Form I-332 - Certificate For Reserve Police Officer, Dnr Deputy Enforcement Officer, Or Member Of The State Guard

ADVERTISEMENT

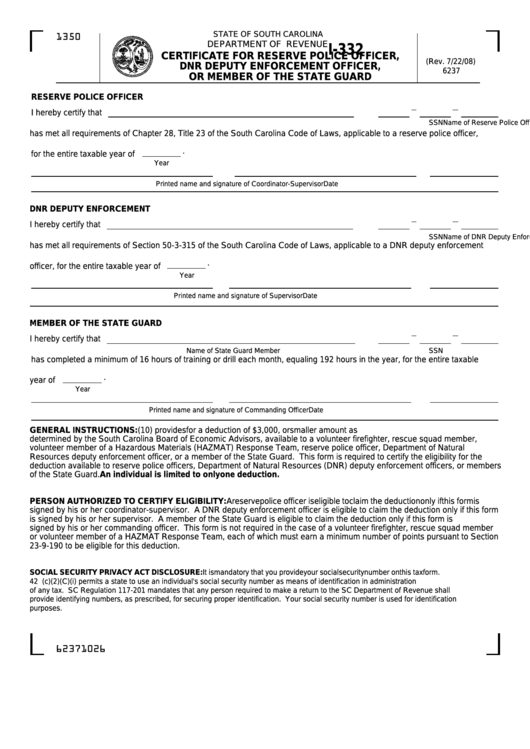

STATE OF SOUTH CAROLINA

1350

DEPARTMENT OF REVENUE

I-332

CERTIFICATE FOR RESERVE POLICE OFFICER,

(Rev. 7/22/08)

DNR DEPUTY ENFORCEMENT OFFICER,

6237

OR MEMBER OF THE STATE GUARD

RESERVE POLICE OFFICER

I hereby certify that

Name of Reserve Police Officer

SSN

has met all requirements of Chapter 28, Title 23 of the South Carolina Code of Laws, applicable to a reserve police officer,

.

for the entire taxable year of

Year

Printed name and signature of Coordinator-Supervisor

Date

DNR DEPUTY ENFORCEMENT

I hereby certify that

Name of DNR Deputy Enforcement Officer

SSN

has met all requirements of Section 50-3-315 of the South Carolina Code of Laws, applicable to a DNR deputy enforcement

.

officer, for the entire taxable year of

Year

Printed name and signature of Supervisor

Date

MEMBER OF THE STATE GUARD

I hereby certify that

Name of State Guard Member

SSN

has completed a minimum of 16 hours of training or drill each month, equaling 192 hours in the year, for the entire taxable

.

year of

Year

Printed name and signature of Commanding Officer

Date

GENERAL INSTRUCTIONS: S.C. Code Section 12-6-1140 (10) provides for a deduction of $3,000, or smaller amount as

determined by the South Carolina Board of Economic Advisors, available to a volunteer firefighter, rescue squad member,

volunteer member of a Hazardous Materials (HAZMAT) Response Team, reserve police officer, Department of Natural

Resources deputy enforcement officer, or a member of the State Guard. This form is required to certify the eligibility for the

deduction available to reserve police officers, Department of Natural Resources (DNR) deputy enforcement officers, or members

of the State Guard. An individual is limited to only one deduction.

PERSON AUTHORIZED TO CERTIFY ELIGIBILITY: A reserve police officer is eligible to claim the deduction only if this form is

signed by his or her coordinator-supervisor. A DNR deputy enforcement officer is eligible to claim the deduction only if this form

is signed by his or her supervisor. A member of the State Guard is eligible to claim the deduction only if this form is

signed by his or her commanding officer. This form is not required in the case of a volunteer firefighter, rescue squad member

or volunteer member of a HAZMAT Response Team, each of which must earn a minimum number of points pursuant to Section

23-9-190 to be eligible for this deduction.

SOCIAL SECURITY PRIVACY ACT DISCLOSURE: It is mandatory that you provide your social security number on this tax form.

42 U.S.C 405 (c)(2)(C)(i) permits a state to use an individual's social security number as means of identification in administration

of any tax. SC Regulation 117-201 mandates that any person required to make a return to the SC Department of Revenue shall

provide identifying numbers, as prescribed, for securing proper identification. Your social security number is used for identification

purposes.

62371026

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1