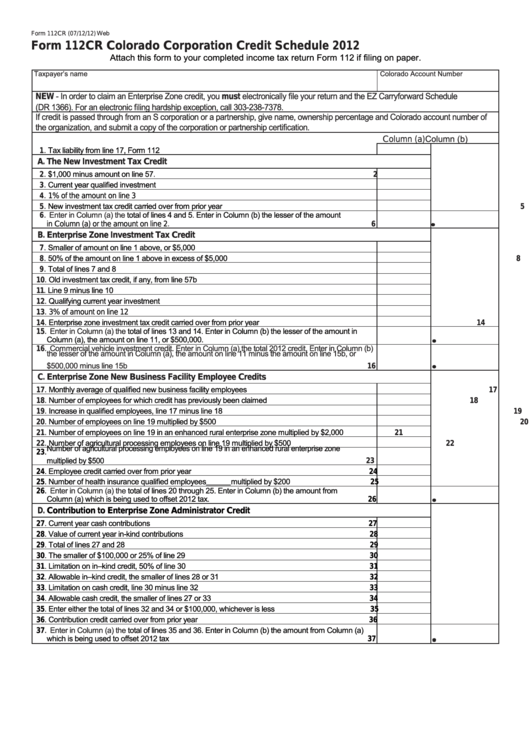

Web

Form 112CR (07/12/12)

Form 112CR

Colorado Corporation Credit Schedule

2012

Attach this form to your completed income tax return Form 112 if filing on paper.

Taxpayer’s name

Colorado Account Number

NEW - In order to claim an Enterprise Zone credit, you must electronically file your return and the EZ Carryforward Schedule

(DR 1366). For an electronic filing hardship exception, call 303-238-7378.

If credit is passed through from an S corporation or a partnership, give name, ownership percentage and Colorado account number of

the organization, and submit a copy of the corporation or partnership certification.

Column (b)

Column (a)

1. Tax liability from line 17, Form 112

1

A. The New Investment Tax Credit

2. $1,000 minus amount on line 57.

2

3. Current year qualified investment

3

4.

1% of the amount on line 3

4

5. New investment tax credit carried over from prior year

5

Enter in Column (a) the total of lines 4 and 5. Enter in Column (b) the lesser of the amount

6.

in Column (a) or the amount on line

2.

6

B. Enterprise Zone Investment Tax Credit

7. Smaller of amount on line 1 above, or $5,000

7

8. 50% of the amount on line 1 above in excess of $5,000

8

9. Total of lines 7 and 8

9

10. Old investment tax credit, if any, from line 57b

10

11. Line 9 minus line 10

11

12. Qualifying current year investment

12

13.

3% of amount on line 12

13

14. Enterprise zone investment tax credit carried over from prior year

14

Enter in Column (a) the total of lines 13 and 14. Enter in Column (b) the lesser of the amount in

15.

Column (a), the amount on line 11, or $500,000.

15

16. Commercial vehicle investment credit. Enter in Column (a) the total 2012 credit. Enter in Column (b)

the lesser of the amount in Column (a), the amount on line 11 minus the amount on line 15b, or

$500,000 minus line 15b

16

C. Enterprise Zone New Business Facility Employee Credits

Monthly average of qualified new business facility employees

17.

17

18. Number of employees for which credit has previously been claimed

18

19. Increase in qualified employees, line 17 minus line 18

19

Number of employees on line 19 multiplied by $500

20.

20

21. Number of employees on line 19 in an enhanced rural enterprise zone multiplied by $2,000

21

22. Number of agricultural processing employees on line 19 multiplied by $500

22

23. Number of agricultural processing employees on line 19 in an enhanced rural enterprise zone

multiplied by $500

23

24

24. Employee credit carried over from prior year

25. Number of health insurance qualified employees ______ multiplied by $200

25

26. Enter in Column (a) the total of lines 20 through 25. Enter in Column (b) the amount from

Column (a) which is being used to offset 2012 tax.

26

D.

Contribution to Enterprise Zone Administrator Credit

27

27. Current year cash contributions

28

28. Value of current year in-kind contributions

29

29. Total of lines 27 and 28

30

30. The smaller of $100,000 or 25% of line 29

31

31. Limitation on in–kind credit, 50% of line 30

32

32. Allowable in–kind credit, the smaller of lines 28 or 31

33

33. Limitation on cash credit, line 30 minus line 32

34

34. Allowable cash credit, the smaller of lines 27 or 33

35

35. Enter either the total of lines 32 and 34 or $100,000, whichever is less

36

36. Contribution credit carried over from prior year

37. Enter in Column (a) the total of lines 35 and 36. Enter in Column (b) the amount from Column (a)

which is being used to offset 2012 tax

37

1

1 2

2