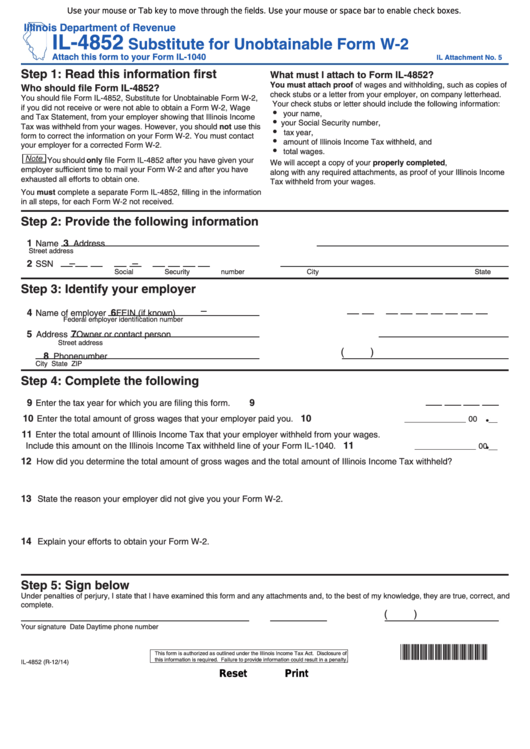

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

IL-4852

Substitute for Unobtainable Form W-2

Attach this form to your Form IL-1040

IL Attachment No. 5

Step 1: Read this information first

What must I attach to Form IL-4852?

You must attach proof of wages and withholding, such as copies of

Who should file Form IL-4852?

check stubs or a letter from your employer, on company letterhead.

You should file Form IL-4852, Substitute for Unobtainable Form W-2,

Your check stubs or letter should include the following information:

if you did not receive or were not able to obtain a Form W-2, Wage

•

your name,

and Tax Statement, from your employer showing that Illinois Income

•

your Social Security number,

Tax was withheld from your wages. However, you should not use this

•

tax year,

form to correct the information on your Form W-2. You must contact

•

amount of Illinois Income Tax withheld, and

your employer for a corrected Form W-2.

•

total wages.

You should only file Form IL-4852 after you have given your

We will accept a copy of your properly completed U.S. Form 4852,

employer sufficient time to mail your Form W-2 and after you have

along with any required attachments, as proof of your Illinois Income

exhausted all efforts to obtain one.

Tax withheld from your wages.

You must complete a separate Form IL-4852, filling in the information

in all steps, for each Form W-2 not received.

Step 2: Provide the following information

1

3

Name

Address

Street address

–

–

2

SSN

Social Security number

City

State

ZIP

Step 3: Identify your employer

–

4

6

Name of employer

FEIN (if known)

Federal employer identification number

5

7

Address

Owner or contact person

Street address

(

)

8

Phone number

City

State

ZIP

Step 4: Complete the following

9

9

Enter the tax year for which you are filing this form.

10

10

Enter the total amount of gross wages that your employer paid you.

______________ 00

11

Enter the total amount of Illinois Income Tax that your employer withheld from your wages.

11

Include this amount on the Illinois Income Tax withheld line of your Form IL-1040.

______________ 00

12

How did you determine the total amount of gross wages and the total amount of Illinois Income Tax withheld?

13

State the reason your employer did not give you your Form W-2.

14

Explain your efforts to obtain your Form W-2.

Step 5: Sign below

Under penalties of perjury, I state that I have examined this form and any attachments and, to the best of my knowledge, they are true, correct, and

complete.

(

)

Your signature

Date

Daytime phone number

*462401110*

This form is authorized as outlined under the Illinois Income Tax Act. Disclosure of

this information is required. Failure to provide information could result in a penalty.

IL-4852 (R-12/14)

Reset

Print

1

1