Schedule I - Iowa Inheritance Tax

ADVERTISEMENT

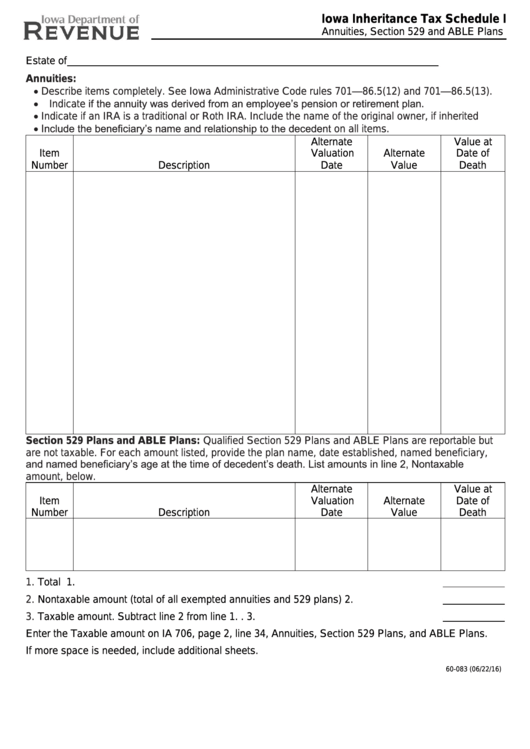

Iowa Inheritance Tax Schedule I

Annuities, Section 529 and ABLE Plans

https://tax.iowa.gov

Estate of

Annuities:

Describe items completely. See Iowa Administrative Code rules 701—86.5(12) and 701—86.5(13).

Indicate if the annuity was derived from an employee’s pension or retirement plan.

Indicate if an IRA is a traditional or Roth IRA. Include the name of the original owner, if inherited

Include the beneficiary’s name and relationship to the decedent on all items.

Alternate

Value at

Item

Valuation

Alternate

Date of

Number

Description

Date

Value

Death

Section 529 Plans and ABLE Plans: Qualified Section 529 Plans and ABLE Plans are reportable but

are not taxable. For each amount listed, provide the plan name, date established, named beneficiary,

and named beneficiary’s age at the time of decedent’s death. List amounts in line 2, Nontaxable

amount, below.

Alternate

Value at

Item

Valuation

Alternate

Date of

Number

Description

Date

Value

Death

1.

Total ............................................................................................................................... 1.

2.

Nontaxable amount (total of all exempted annuities and 529 plans).............................. 2.

3.

Taxable amount. Subtract line 2 from line 1. ................................................................. 3.

Enter the Taxable amount on IA 706, page 2, line 34, Annuities, Section 529 Plans, and ABLE Plans.

If more space is needed, include additional sheets.

60-083 (06/22/16)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1