Form Wv/it-104 - West Virginia Employee'S Withholding Exemption Certificate

ADVERTISEMENT

WEST VIRGINIA

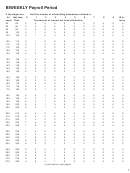

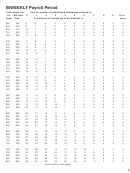

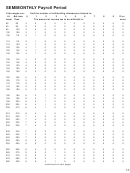

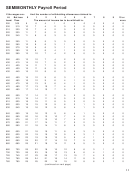

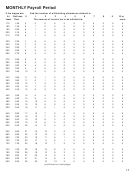

EMPLOYER’S WITHHOLDING

TAX TABLES

In an effort to withhold the correct amount of West Virginia State Income tax from employee’s wages,

the State Tax Department has adjusted the withholding table. The revised Income Tax Withholding Tables

should be used beginning January 1, 2007

At the same time, January 1, 2007, employers should provide each employee with a copy of the revised

West Virginia Withholding Exemption Certificate, Form WV/IT-104. A reproducible form is on page 2 of this

booklet. You should keep this completed certificate in your files.

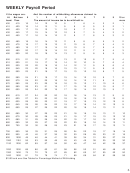

The tables provided in this booklet are to be used for ALL employees unless the employee has requested

on the Withholding Exemption Certificate that tax be withheld at a lower rate. Use the charts on pages 19 and

20 to calculate the amount to be withheld for these employees. These charts are for single or head of household

employees earning wages from only one job or for married employees whose spouse does not work.

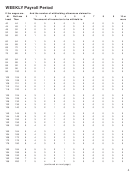

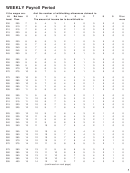

The withholding tables included in this publication are based on two-earner/two-job income. The tables

are computed at a higher rate to help in preventing under-withholding for married employees filing a joint

personal income tax return and for those employees earning wages from more than one job.

The amount of tax to be withheld is based on the employee’s withholding exemption certificate and the

rates set forth in this booklet. To determine the amount of tax to be withheld, the employer may use the wage

bracket tables beginning on page 4 or the percentage charts on pages 16 through 20. Add to this any additional

amount requested by the employee to be withheld. Amounts to be withheld must be rounded to the nearest

whole dollar.

Visit Our Web Site

For Assistance

Toll-Free 1-800-982-8297

Or (304) 558-3333

Hearing Impaired

TDD Service 1-800-282-9833

Form WV/IT-100.1-A

January 1, 2007

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20