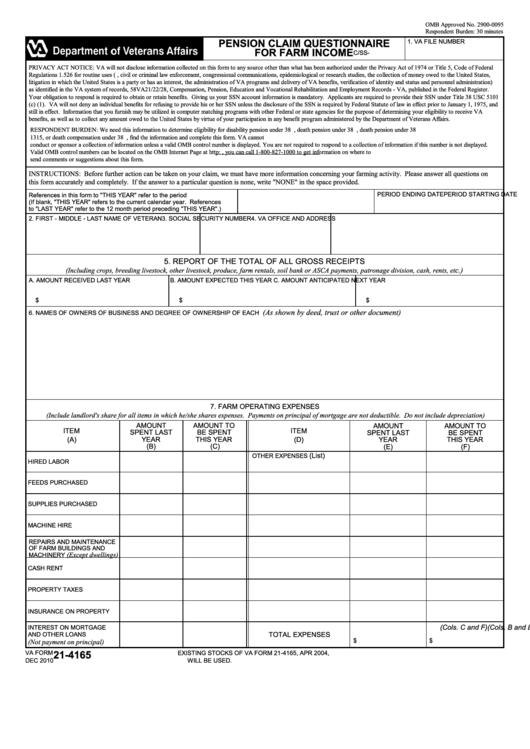

OMB Approved No. 2900-0095

Respondent Burden: 30 minutes

PENSION CLAIM QUESTIONNAIRE

1. VA FILE NUMBER

FOR FARM INCOME

C/SS-

PRIVACY ACT NOTICE: VA will not disclose information collected on this form to any source other than what has been authorized under the Privacy Act of 1974 or Title 5, Code of Federal

Regulations 1.526 for routine uses (i.e., civil or criminal law enforcement, congressional communications, epidemiological or research studies, the collection of money owed to the United States,

litigation in which the United States is a party or has an interest, the administration of VA programs and delivery of VA benefits, verification of identity and status and personnel administration)

as identified in the VA system of records, 58VA21/22/28, Compensation, Pension, Education and Vocational Rehabilitation and Employment Records - VA, published in the Federal Register.

Your obligation to respond is required to obtain or retain benefits. Giving us your SSN account information is mandatory. Applicants are required to provide their SSN under Title 38 USC 5101

(c) (1). VA will not deny an individual benefits for refusing to provide his or her SSN unless the disclosure of the SSN is required by Federal Statute of law in effect prior to January 1, 1975, and

still in effect. Information that you furnish may be utilized in computer matching programs with other Federal or state agencies for the purpose of determining your eligibility to receive VA

benefits, as well as to collect any amount owed to the United States by virtue of your participation in any benefit program administered by the Department of Veterans Affairs.

RESPONDENT BURDEN: We need this information to determine eligibility for disability pension under 38 U.S.C. 1521, death pension under 38 U.S.C. 1521, death pension under 38 U.S.C.

1315, or death compensation under 38 U.S.C. 1121. We estimate that you will need an average 30 minutes to review the instructions, find the information and complete this form. VA cannot

conduct or sponsor a collection of information unless a valid OMB control number is displayed. You are not required to respond to a collection of information if this number is not displayed.

Valid OMB control numbers can be located on the OMB Internet Page at http: If desired, you can call 1-800-827-1000 to get information on where to

send comments or suggestions about this form.

INSTRUCTIONS: Before further action can be taken on your claim, we must have more information concerning your farming activity. Please answer all questions on

this form accurately and completely. If the answer to a particular question is none, write "NONE" in the space provided.

PERIOD STARTING DATE

PERIOD ENDING DATE

References in this form to "THIS YEAR" refer to the period

(If blank, "THIS YEAR" refers to the current calendar year. References

to "LAST YEAR" refer to the 12 month period preceding "THIS YEAR".)

2. FIRST - MIDDLE - LAST NAME OF VETERAN

3. SOCIAL SECURITY NUMBER

4. VA OFFICE AND ADDRESS

5. REPORT OF THE TOTAL OF ALL GROSS RECEIPTS

c.)

(Including crops, breeding livestock, other livestock, produce, farm rentals, soil bank or ASCA payments, patronage division, cash, rents, et

A. AMOUNT RECEIVED LAST YEAR

B. AMOUNT EXPECTED THIS YEAR

C. AMOUNT ANTICIPATED NEXT YEAR

$

$

$

(As shown by deed, trust or other document)

6. NAMES OF OWNERS OF BUSINESS AND DEGREE OF OWNERSHIP OF EACH

7. FARM OPERATING EXPENSES

(Include landlord's share for all items in which he/she shares expenses. Payments on principal of mortgage are not deductible. Do not include depreciation)

AMOUNT

AMOUNT TO

AMOUNT

AMOUNT TO

ITEM

ITEM

SPENT LAST

BE SPENT

SPENT LAST

BE SPENT

YEAR

THIS YEAR

(A)

(D)

YEAR

THIS YEAR

(B)

(C)

(E)

(F)

(List)

OTHER EXPENSES

HIRED LABOR

FEEDS PURCHASED

SUPPLIES PURCHASED

MACHINE HIRE

REPAIRS AND MAINTENANCE

OF FARM BUILDINGS AND

(Except dwellings)

MACHINERY

CASH RENT

PROPERTY TAXES

INSURANCE ON PROPERTY

(Cols. B and E)

(Cols. C and F)

INTEREST ON MORTGAGE

TOTAL EXPENSES

AND OTHER LOANS

(Not payment on principal)

$

$

21-4165

VA FORM

EXISTING STOCKS OF VA FORM 21-4165, APR 2004,

DEC 2010

WILL BE USED.

1

1 2

2