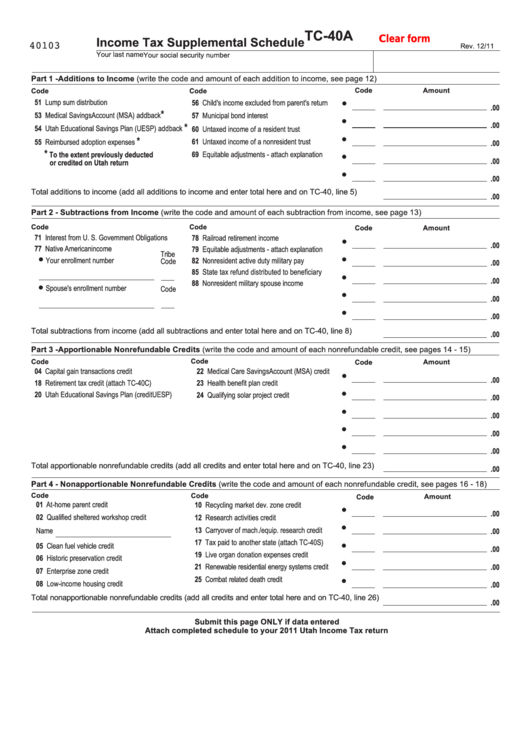

TC-40A

Clear form

Income Tax Supplemental Schedule

40103

Rev. 12/11

Your last name

Your social security number

Part 1 - Additions to Income (write the code and amount of each addition to income, see page 12)

Code

Amount

Code

Code

51 Lump sum distribution

56 Child's income excluded from parent's return

.00

*

53 Medical Savings Account (MSA) addback

57 Municipal bond interest

.00

*

54 Utah Educational Savings Plan (UESP) addback

60 Untaxed income of a resident trust

*

61 Untaxed income of a nonresident trust

55 Reimbursed adoption expenses

.00

*

To the extent previously deducted

69 Equitable adjustments - attach explanation

.00

or credited on Utah return

.00

Total additions to income (add all additions to income and enter total here and on TC-40, line 5)

.00

Part 2 - Subtractions from Income (write the code and amount of each subtraction from income, see page 13)

Code

Code

Code

Amount

71 Interest from U. S. Government Obligations

78 Railroad retirement income

.00

77 Native American income

79 Equitable adjustments - attach explanation

Tribe

Your enrollment number

82 Nonresident active duty military pay

Code

.00

85 State tax refund distributed to beneficiary

.00

88 Nonresident military spouse income

Spouse's enrollment number

Code

.00

.00

Total subtractions from income (add all subtractions and enter total here and on TC-40, line 8)

.00

Part 3 - Apportionable Nonrefundable Credits (write the code and amount of each nonrefundable credit, see pages 14 - 15)

Code

Code

Amount

Code

04 Capital gain transactions credit

22 Medical Care Savings Account (MSA) credit

.00

18 Retirement tax credit (attach TC-40C)

23 Health benefit plan credit

20 Utah Educational Savings Plan (

UESP)

credit

24 Qualifying solar project credit

.00

.00

.00

.00

Total apportionable nonrefundable credits (add all credits and enter total here and on TC-40, line 23)

.00

Part 4 - Nonapportionable Nonrefundable Credits (write the code and amount of each nonrefundable credit, see pages 16 - 18)

Code

Code

Amount

Code

01 At-home parent credit

10 Recycling market dev. zone credit

.00

02 Qualified sheltered workshop credit

12 Research activities credit

13 Carryover of mach./equip. research credit

Name

.00

17 Tax paid to another state (attach TC-40S)

05 Clean fuel vehicle credit

.00

19 Live organ donation expenses credit

06 Historic preservation credit

21 Renewable residential energy systems credit

.00

07 Enterprise zone credit

25 Combat related death credit

08 Low-income housing credit

.00

Total nonapportionable nonrefundable credits (add all credits and enter total here and on TC-40, line 26)

.00

Submit this page ONLY if data entered

Attach completed schedule to your 2011 Utah Income Tax return

1

1 2

2