4

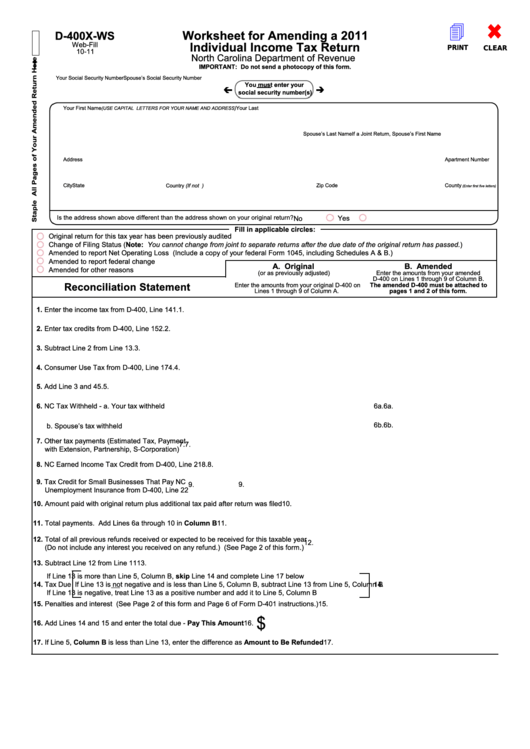

Worksheet for Amending a 2011

D-400X-WS

Individual Income Tax Return

Web-Fill

PRINT

CLEAR

10-11

North Carolina Department of Revenue

IMPORTANT: Do not send a photocopy of this form.

Your Social Security Number

Spouse’s Social Security Number

You must enter your

social security number(s)

Your First Name

M.I.

Your Last Name

(USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

If a Joint Return, Spouse’s First Name

M.I.

Spouse’s Last Name

Address

Apartment Number

City

State

Zip Code

County

Country (If not U.S.)

(Enter first five letters)

Is the address shown above different than the address shown on your original return?

Yes

No

Fill in applicable circles:

Original return for this tax year has been previously audited

Change of Filing Status (Note: You cannot change from joint to separate returns after the due date of the original return has passed.)

Amended to report Net Operating Loss (Include a copy of your federal Form 1045, including Schedules A & B.)

Amended to report federal change

A. Original

B. Amended

Amended for other reasons

(or as previously adjusted)

Enter the amounts from your amended

D-400 on Lines 1 through 9 of Column B.

Reconciliation Statement

Enter the amounts from your original D-400 on

The amended D-400 must be attached to

Lines 1 through 9 of Column A.

pages 1 and 2 of this form.

1. Enter the income tax from D-400, Line 14

1.

1.

2. Enter tax credits from D-400, Line 15

2.

2.

3. Subtract Line 2 from Line 1

3.

3.

4. Consumer Use Tax from D-400, Line 17

4.

4.

5.

5.

5. Add Line 3 and 4

6. NC Tax Withheld - a. Your tax withheld

6a.

6a.

6b.

6b.

b. Spouse’s tax withheld

7. Other tax payments (Estimated Tax, Payment

7.

7.

with Extension, Partnership, S-Corporation)

8. NC Earned Income Tax Credit from D-400, Line 21

8.

8.

9. Tax Credit for Small Businesses That Pay NC

9.

9.

Unemployment Insurance from D-400, Line 22

10. Amount paid with original return plus additional tax paid after return was filed

10.

11. Total payments. Add Lines 6a through 10 in Column B

11.

12. Total of all previous refunds received or expected to be received for this taxable year

12.

(Do not include any interest you received on any refund.) (See Page 2 of this form.)

13. Subtract Line 12 from Line 11

13.

If Line 13 is more than Line 5, Column B, skip Line 14 and complete Line 17 below

14.

Tax Due If Line 13 is not negative and is less than Line 5, Column B, subtract Line 13 from Line 5, Column B

14.

If Line 13 is negative, treat Line 13 as a positive number and add it to Line 5, Column B

15. Penalties and interest (See Page 2 of this form and Page 6 of Form D-401 instructions.)

15.

$

16. Add Lines 14 and 15 and enter the total due - Pay This Amount

16.

17. If Line 5, Column B is less than Line 13, enter the difference as Amount to Be Refunded

17.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8