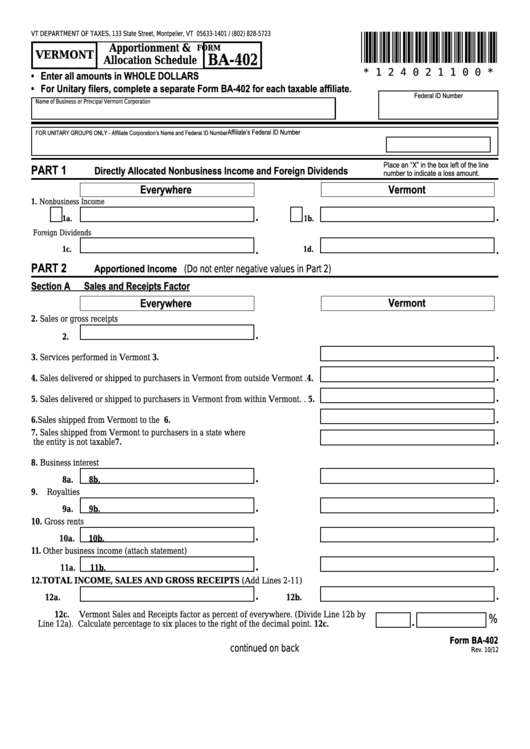

Form Ba-402 - Vermont Apportionment & Allocation Schedule

ADVERTISEMENT

VT DEPARTMENT OF TAXES, 133 State Street, Montpelier, VT 05633-1401 / (802) 828-5723

*124021100*

Apportionment &

FORM

VERMONT

BA-402

Allocation Schedule

• Enter all amounts in WHOLE DOLLARS

* 1 2 4 0 2 1 1 0 0 *

• For Unitary filers, complete a separate Form BA-402 for each taxable affiliate.

Federal ID Number

Name of Business or Principal Vermont Corporation

Affiliate’s Federal ID Number

FOR UNITARY GROUPS ONLY - Affiliate Corporation’s Name and Federal ID Number

Place an “X” in the box left of the line

PART 1

Directly Allocated Nonbusiness Income and Foreign Dividends

number to indicate a loss amount.

Everywhere

Vermont

1.

Nonbusiness Income

.

.

1a.

1b.

Foreign Dividends

.

.

1c.

1d.

PART 2

Apportioned Income (Do not enter negative values in Part 2)

Section A Sales and Receipts Factor

Everywhere

Vermont

2. Sales or gross receipts

.

2.

.

3. Services performed in Vermont . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

.

4.

Sales delivered or shipped to purchasers in Vermont from outside Vermont .4.

.

5.

Sales delivered or shipped to purchasers in Vermont from within Vermont . .5.

.

6.

Sales shipped from Vermont to the U.S. Government . . . . . . . . . . . . . . . . . . .6.

7.

Sales shipped from Vermont to purchasers in a state where

.

the entity is not taxable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7.

8.

Business interest

.

.

8a.

8b.

9. Royalties

.

.

9a.

9b.

10. Gross rents

.

.

10a.

10b.

11. Other business income (attach statement)

.

.

11a.

11b.

12. TOTAL INCOME, SALES AND GROSS RECEIPTS (Add Lines 2-11)

.

.

12a.

12b.

%

12c.

Vermont Sales and Receipts factor as percent of everywhere. (Divide Line 12b by

.

Line 12a)

Calculate percentage to six places to the right of the decimal point. 12c.

.

Form BA-402

continued on back

Rev. 10/12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2