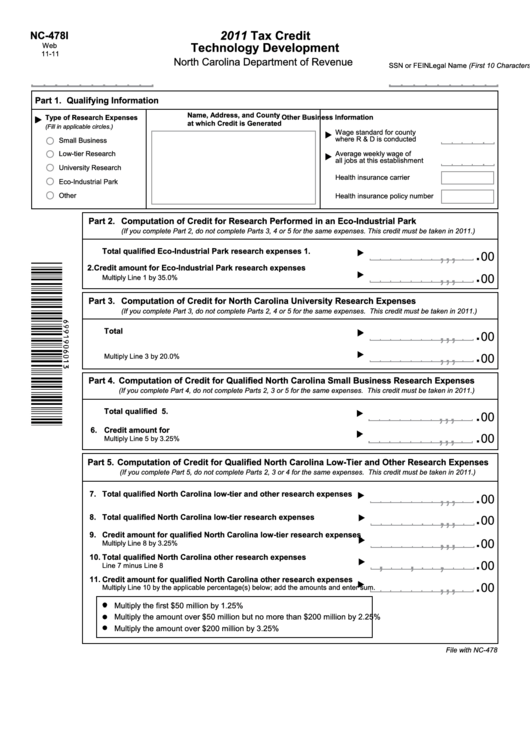

Form Nc-478i - Tax Credit Technology Development - 2011

ADVERTISEMENT

2011 Tax Credit

NC-478I

Technology Development

Web

11-11

North Carolina Department of Revenue

Legal Name (First 10 Characters)

SSN or FEIN

Part 1.

Qualifying Information

Name, Address, and County

Other Business Information

Type of Research Expenses

at which Credit is Generated

(Fill in applicable circles.)

Wage standard for county

where R & D is conducted

Small Business

Low-tier Research

Average weekly wage of

all jobs at this establishment

University Research

Health insurance carrier

Eco-Industrial Park

Other

Health insurance policy number

Part 2.

Computation of Credit for Research Performed in an Eco-Industrial Park

(If you complete Part 2, do not complete Parts 3, 4 or 5 for the same expenses. This credit must be taken in 2011.)

.

,

,

,

1.

Total qualified Eco-Industrial Park research expenses

00

.

,

,

,

2.

Credit amount for Eco-Industrial Park research expenses

00

Multiply Line 1 by 35.0%

Part 3.

Computation of Credit for North Carolina University Research Expenses

(If you complete Part 3, do not complete Parts 2, 4 or 5 for the same expenses. This credit must be taken in 2011.)

.

,

,

,

3.

Total N.C. university research expenses

00

.

,

,

,

4. Credit amount for N.C. university research expenses

00

Multiply Line 3 by 20.0%

Part 4.

Computation of Credit for Qualified North Carolina Small Business Research Expenses

(If you complete Part 4, do not complete Parts 2, 3 or 5 for the same expenses. This credit must be taken in 2011.)

,

,

,

.

5.

Total qualified N.C. small business research expenses

00

,

,

,

.

6.

Credit amount for N.C. small business research expenses

00

Multiply Line 5 by 3.25%

Part 5. Computation of Credit for Qualified North Carolina Low-Tier and Other Research Expenses

(If you complete Part 5, do not complete Parts 2, 3 or 4 for the same expenses. This credit must be taken in 2011.)

,

,

,

.

7.

Total qualified North Carolina low-tier and other research expenses

00

.

,

,

,

8.

Total qualified North Carolina low-tier research expenses

00

,

,

,

.

9.

Credit amount for qualified North Carolina low-tier research expenses

00

Multiply Line 8 by 3.25%

,

,

,

.

10.

Total qualified North Carolina other research expenses

00

Line 7 minus Line 8

.

,

,

,

11.

Credit amount for qualified North Carolina other research expenses

00

Multiply Line 10 by the applicable percentage(s) below; add the amounts and enter sum.

Multiply the first $50 million by 1.25%

Multiply the amount over $50 million but no more than $200 million by 2.25%

Multiply the amount over $200 million by 3.25%

File with NC-478

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2