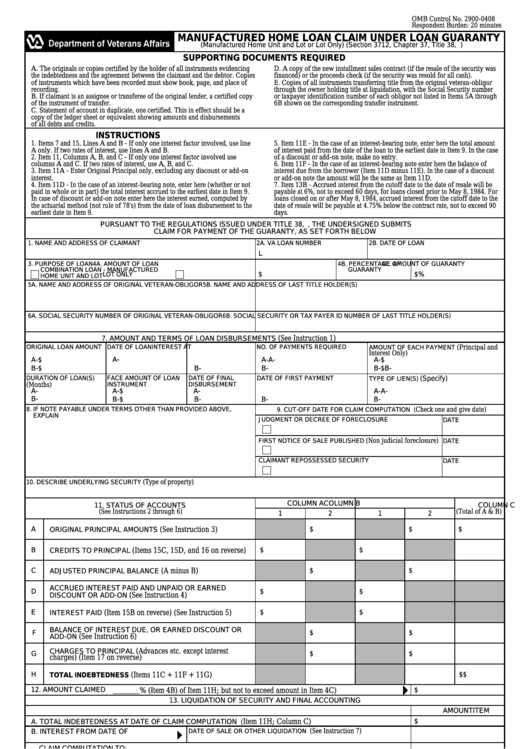

OMB Control No. 2900-0408

Respondent Burden: 20 minutes

MANUFACTURED HOME LOAN CLAIM UNDER LOAN GUARANTY

(Manufactured Home Unit and Lot or Lot Only) (Section 3712, Chapter 37, Title 38, U.S.C.)

SUPPORTING DOCUMENTS REQUIRED

A. The originals or copies certified by the holder of all instruments evidencing

D. A copy of the new installment sales contract (if the resale of the security was

the indebtedness and the agreement between the claimant and the debtor. Copies

financed) or the proceeds check (if the security was resold for all cash).

of instruments which have been recorded must show book, page, and place of

E. Copies of all instruments transferring title from the original veteran-obligor

recording.

through the owner holding title at liquidation, with the Social Security number

B. If claimant is an assignee or transferee of the original lender, a certified copy

or taxpayer identification number of each obligor not listed in Items 5A through

of the instrument of transfer.

6B shown on the corresponding transfer instrument.

C. Statement of account in duplicate, one certified. This in effect should be a

copy of the ledger sheet or equivalent showing amounts and disbursements

of all debts and credits.

INSTRUCTIONS

1. Items 7 and 15, Lines A and B - If only one interest factor involved, use line

5. Item 11E - In the case of an interest-bearing note, enter here the total amount

A only. If two rates of interest, use lines A and B.

of interest paid from the date of the loan to the earliest date in Item 9. In the case

2. Item 11, Columns A, B, and C - If only one interest factor involved use

of a discount or add-on note, make no entry.

columns A and C. If two rates of interest, use A, B, and C.

6. Item 11F - In the case of an interest-bearing note enter here the balance of

3. Item 11A - Enter Original Principal only, excluding any discount or add-on

interest due from the borrower (Item 11D minus 11E). In the case of a discount

interest.

or add-on note the amount will be the same as Item 11D.

4. Item 11D - In the case of an interest-bearing note, enter here (whether or not

7. Item 13B - Accrued interest from the cutoff date to the date of resale will be

paid in whole or in part) the total interest accrued to the earliest date in Item 9.

payable at 6%, not to exceed 60 days, for loans closed prior to May 8, 1984. For

In case of discount or add-on note enter here the interest earned, computed by

loans closed on or after May 8, 1984, accrued interest from the cutoff date to the

the actuarial method (not rule of 78's) from the date of loan disbursement to the

date of resale will be payable at 4.75% below the contract rate, not to exceed 90

earliest date in Item 9.

days.

PURSUANT TO THE REGULATIONS ISSUED UNDER TITLE 38, U.S.C., THE UNDERSIGNED SUBMITS

CLAIM FOR PAYMENT OF THE GUARANTY, AS SET FORTH BELOW

1. NAME AND ADDRESS OF CLAIMANT

2A. VA LOAN NUMBER

2B. DATE OF LOAN

L

3. PURPOSE OF LOAN

4A. AMOUNT OF LOAN

4B. PERCENTAGE OF

4C. AMOUNT OF GUARANTY

GUARANTY

COMBINATION LOAN - MANUFACTURED

$

%

$

LOT ONLY

HOME UNIT AND LOT

5A. NAME AND ADDRESS OF ORIGINAL VETERAN-OBLIGOR

5B. NAME AND ADDRESS OF LAST TITLE HOLDER(S)

6A. SOCIAL SECURITY NUMBER OF ORIGINAL VETERAN-OBLIGOR

6B. SOCIAL SECURITY OR TAX PAYER ID NUMBER OF LAST TITLE HOLDER(S)

(See Instruction 1)

7. AMOUNT AND TERMS OF LOAN DISBURSEMENTS

ORIGINAL LOAN AMOUNT

DATE OF LOAN

INTEREST AT

NO. OF PAYMENTS REQUIRED

(Principal and

AMOUNT OF EACH PAYMENT

Interest Only)

A-$

A-

A-

A-

A-$

B-$

B-

B-

B-

B-$

DURATION OF LOAN(S)

FACE AMOUNT OF LOAN

DATE OF FINAL

DATE OF FIRST PAYMENT

(Specify)

TYPE OF LIEN(S)

INSTRUMENT

DISBURSEMENT

(Months)

A-

A-$

A-

A-

A-

B-

B-$

B-

B-

B-

8. IF NOTE PAYABLE UNDER TERMS OTHER THAN PROVIDED ABOVE,

9. CUT-OFF DATE FOR CLAIM COMPUTATION (

Check one and give date)

EXPLAIN

JUDGMENT OR DECREE OF FORECLOSURE

DATE

(Non judicial foreclosure)

DATE

FIRST NOTICE OF SALE PUBLISHED

CLAIMANT REPOSSESSED SECURITY

DATE

(Type of property)

10. DESCRIBE UNDERLYING SECURITY

COLUMN A

COLUMN B

11. STATUS OF ACCOUNTS

COLUMN C

(See Instructions 2 through 6)

(Total of A & B)

1

2

1

2

A

$

$

$

ORIGINAL PRINCIPAL AMOUNTS

(See Instruction 3)

B

(Items 15C, 15D, and 16 on reverse)

$

$

CREDITS TO PRINCIPAL

C

$

$

(A minus B)

ADJUSTED PRINCIPAL BALANCE

ACCRUED INTEREST PAID AND UNPAID OR EARNED

D

$

$

DISCOUNT OR ADD-ON

(See Instruction 4)

E

(Item 15B on reverse) (See Instruction 5)

$

$

INTEREST PAID

BALANCE OF INTEREST DUE, OR EARNED DISCOUNT OR

F

$

$

ADD-ON

(See Instruction 6)

CHARGES TO PRINCIPAL

(Advances etc. except interest

G

$

$

charges) (Item 17 on reverse)

H

(Items 11C + 11F + 11G)

$

$

$

TOTAL INDEBTEDNESS

12. AMOUNT CLAIMED

$

% (Item 4B) of Item 11H; but not to exceed amount in Item 4C)

13. LIQUIDATION OF SECURITY AND FINAL ACCOUNTING

ITEM

AMOUNT

Item 11H; Column C)

$

A. TOTAL INDEBTEDNESS AT DATE OF CLAIM COMPUTATION (

B. INTEREST FROM DATE OF

DATE OF SALE OR OTHER LIQUIDATION

(See Instruction 7)

CLAIM COMPUTATION TO:

C. LIQUIDATION EXPENSES

(From Item 18, Schedule A)

(Not included in Item 11G) (See Item 17 on reverse)

D. ADVANCES

E. TOTAL

F. LESS BALANCE IN TAX AND INS. ACCT., INS. REFUND AND OTHER CREDITS

(Omit if included in Item 11B) (See Items 16 and 19 on reverse)

G. TOTAL INDEBTEDNESS AT DATE OF SALE OR OTHER LIQUIDATION

H. PROCEEDS OF LIQUIDATION

$

I. AMOUNT CLAIMED

(Not to exceed amount claimed at Item 12)

14. DATE OF FILING CLAIM

NOTE: See reverse for additional items.

VA FORM

SUPERCEDES VA FORM 26-8630, MAR 2005,

26-8630

OCT 2008

WHICH WILL NOT BE USED.

1

1 2

2