Form Ct-400 - Estimated Tax For Corporations

ADVERTISEMENT

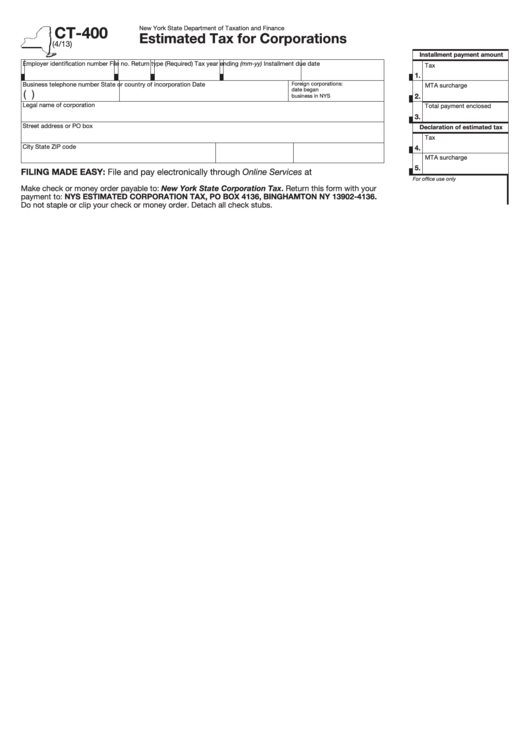

CT-400

New York State Department of Taxation and Finance

Estimated Tax for Corporations

(4/13)

Installment payment amount

Employer identification number

File no.

Return type (Required)

Tax year ending (mm-yy)

Installment due date

Tax

1.

Business telephone number

State or country of incorporation

Date

Foreign corporations:

MTA surcharge

date began

(

)

2.

business in NYS

Legal name of corporation

Total payment enclosed

3.

Street address or PO box

Declaration of estimated tax

Tax

City

State

ZIP code

4.

MTA surcharge

5.

FILING MADE EASY: File and pay electronically through Online Services at

For office use only

Make check or money order payable to: New York State Corporation Tax. Return this form with your

payment to: NYS ESTIMATED CORPORATION TAX, PO BOX 4136, BINGHAMTON NY 13902-4136.

Do not staple or clip your check or money order. Detach all check stubs.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1