Form Nc-1099ps - Personal Services Income Paid To A Nonresident

ADVERTISEMENT

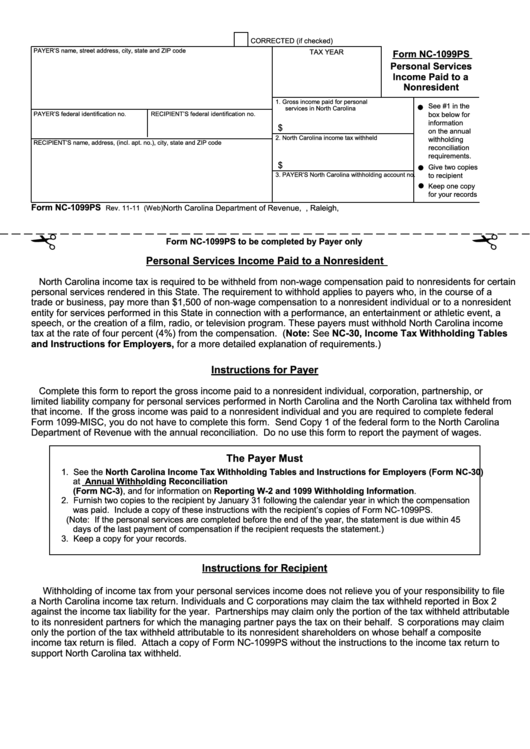

CORRECTED (if checked)

PAYER’S name, street address, city, state and ZIP code

TAX YEAR

Form NC-1099PS

Personal Services

Income Paid to a

Nonresident

1. Gross income paid for personal

See #1 in the

services in North Carolina

PAYER’S federal identification no.

box below for

RECIPIENT’S federal identification no.

information

$

on the annual

2. North Carolina income tax withheld

withholding

RECIPIENT’S name, address, (incl. apt. no.), city, state and ZIP code

reconciliation

requirements.

$

Give two copies

3. PAYER’S North Carolina withholding account no.

to recipient

Keep one copy

for your records

Form NC-1099PS

North Carolina Department of Revenue, P.O. Box 25000, Raleigh, N.C. 27640-0001

Rev. 11-11 (Web)

Form NC-1099PS to be completed by Payer only

Personal Services Income Paid to a Nonresident

North Carolina income tax is required to be withheld from non-wage compensation paid to nonresidents for certain

personal services rendered in this State. The requirement to withhold applies to payers who, in the course of a

trade or business, pay more than $1,500 of non-wage compensation to a nonresident individual or to a nonresident

entity for services performed in this State in connection with a performance, an entertainment or athletic event, a

speech, or the creation of a film, radio, or television program. These payers must withhold North Carolina income

tax at the rate of four percent (4%) from the compensation. (Note: See NC-30, Income Tax Withholding Tables

and Instructions for Employers, for a more detailed explanation of requirements.)

Instructions for Payer

Complete this form to report the gross income paid to a nonresident individual, corporation, partnership, or

limited liability company for personal services performed in North Carolina and the North Carolina tax withheld from

that income. If the gross income was paid to a nonresident individual and you are required to complete federal

Form 1099-MISC, you do not have to complete this form. Send Copy 1 of the federal form to the North Carolina

Department of Revenue with the annual reconciliation. Do no use this form to report the payment of wages.

The Payer Must

1. See the North Carolina Income Tax Withholding Tables and Instructions for Employers (Form NC-30)

at for information regarding the submission of the Annual Withholding Reconciliation

(Form NC-3), and for information on Reporting W-2 and 1099 Withholding Information.

2. Furnish two copies to the recipient by January 31 following the calendar year in which the compensation

was paid. Include a copy of these instructions with the recipient’s copies of Form NC-1099PS.

(Note: If the personal services are completed before the end of the year, the statement is due within 45

days of the last payment of compensation if the recipient requests the statement.)

3. Keep a copy for your records.

Instructions for Recipient

Withholding of income tax from your personal services income does not relieve you of your responsibility to file

a North Carolina income tax return. Individuals and C corporations may claim the tax withheld reported in Box 2

against the income tax liability for the year. Partnerships may claim only the portion of the tax withheld attributable

to its nonresident partners for which the managing partner pays the tax on their behalf. S corporations may claim

only the portion of the tax withheld attributable to its nonresident shareholders on whose behalf a composite

income tax return is filed. Attach a copy of Form NC-1099PS without the instructions to the income tax return to

support North Carolina tax withheld.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1