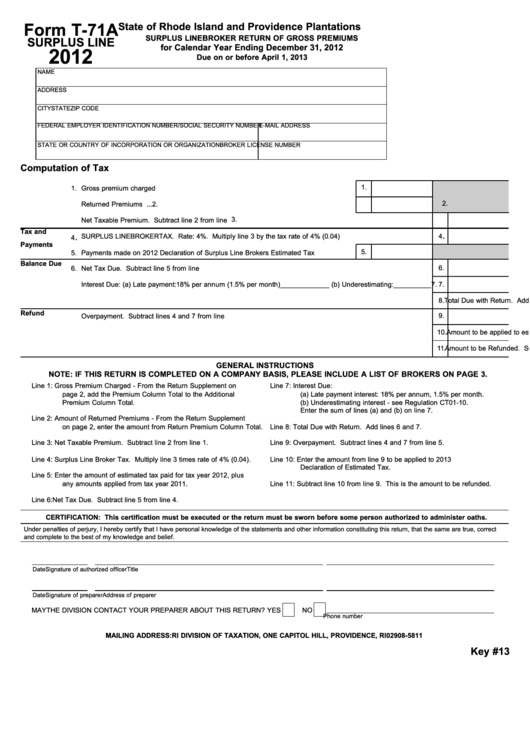

State of Rhode Island and Providence Plantations

Form T-71A

SURPLUS LINE BROKER RETURN OF GROSS PREMIUMS

SURPLUS LINE

for Calendar Year Ending December 31, 2012

2012

Due on or before April 1, 2013

NAME

ADDRESS

CITY

STATE

ZIP CODE

FEDERAL EMPLOYER IDENTIFICATION NUMBER/SOCIAL SECURITY NUMBER

E-MAIL ADDRESS

STATE OR COUNTRY OF INCORPORATION OR ORGANIZATION

BROKER LICENSE NUMBER

Computation of Tax

1.

1.

Gross premium charged .........................................................................................................

2.

2.

Returned Premiums ................................................................................................................

3.

3.

Net Taxable Premium. Subtract line 2 from line 1...........................................................................................................

Tax and

.

.

SURPLUS LINE BROKER TAX. Rate: 4%. Multiply line 3 by the tax rate of 4% (0.04)...............................................

4

4

Payments

5.

5.

Payments made on 2012 Declaration of Surplus Line Brokers Estimated Tax ......................

Balance Due

6.

6.

Net Tax Due. Subtract line 5 from line 4.........................................................................................................................

7.

Interest Due: (a) Late payment:18% per annum (1.5% per month)_____________ (b) Underestimating:__________

7.

8.

Total Due with Return. Add lines 6 and 7 .......................................................................................................................

8.

Refund

9.

9.

Overpayment. Subtract lines 4 and 7 from line 5............................................................................................................

10.

Amount to be applied to estimated tax for calendar year 2013.......................................................................................

10.

11.

Amount to be Refunded. Subtract line 10 from line 9.....................................................................................................

11.

GENERAL INSTRUCTIONS

NOTE: IF THIS RETURN IS COMPLETED ON A COMPANY BASIS, PLEASE INCLUDE A LIST OF BROKERS ON PAGE 3.

Line 1:

Gross Premium Charged - From the Return Supplement on

Line 7:

Interest Due:

page 2, add the Premium Column Total to the Additional

(a) Late payment interest: 18% per annum, 1.5% per month.

Premium Column Total.

(b) Underestimating interest - see Regulation CT01-10.

Enter the sum of lines (a) and (b) on line 7.

Line 2:

Amount of Returned Premiums - From the Return Supplement

on page 2, enter the amount from Return Premium Column Total.

Line 8:

Total Due with Return. Add lines 6 and 7.

Line 3:

Net Taxable Premium. Subtract line 2 from line 1.

Line 9:

Overpayment. Subtract lines 4 and 7 from line 5.

Line 4:

Surplus Line Broker Tax. Multiply line 3 times rate of 4% (0.04).

Line 10: Enter the amount from line 9 to be applied to 2013

Declaration of Estimated Tax.

Line 5:

Enter the amount of estimated tax paid for tax year 2012, plus

any amounts applied from tax year 2011.

Line 11: Subtract line 10 from line 9. This is the amount to be refunded.

Line 6:

Net Tax Due. Subtract line 5 from line 4.

CERTIFICATION: This certification must be executed or the return must be sworn before some person authorized to administer oaths.

Under penalties of perjury, I hereby certify that I have personal knowledge of the statements and other information constituting this return, that the same are true, correct

and complete to the best of my knowledge and belief.

Date

Signature of authorized officer

Title

Date

Signature of preparer

Address of preparer

MAY THE DIVISION CONTACT YOUR PREPARER ABOUT THIS RETURN? YES

NO

Phone number

MAILING ADDRESS: RI DIVISION OF TAXATION, ONE CAPITOL HILL, PROVIDENCE, RI 02908-5811

Key #13

1

1 2

2 3

3