

Schedule Ieia-Sp - Tax Computation Schedule (For An Ieia Project Of A Pass-Through Entity) Page 2

ADVERTISEMENT

Page 2

41A720–S52 (10–14)

INSTRUCTIONS–SCHEDULE IEIA–SP

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

PURPOSE OF SCHEDULE—This schedule is used by

operations and activities of the approved company are

any pass–through entity which has entered into a

such that it is not practical to use a separate accounting

tax incentive agreement for an Incentives for Energy

method to determine the net income, Kentucky gross

Independence Act (IEIA) project to determine the

receipts and Kentucky gross profits from the facility at

credit allowed against the Kentucky income tax and

which the economic development project is located,

LLET in accordance with KRS 141.421 on the income

the approved company shall use an alternative method

and Kentucky gross receipts or Kentucky gross profits

approved by the Department of Revenue. A copy of

from the project.

the letter from the Department of Revenue approving

the alternative method must be attached to this

Pass–through entities should first complete Form

schedule.

720S, 765 or 765–GP to determine net income (loss),

deductions, etc., from the entire operations of the

Separate Accounting—If the economic development

pass–through entity. The pass–through entity should

project is a totally separate facility, net income shall

then complete Schedule IEIA–SP to determine the

IEIA

reflect only the gross income, deductions, expenses,

tax credit and the tax due, if any, from the

IEIA

project.

gains and losses allowed under this chapter directly

A pass–through entity is subject to tax as provided

attributable to the facility and overhead expenses

by KRS 141.020 and KRS 141.0401 on the net income

apportioned to the facility; and Kentucky gross receipts

and the Kentucky gross receipts or Kentucky gross

or Kentucky gross profits shall reflect only Kentucky

profits from the project and the

IEIA

credit is applied

gross receipts or Kentucky gross profits directly

against the tax of the

IEIA

project. Consequently,

attributable to the facility.

the pass–through entity must use Form 720S(K),

Form 765(K) or Form 765–GP(K) in lieu of Schedule

Line 2—Enter the net operating loss from the

IEIA

project,

K (Form 720S), Schedule K (Form 765) or Schedule

if any, being carried forward from previous years.

K (Form 765–GP) in order to exclude the net income

from the

IEIA

project from the partners, members or

Note: Just as the income from a

IEIA

project does not

shareholders’ distributive share income, and Schedule

flow through to partners, members or shareholders,

LLET(K) in lieu of Schedule LLET in order to exclude the

neither do the losses. The project’s net operating loss

Kentucky gross receipts or the Kentucky gross profits

from prior years must be subtracted from the project

of the

IEIA

project from the LLET at the entity level.

income before calculating the

IEIA

credit.

Multiple Projects—A pass–through entity with multiple

General Partnership—Lines 5 and 6 of this schedule

economic development projects must complete an

shall not be completed by a general partnership as a

applicable schedule (Schedule KREDA–SP , Schedule

general partnership is not subject to LLET.

KIDA–SP, Schedule KEOZ–SP, Schedule KJRA–SP,

Schedule KIRA–SP, Schedule KJDA–SP, Schedule

Line 5—Using Schedule LLET, create a new Schedule

KBI–SP, Schedule KRA–SP or Schedule IEIA–SP) to

LLET to compute the LLET of the

IEIA

project using

determine the credit and net tax liability, if any, for

only the Kentucky gross receipts and Kentucky gross

each project.

profits of the project. Enter “IEIA” at the top center of

the Schedule LLET and attach it to the tax return.

Line 1—If the pass–through entity’s only operation is

the

IEIA

project, the amount entered on Line 1 is the

Line 9—In lieu of the tax credit, the approved

net income (loss) from Form 720S, 765 or 765–GP . If

company may elect, on an annual basis, to apply as

the pass–through entity has operations other than the

an estimated tax payment an amount equal to the

IEIA

project, a schedule must be attached reflecting

allowable tax credit. Any estimated tax payment shall

the computation of the net income (loss) from the

IEIA

be in satisfaction of the tax liability of the partners,

project in accordance with the following instructions,

members or shareholders of the pass–through entity,

and such amount entered on Line 1.

and shall be paid on behalf of the partners, members

or shareholders. Enter an amount on either (a) or (b),

Separate Facility—In accordance with KRS 141.421(6),

but in no case shall there be an entry on both (a) and

if the project is a totally separate facility, net income,

(b). In accordance with KRS 141.421(5), this estimated

Kentucky gross receipts, and Kentucky gross profits

tax payment is excluded in determining each partner,

attributable to the project shall be determined by a

member or shareholder’s distributive share income

separate accounting method.

or credit from a pass–through entity. Accordingly, the

partners, members or shareholders are not entitled

Alternative Methods—In accordance with KRS 141.421(7),

to claim any portion of this estimated tax payment

if the approved company can show that the nature of the

against their Kentucky income tax liability.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2