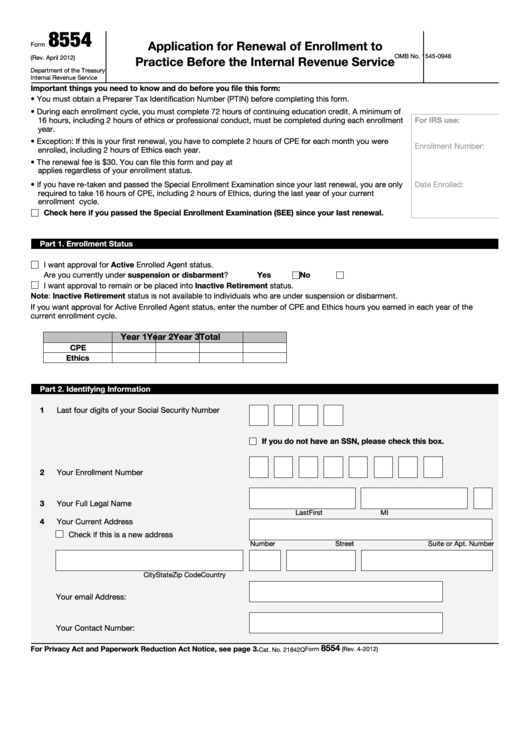

8554

Application for Renewal of Enrollment to

Form

OMB No. 1545-0946

(Rev. April 2012)

Practice Before the Internal Revenue Service

Department of the Treasury

Internal Revenue Service

Important things you need to know and do before you file this form:

• You must obtain a Preparer Tax Identification Number (PTIN) before completing this form.

• During each enrollment cycle, you must complete 72 hours of continuing education credit. A minimum of

16 hours, including 2 hours of ethics or professional conduct, must be completed during each enrollment

For IRS use:

year.

• Exception: If this is your first renewal, you have to complete 2 hours of CPE for each month you were

Enrollment Number:

enrolled, including 2 hours of Ethics each year.

• The renewal fee is $30. You can file this form and pay at This fee is non-refundable and

applies regardless of your enrollment status.

• If you have re-taken and passed the Special Enrollment Examination since your last renewal, you are only

Date Enrolled:

required to take 16 hours of CPE, including 2 hours of Ethics, during the last year of your current

enrollment cycle.

Check here if you passed the Special Enrollment Examination (SEE) since your last renewal.

Part 1. Enrollment Status

I want approval for Active Enrolled Agent status.

Are you currently under suspension or disbarment?

.

.

.

.

.

Yes

No

I want approval to remain or be placed into Inactive Retirement status.

Note: Inactive Retirement status is not available to individuals who are under suspension or disbarment.

If you want approval for Active Enrolled Agent status, enter the number of CPE and Ethics hours you earned in each year of the

current enrollment cycle.

Year 1

Year 2

Year 3

Total

CPE

Ethics

Part 2. Identifying Information

1

Last four digits of your Social Security Number

If you do not have an SSN, please check this box.

2

Your Enrollment Number

3

Your Full Legal Name

Last

First

MI

4

Your Current Address

Check if this is a new address

Number

Street

Suite or Apt. Number

City

State

Zip Code

Country

Your email Address:

Your Contact Number:

8554

For Privacy Act and Paperwork Reduction Act Notice, see page 3.

Form

(Rev. 4-2012)

Cat. No. 21842Q

1

1 2

2 3

3