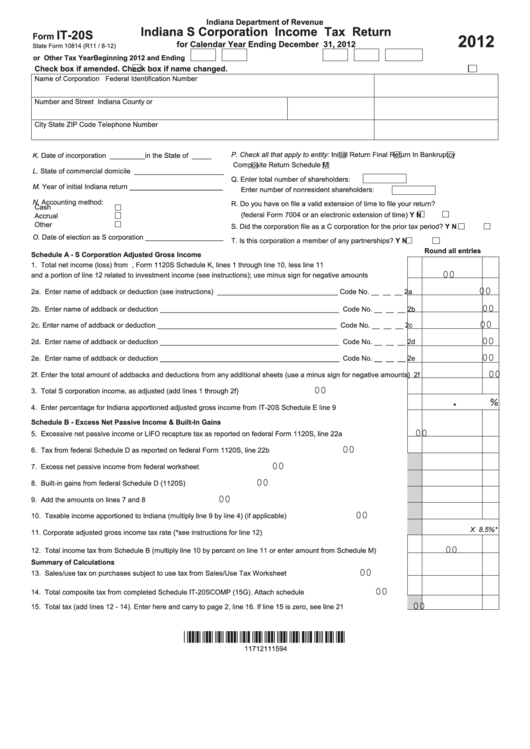

Indiana Department of Revenue

Indiana S Corporation Income Tax Return

IT-20S

Form

2012

for Calendar Year Ending December 31, 2012

State Form 10814 (R11 / 8-12)

or Other Tax YearBeginning

2012 and Ending

Check box if amended.

Check box if name changed.

Name of Corporation

Federal Identification Number

Number and Street

Indiana County or O.O.S.

Principal Business Activity Code

City

State

ZIP Code

Telephone Number

P. Check all that apply to entity:

Initial Return

Final Return

In Bankruptcy

K. Date of incorporation

_________in the State of

_____

Composite Return

Schedule M

L. State of commercial domicile _______________________

Q. Enter total number of shareholders:

M. Year of initial Indiana return ________________________

Enter number of nonresident shareholders:

N. Accounting method:

R. Do you have on file a valid extension of time to file your return?

Cash

(federal Form 7004 or an electronic extension of time)

Y

N

Accrual

Other

S. Did the corporation file as a C corporation for the prior tax period?

Y

N

O. Date of election as S corporation ____________________

T. Is this corporation a member of any partnerships?

Y

N

Round all entries

Schedule A - S Corporation Adjusted Gross Income

1. Total net income (loss) from U.S. S corporation return, Form 1120S Schedule K, lines 1 through line 10, less line 11

00

and a portion of line 12 related to investment income (see instructions); use minus sign for negative amounts ............. 1

00

2a. Enter name of addback or deduction (see instructions) _______________________________ Code No. __ __ __

2a

00

2b. Enter name of addback or deduction ______________________________________________ Code No. __ __ __

2b

00

2c. Enter name of addback or deduction ______________________________________________ Code No. __ __ __

2c

00

2d. Enter name of addback or deduction ______________________________________________ Code No. __ __ __

2d

00

2e. Enter name of addback or deduction ______________________________________________ Code No. __ __ __

2e

00

2f. Enter the total amount of addbacks and deductions from any additional sheets (use a minus sign for negative amounts)

2f

00

3. Total S corporation income, as adjusted (add lines 1 through 2f) ...................................................................................

3

.

%

4. Enter percentage for Indiana apportioned adjusted gross income from IT-20S Schedule E line 9 .................................

4

Schedule B - Excess Net Passive Income & Built-In Gains

00

5. Excessive net passive income or LIFO recapture tax as reported on federal Form 1120S, line 22a ...............................

5

00

6. Tax from federal Schedule D as reported on federal Form 1120S, line 22b .....................................................................

6

00

7. Excess net passive income from federal worksheet ........................................................................................................

7

00

8. Built-in gains from federal Schedule D (1120S)................................................................................................................

8

00

9. Add the amounts on lines 7 and 8 ....................................................................................................................................

9

00

10. Taxable income apportioned to Indiana (multiply line 9 by line 4) (if applicable) ..............................................................

10

X 8.5%*

11. Corporate adjusted gross income tax rate (*see instructions for line 12) .........................................................................

11

00

12. Total income tax from Schedule B (multiply line 10 by percent on line 11 or enter amount from Schedule M) ................

12

Summary of Calculations

00

13. Sales/use tax on purchases subject to use tax from Sales/Use Tax Worksheet ............................................................

13

00

14. Total composite tax from completed Schedule IT-20SCOMP (15G). Attach schedule ....................................................

14

00

15. Total tax (add lines 12 - 14). Enter here and carry to page 2, line 16. If line 15 is zero, see line 21 ................................

15

*11712111594*

11712111594

1

1 2

2 3

3 4

4 5

5 6

6 7

7