Clear Form

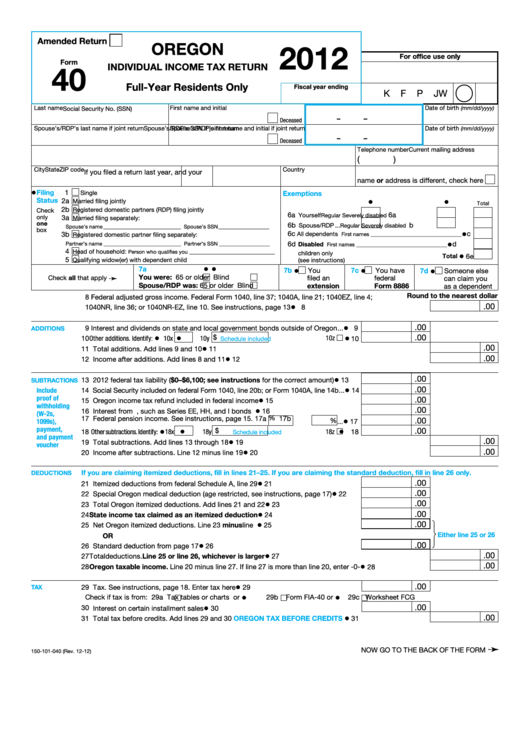

Amended Return

OREGON

2012

For office use only

Form

40

INDIVIDUAL INCOME TAX RETURN

Full-Year Residents Only

Fiscal year ending

K

F

P

J

W

Last name

First name and initial

Date of birth

(mm/dd/yyyy)

Social Security No. (SSN)

–

–

Deceased

Spouse’s/RDP’s last name if joint return

Spouse’s/RDP’s first name and initial if joint return

Spouse’s/RDP’s SSN if joint return

Date of birth

(mm/dd/yyyy)

–

–

Deceased

Current mailing address

Telephone number

(

)

City

State

ZIP code

Country

If you filed a return last year, and your

name or address is different, check here

•

Filing

1

Exemptions

Single

Status

•

•

2a

Married filing jointly

Total

2b

Registered domestic partners (RDP) filing jointly

Check

6a

6a

Yourself ...........

Regular

...... Severely disabled

....

only

3a

Married filing separately:

one

6b

b

Spouse/RDP ...

Regular

...... Severely disabled

......

Spouse’s name _____________________________ Spouse’s SSN ___________________

box

3b

•

Registered domestic partner filing separately:

6c

c

All dependents

First names __________________________________

Partner’s name _____________________________ Partner’s SSN ___________________

•

6d

d

Disabled

First names __________________________________

4

Head of household:

Person who qualifies you ________________________________

children only

•

Total

6e

5

Qualifying widow(er) with dependent child

(see instructions)

•

•

•

•

•

7a

7b

You

7c

You have

7d

Someone else

You were:

65 or older

Blind

Check all that apply

➛

filed an

federal

can claim you

Spouse/RDP was:

65 or older

Blind

extension

Form 8886

as a dependent

Round to the nearest dollar

8 Federal adjusted gross income. Federal Form 1040, line 37; 1040A, line 21; 1040EZ, line 4;

•

.00

1040NR, line 36; or 1040NR-EZ, line 10. See instructions, page 13 ...........................................................

8

•

.00

9 Interest and dividends on state and local government bonds outside of Oregon ...

9

ADDITIONS

•

.00

•

•

10y $

10 Other additions. Identify:

10x

10z

10

Schedule included

•

.00

11 Total additions. Add lines 9 and 10 .............................................................................................................

11

•

.00

12 Income after additions. Add lines 8 and 11 .................................................................................................

12

•

.00

13 2012 federal tax liability ($0–$6,100; see instructions for the correct amount) .....

13

SUBTRACTIONS

•

.00

Include

14 Social Security included on federal Form 1040, line 20b; or Form 1040A, line 14b ...

14

proof of

•

.00

15 Oregon income tax refund included in federal income ............................................

15

withholding

•

.00

16 Interest from U.S. government, such as Series EE, HH, and I bonds .....................

16

(W-2s,

•

.00

% ...

% 17b

1099s),

17 Federal pension income. See instructions, page 15. 17a

17

payment,

•

•

•

.00

18y $

18 Other subtractions. Identify:

18x

18z

18

Schedule included

and payment

•

.00

19 Total subtractions. Add lines 13 through 18 ................................................................................................

19

voucher

•

.00

20 Income after subtractions. Line 12 minus line 19 ........................................................................................

20

If you are claiming itemized deductions, fill in lines 21–25. If you are claiming the standard deduction, fill in line 26 only.

DEDUCTIONS

•

.00

21 Itemized deductions from federal Schedule A, line 29 ............................................

21

•

.00

22 Special Oregon medical deduction (age restricted, see instructions, page 17) ......

22

•

.00

23 Total Oregon itemized deductions. Add lines 21 and 22 .........................................

23

•

.00

24 State income tax claimed as an itemized deduction ..........................................

24

•

.00

25 Net Oregon itemized deductions. Line 23 minus line 24.........................................

25

Either line 25 or 26

OR

•

.00

26 Standard deduction from page 17 ...........................................................................

26

•

.00

27 Total deductions. Line 25 or line 26, whichever is larger .........................................................................

27

•

.00

28 Oregon taxable income. Line 20 minus line 27. If line 27 is more than line 20, enter -0- .........................

28

•

.00

TAX

29 Tax. See instructions, page 18. Enter tax here ........................................................

29

•

•

Check if tax is from: 29a

Tax tables or charts or

29b

Form FIA-40 or

29c

Worksheet FCG

•

.00

30 Interest on certain installment sales .........................................................................

30

•

.00

31 Total tax before credits. Add lines 29 and 30 ...................................

OREGON TAX BEFORE CREDITS

31

➛

NOW GO TO THE BACK OF THE FORM

150-101-040 (Rev. 12-12)

1

1 2

2