Instructions For Forms 1099-Qa And 5498-Qa - Distributions From Able Accounts And Able Account Contribution Information - 2016

ADVERTISEMENT

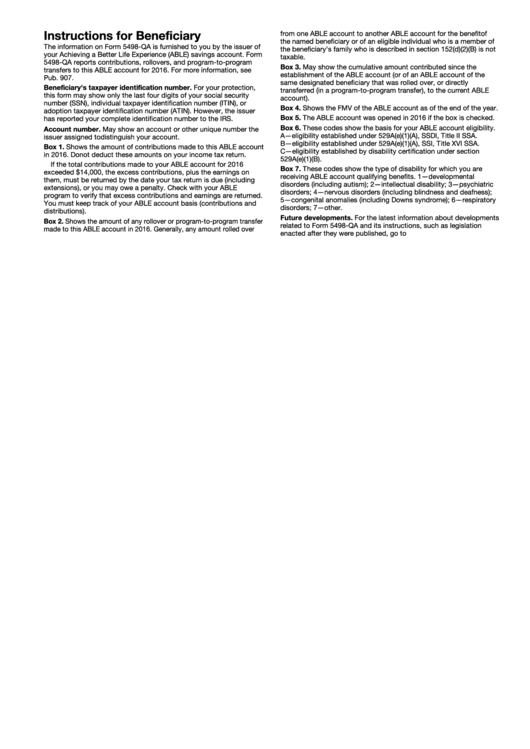

Instructions for Beneficiary

from one ABLE account to another ABLE account for the benefit of

the named beneficiary or of an eligible individual who is a member of

The information on Form 5498-QA is furnished to you by the issuer of

the beneficiary's family who is described in section 152(d)(2)(B) is not

your Achieving a Better Life Experience (ABLE) savings account. Form

taxable.

5498-QA reports contributions, rollovers, and program-to-program

Box 3. May show the cumulative amount contributed since the

transfers to this ABLE account for 2016. For more information, see

establishment of the ABLE account (or of an ABLE account of the

Pub. 907.

same designated beneficiary that was rolled over, or directly

Beneficiary's taxpayer identification number. For your protection,

transferred (in a program-to-program transfer), to the current ABLE

this form may show only the last four digits of your social security

account).

number (SSN), individual taxpayer identification number (ITIN), or

Box 4. Shows the FMV of the ABLE account as of the end of the year.

adoption taxpayer identification number (ATIN). However, the issuer

Box 5. The ABLE account was opened in 2016 if the box is checked.

has reported your complete identification number to the IRS.

Box 6. These codes show the basis for your ABLE account eligibility.

Account number. May show an account or other unique number the

A—eligibility established under 529A(e)(1)(A), SSDI, Title II SSA.

issuer assigned to distinguish your account.

B—eligibility established under 529A(e)(1)(A), SSI, Title XVI SSA.

Box 1. Shows the amount of contributions made to this ABLE account

C—eligibility established by disability certification under section

in 2016. Do not deduct these amounts on your income tax return.

529A(e)(1)(B).

If the total contributions made to your ABLE account for 2016

Box 7. These codes show the type of disability for which you are

exceeded $14,000, the excess contributions, plus the earnings on

receiving ABLE account qualifying benefits. 1—developmental

them, must be returned by the date your tax return is due (including

disorders (including autism); 2—intellectual disability; 3—psychiatric

extensions), or you may owe a penalty. Check with your ABLE

disorders; 4—nervous disorders (including blindness and deafness);

program to verify that excess contributions and earnings are returned.

5—congenital anomalies (including Downs syndrome); 6—respiratory

You must keep track of your ABLE account basis (contributions and

disorders; 7—other.

distributions).

Future developments. For the latest information about developments

Box 2. Shows the amount of any rollover or program-to-program transfer

related to Form 5498-QA and its instructions, such as legislation

made to this ABLE account in 2016. Generally, any amount rolled over

enacted after they were published, go to

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5