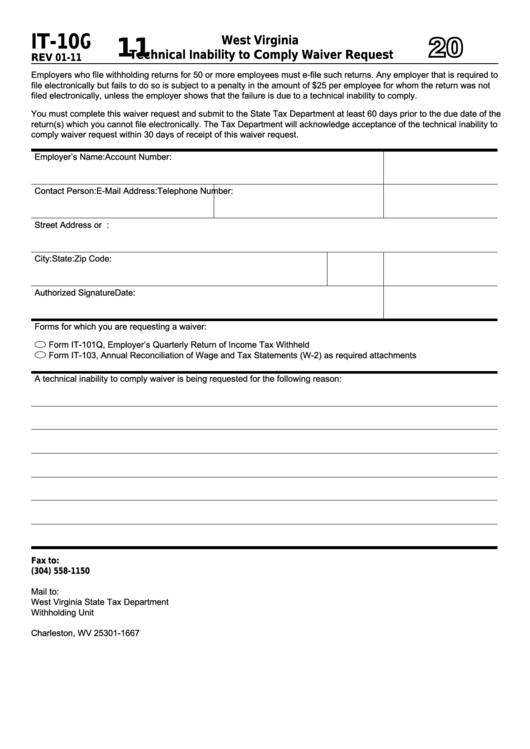

Form It-106 - West Virginia Technical Inability To Comply Waiver Request - 2011

ADVERTISEMENT

2011

IT-106

West Virginia

Technical Inability to Comply Waiver Request

REV 01-11

Employers who file withholding returns for 50 or more employees must e-file such returns. Any employer that is required to

file electronically but fails to do so is subject to a penalty in the amount of $25 per employee for whom the return was not

filed electronically, unless the employer shows that the failure is due to a technical inability to comply.

You must complete this waiver request and submit to the State Tax Department at least 60 days prior to the due date of the

return(s) which you cannot file electronically. The Tax Department will acknowledge acceptance of the technical inability to

comply waiver request within 30 days of receipt of this waiver request.

Employer’s Name:

Account Number:

Contact Person:

E-Mail Address:

Telephone Number:

Street Address or P.O. Box:

City:

State:

Zip Code:

Authorized Signature

Date:

Forms for which you are requesting a waiver:

Form IT-101Q, Employer’s Quarterly Return of Income Tax Withheld

Form IT-103, Annual Reconciliation of Wage and Tax Statements (W-2) as required attachments

A technical inability to comply waiver is being requested for the following reason:

Fax to:

(304) 558-1150

Mail to:

West Virginia State Tax Department

Withholding Unit

P.O. Box 1667

Charleston, WV 25301-1667

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1