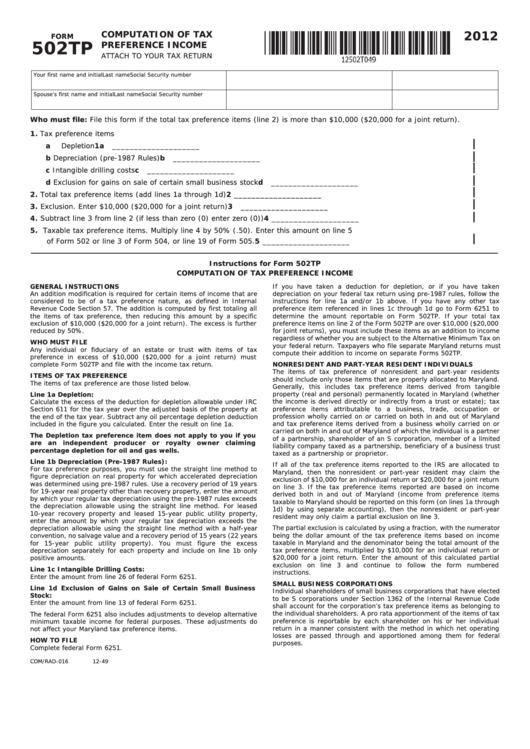

2012

COMPUTATION OF TAX

FORM

502TP

PREFERENCE INCOME

ATTACH TO YOUR TAX RETURN

Your first name and initial

Last name

Social Security number

Spouse’s first name and initial

Last name

Social Security number

Who must file: File this form if the total tax preference items (line 2) is more than $10,000 ($20,000 for a joint return).

1.

Tax preference items

|

a

Depletion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1a

____________________

|

b

Depreciation (pre-1987 Rules) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . b

____________________

|

c

Intangible drilling costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . c

____________________

|

d

Exclusion for gains on sale of certain small business stock. . . . . . . . . . . . . . . . . . . . . . . . . . d

____________________

|

2.

Total tax preference items (add lines 1a through 1d). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

____________________

|

3.

Exclusion. Enter $10,000 ($20,000 for a joint return) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

____________________

|

4.

Subtract line 3 from line 2 (if less than zero (0) enter zero (0)) . . . . . . . . . . . . . . . . . . . . . . . . . 4

____________________

5.

Taxable tax preference items. Multiply line 4 by 50% (.50). Enter this amount on line 5

|

of Form 502 or line 3 of Form 504, or line 19 of Form 505. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

____________________

Instructions for Form 502TP

COMPUTATION OF TAX PREFERENCE INCOME

GENERAL INSTRUCTIONS

If you have taken a deduction for depletion, or if you have taken

An addition modification is required for certain items of income that are

depreciation on your federal tax return using pre-1987 rules, follow the

considered to be of a tax preference nature, as defined in Internal

instructions for line 1a and/or 1b above. If you have any other tax

Revenue Code Section 57. The addition is computed by first totaling all

preference item referenced in lines 1c through 1d go to Form 6251 to

the items of tax preference, then reducing this amount by a specific

determine the amount reportable on Form 502TP. If your total tax

exclusion of $10,000 ($20,000 for a joint return). The excess is further

preference items on line 2 of the Form 502TP are over $10,000 ($20,000

reduced by 50%.

for joint returns), you must include these items as an addition to income

regardless of whether you are subject to the Alternative Minimum Tax on

WHO MUST FILE

your federal return. Taxpayers who file separate Maryland returns must

Any individual or fiduciary of an estate or trust with items of tax

compute their addition to income on separate Forms 502TP.

preference in excess of $10,000 ($20,000 for a joint return) must

complete Form 502TP and file with the income tax return.

NONRESIDENT AND PART-YEAR RESIDENT INDIVIDUALS

The items of tax preference of nonresident and part-year residents

ITEMS OF TAX PREFERENCE

should include only those items that are properly allocated to Maryland.

The items of tax preference are those listed below.

Generally, this includes tax preference items derived from tangible

property (real and personal) permanently located in Maryland (whether

Line 1a Depletion:

the income is derived directly or indirectly from a trust or estate); tax

Calculate the excess of the deduction for depletion allowable under IRC

preference items attributable to a business, trade, occupation or

Section 611 for the tax year over the adjusted basis of the property at

profession wholly carried on or carried on both in and out of Maryland

the end of the tax year. Subtract any oil percentage depletion deduction

included in the figure you calculated. Enter the result on line 1a.

and tax preference items derived from a business wholly carried on or

carried on both in and out of Maryland of which the individual is a partner

The Depletion tax preference item does not apply to you if you

of a partnership, shareholder of an S corporation, member of a limited

are an independent producer or royalty owner claiming

liability company taxed as a partnership, beneficiary of a business trust

percentage depletion for oil and gas wells.

taxed as a partnership or proprietor.

Line 1b Depreciation (Pre-1987 Rules):

If all of the tax preference items reported to the IRS are allocated to

For tax preference purposes, you must use the straight line method to

Maryland, then the nonresident or part-year resident may claim the

figure depreciation on real property for which accelerated depreciation

exclusion of $10,000 for an individual return or $20,000 for a joint return

was determined using pre-1987 rules. Use a recovery period of 19 years

on line 3. If the tax preference items reported are based on income

for 19-year real property other than recovery property, enter the amount

derived both in and out of Maryland (income from preference items

by which your regular tax depreciation using the pre-1987 rules exceeds

taxable to Maryland should be reported on this form (on lines 1a through

the depreciation allowable using the straight line method. For leased

1d) by using separate accounting), then the nonresident or part-year

10-year recovery property and leased 15-year public utility property,

resident may only claim a partial exclusion on line 3.

enter the amount by which your regular tax depreciation exceeds the

depreciation allowable using the straight line method with a half-year

The partial exclusion is calculated by using a fraction, with the numerator

convention, no salvage value and a recovery period of 15 years (22 years

being the dollar amount of the tax preference items based on income

taxable in Maryland and the denominator being the total amount of the

for 15-year public utility property). You must figure the excess

tax preference items, multiplied by $10,000 for an individual return or

depreciation separately for each property and include on line 1b only

$20,000 for a joint return. Enter the amount of this calculated partial

positive amounts.

exclusion on line 3 and continue to follow the form numbered

Line 1c Intangible Drilling Costs:

instructions.

Enter the amount from line 26 of federal Form 6251.

SMALL BUSINESS CORPORATIONS

Line 1d Exclusion of Gains on Sale of Certain Small Business

Individual shareholders of small business corporations that have elected

Stock:

to be S corporations under Section 1362 of the Internal Revenue Code

Enter the amount from line 13 of federal Form 6251.

shall account for the corporation’s tax preference items as belonging to

the individual shareholders. A pro rata apportionment of the items of tax

The federal Form 6251 also includes adjustments to develop alternative

preference is reportable by each shareholder on his or her individual

minimum taxable income for federal purposes. These adjustments do

return in a manner consistent with the method in which net operating

not affect your Maryland tax preference items.

losses are passed through and apportioned among them for federal

HOW TO FILE

purposes.

Complete federal Form 6251.

COM/RAD-016

12-49

1

1