Form Nc-478g - Tax Credit Investing In Renewable Energy Property - 2011

ADVERTISEMENT

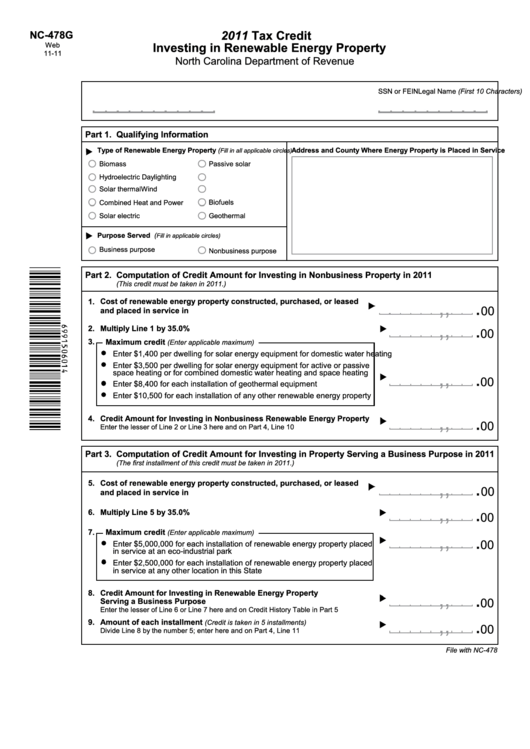

2011 Tax Credit

NC-478G

Investing in Renewable Energy Property

Web

11-11

North Carolina Department of Revenue

Legal Name (First 10 Characters)

SSN or FEIN

Part 1.

Qualifying Information

Type of Renewable Energy Property (

Address and County Where Energy Property is Placed in Service

Fill in all applicable circles)

Biomass

Passive solar

Hydroelectric

Daylighting

Solar thermal

Wind

Biofuels

Combined Heat and Power

Solar electric

Geothermal

Purpose Served (

Fill in applicable circles)

Business purpose

Nonbusiness purpose

Part 2.

Computation of Credit Amount for Investing in Nonbusiness Property in 2011

(This credit must be taken in 2011.)

,

,

.

Cost of renewable energy property constructed, purchased, or leased

1.

00

and placed in service in N.C. in 2011 for a nonbusiness purpose

,

,

.

2.

Multiply Line 1 by 35.0%

00

3.

Maximum credit

(Enter applicable maximum)

Enter $1,400 per dwelling for solar energy equipment for domestic water heating

Enter $3,500 per dwelling for solar energy equipment for active or passive

,

,

.

space heating or for combined domestic water heating and space heating

00

Enter $8,400 for each installation of geothermal equipment

Enter $10,500 for each installation of any other renewable energy property

,

,

.

4.

Credit Amount for Investing in Nonbusiness Renewable Energy Property

00

Enter the lesser of Line 2 or Line 3 here and on Part 4, Line 10

Part 3.

Computation of Credit Amount for Investing in Property Serving a Business Purpose in 2011

(The first installment of this credit must be taken in 2011.)

,

,

.

5.

Cost of renewable energy property constructed, purchased, or leased

00

and placed in service in N.C. in 2011 for a business purpose

,

,

.

6.

Multiply Line 5 by 35.0%

00

7.

Maximum credit

,

,

(Enter applicable maximum)

.

00

Enter $5,000,000 for each installation of renewable energy property placed

in service at an eco-industrial park

Enter $2,500,000 for each installation of renewable energy property placed

in service at any other location in this State

,

,

.

8. Credit Amount for Investing in Renewable Energy Property

00

Serving a Business Purpose

Enter the lesser of Line 6 or Line 7 here and on Credit History Table in Part 5

,

,

.

9.

Amount of each installment

(Credit is taken in 5 installments)

00

Divide Line 8 by the number 5; enter here and on Part 4, Line 11

File with NC-478

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2