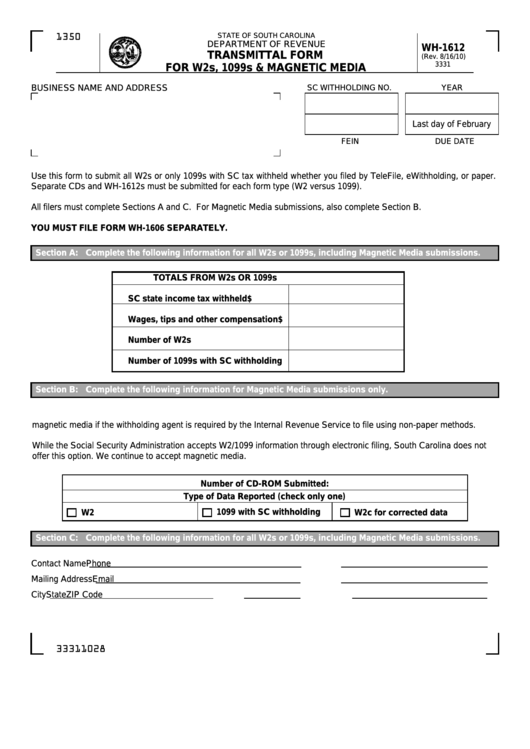

Form Wh-1612 - Transmittal Form For W2s, 1099s & Magnetic Media

ADVERTISEMENT

STATE OF SOUTH CAROLINA

1350

DEPARTMENT OF REVENUE

WH-1612

TRANSMITTAL FORM

(Rev. 8/16/10)

3331

FOR W2s, 1099s & MAGNETIC MEDIA

BUSINESS NAME AND ADDRESS

SC WITHHOLDING NO.

YEAR

Last day of February

FEIN

DUE DATE

Use this form to submit all W2s or only 1099s with SC tax withheld whether you filed by TeleFile, eWithholding, or paper.

Separate CDs and WH-1612s must be submitted for each form type (W2 versus 1099).

All filers must complete Sections A and C. For Magnetic Media submissions, also complete Section B.

YOU MUST FILE FORM WH-1606 SEPARATELY.

Section A: Complete the following information for all W2s or 1099s, including Magnetic Media submissions.

TOTALS FROM W2s OR 1099s

SC state income tax withheld

$

Wages, tips and other compensation

$

Number of W2s

Number of 1099s with SC withholding

Section B: Complete the following information for Magnetic Media submissions only.

S.C.Code Section 12-8-1550 requires wage and tax information to be submitted to the SC Department of Revenue on

magnetic media if the withholding agent is required by the Internal Revenue Service to file using non-paper methods.

While the Social Security Administration accepts W2/1099 information through electronic filing, South Carolina does not

offer this option. We continue to accept magnetic media.

Number of CD-ROM Submitted:

Type of Data Reported (check only one)

1099 with SC withholding

W2

W2c for corrected data

Section C: Complete the following information for all W2s or 1099s, including Magnetic Media submissions.

Contact Name

Phone

Mailing Address

Email

City

State

ZIP Code

33311028

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2