2015

Form 1040-V

Department of the Treasury

Internal Revenue Service

What Is Form 1040-V

• To help us process your payment, enter the amount on

the right side of your check like this: $ XXX.XX. Do not

It is a statement you send with your check or money

use dashes or lines (for example, do not enter “$ XXX—”

order for any balance due on the “Amount you owe” line

or “$ XXX

”).

/

xx

100

of your 2015 Form 1040, Form 1040A, or Form 1040EZ.

How To Send In Your 2015 Tax Return,

Consider Making Your Tax Payment

Payment, and Form 1040-V

Electronically—It's Easy

• Do not staple or otherwise attach your payment or Form

You can make electronic payments online, by phone, or

1040-V to your return. Instead, just put them loose in the

from a mobile device. Paying electronically is safe and

envelope.

secure. When you schedule your payment you will receive

• Mail your 2015 tax return, payment, and Form 1040-V in

immediate confirmation from the IRS. Go to

the large envelope that came with this package.

payments to see all your electronic payment options.

How To Fill In Form 1040-V

How To Pay Electronically

Line 1. Enter your social security number (SSN). If you are

Pay Online

filing a joint return, enter the SSN shown first on your

Paying online is convenient, secure, and helps make sure

return.

we get your payments on time. You can pay using either

Line 2. If you are filing a joint return, enter the SSN shown

of the following electronic payment methods. To pay your

second on your return.

taxes online or for more information, go to

Line 3. Enter the amount you are paying by check or

payments.

money order.

Direct Pay

Line 4. Enter your name(s) and address exactly as shown

Pay your taxes directly from your checking or savings

on your return. Please print clearly.

account at no cost to you. You receive instant

How To Prepare Your Payment

confirmation that your payment has been made, and you

can schedule your payment up to 30 days in advance.

• Make your check or money order payable to “United

States Treasury.” Do not send cash.

Debit or Credit Card

• Make sure your name and address appear on your

The IRS does not charge a fee for this service; the card

check or money order.

processors do. The authorized card processors and their

phone numbers are all on payments.

• Enter your daytime phone number and your SSN on

your check or money order. If you have an Individual

Taxpayer Identification Number (ITIN), enter it wherever

your SSN is requested. If you are filing a joint return, enter

the SSN shown first on your return. Also enter “2015

Form 1040,” “2015 Form 1040A,” or “2015 Form

1040EZ,” whichever is appropriate.

1040-V

Form

(2015)

Cat. No. 20975C

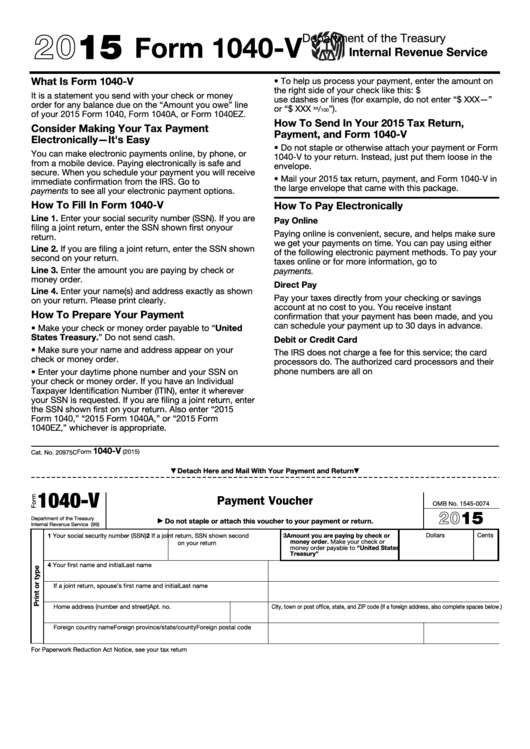

Detach Here and Mail With Your Payment and Return

▼

▼

1040-V

Payment Voucher

OMB No. 1545-0074

2015

Department of the Treasury

Do not staple or attach this voucher to your payment or return.

▶

Internal Revenue Service (99)

Dollars

Cents

1 Your social security number (SSN)

2 If a joint return, SSN shown second

3 Amount you are paying by check or

money order. Make your check or

on your return

money order payable to “United States

Treasury”

4 Your first name and initial

Last name

If a joint return, spouse’s first name and initial

Last name

Home address (number and street)

Apt. no.

City, town or post office, state, and ZIP code (If a foreign address, also complete spaces below.)

Foreign country name

Foreign province/state/county

Foreign postal code

For Paperwork Reduction Act Notice, see your tax return instructions.

Cat. No. 20975C

1

1 2

2