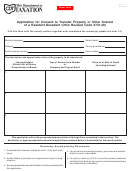

Form Ht-106 - Application For Consent To Transfer Property Or Release Of Inheritance Tax Lien

ADVERTISEMENT

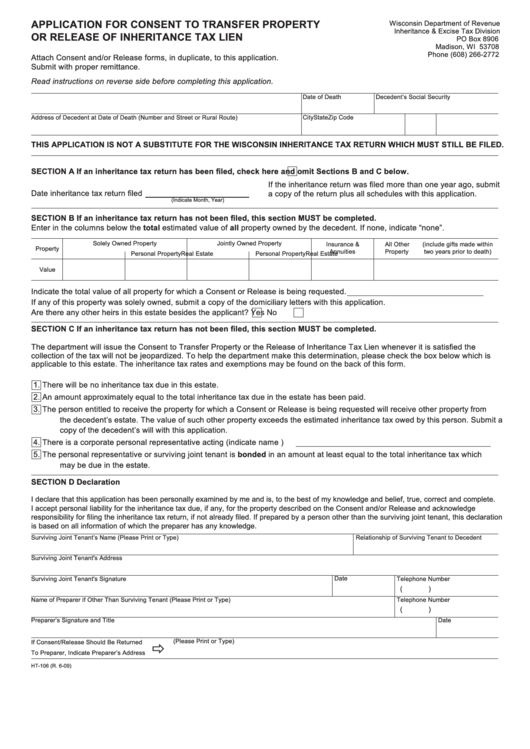

APPLICATION FOR CONSENT TO TRANSFER PROPERTY

Wisconsin Department of Revenue

Inheritance & Excise Tax Division

OR RELEASE OF INHERITANCE TAX LIEN

PO Box 8906

Madison, WI 53708

Phone (608) 266-2772

Attach Consent and/or Release forms, in duplicate, to this application.

Submit with proper remittance.

Read instructions on reverse side before completing this application.

Estate of

Date of Death

Decedent’s Social Security No.

City

State

Zip Code

Address of Decedent at Date of Death (Number and Street or Rural Route)

THIS APPLICATION IS NOT A SUBSTITUTE FOR THE WISCONSIN INHERITANCE TAX RETURN WHICH MUST STILL BE FILED.

SECTION A If an inheritance tax return has been filed, check here

and omit Sections B and C below.

If the inheritance return was filed more than one year ago, submit

Date inheritance tax return filed

a copy of the return plus all schedules with this application.

(Indicate Month, Year)

SECTION B If an inheritance tax return has not been filed, this section MUST be completed.

Enter in the columns below the total estimated value of all property owned by the decedent. If none, indicate “none”.

Solely Owned Property

Jointly Owned Property

Insurance &

All Other

(include gifts made within

Property

Annuities

Property

two years prior to death)

Real Estate

Personal Property

Real Estate

Personal Property

Value

Indicate the total value of all property for which a Consent or Release is being requested.

If any of this property was solely owned, submit a copy of the domiciliary letters with this application.

Are there any other heirs in this estate besides the applicant?

Yes

No

SECTION C If an inheritance tax return has not been filed, this section MUST be completed.

The department will issue the Consent to Transfer Property or the Release of Inheritance Tax Lien whenever it is satisfied the

collection of the tax will not be jeopardized. To help the department make this determination, please check the box below which is

applicable to this estate. The inheritance tax rates and exemptions may be found on the back of this form.

1. There will be no inheritance tax due in this estate.

2. An amount approximately equal to the total inheritance tax due in the estate has been paid.

3. The person entitled to receive the property for which a Consent or Release is being requested will receive other property from

the decedent’s estate. The value of such other property exceeds the estimated inheritance tax owed by this person. Submit a

copy of the decedent’s will with this application.

4. There is a corporate personal representative acting (indicate name

)

5. The personal representative or surviving joint tenant is bonded in an amount at least equal to the total inheritance tax which

may be due in the estate.

SECTION D

Declaration

I declare that this application has been personally examined by me and is, to the best of my knowledge and belief, true, correct and complete.

I accept personal liability for the inheritance tax due, if any, for the property described on the Consent and/or Release and acknowledge

responsibility for filing the inheritance tax return, if not already filed. If prepared by a person other than the surviving joint tenant, this declaration

is based on all information of which the preparer has any knowledge.

Surviving Joint Tenant’s Name (Please Print or Type)

Relationship of Surviving Tenant to Decedent

Surviving Joint Tenant's Address

Date

Surviving Joint Tenant's Signature

Telephone Number

(

)

Name of Preparer if Other Than Surviving Tenant (Please Print or Type)

Telephone Number

(

)

Preparer’s Signature and Title

Date

(Please Print or Type)

If Consent/Release Should Be Returned

ð

To Preparer, Indicate Preparer’s Address

HT-106 (R. 6-09)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2