Reset Form

IT/SD 2210 Long

Rev. 8/12

10211411

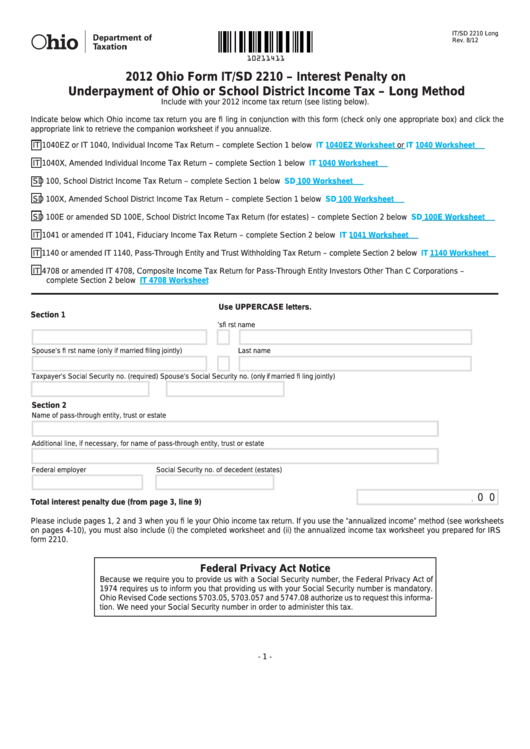

2012 Ohio Form IT/SD 2210 – Interest Penalty on

Underpayment of Ohio or School District Income Tax – Long Method

Include with your 2012 income tax return (see listing below).

Indicate below which Ohio income tax return you are fi ling in conjunction with this form (check only one appropriate box) and click the

appropriate link to retrieve the companion worksheet if you annualize.

IT 1040EZ or IT 1040, Individual Income Tax Return – complete Section 1 below

IT 1040EZ Worksheet

or

IT 1040 Worksheet

IT 1040X, Amended Individual Income Tax Return – complete Section 1 below

IT 1040 Worksheet

SD 100, School District Income Tax Return – complete Section 1 below

SD 100 Worksheet

SD 100X, Amended School District Income Tax Return – complete Section 1 below

SD 100 Worksheet

SD 100E or amended SD 100E, School District Income Tax Return (for estates) – complete Section 2 below

SD 100E Worksheet

IT 1041 or amended IT 1041, Fiduciary Income Tax Return – complete Section 2 below

IT 1041 Worksheet

IT 1140 or amended IT 1140, Pass-Through Entity and Trust Withholding Tax Return – complete Section 2 below

IT 1140 Worksheet

IT 4708 or amended IT 4708, Composite Income Tax Return for Pass-Through Entity Investors Other Than C Corporations –

complete Section 2 below

IT 4708 Worksheet

Use UPPERCASE letters.

Section 1

Taxpayer’s fi rst name

M.I.

Last name

Spouse’s fi rst name (only if married fi ling jointly)

M.I.

Last name

Taxpayer’s Social Security no. (required)

Spouse’s Social Security no. (only if married fi ling jointly)

Section 2

Name of pass-through entity, trust or estate

Additional line, if necessary, for name of pass-through entity, trust or estate

Federal employer I.D. number

Social Security no. of decedent (estates)

.

0 0

Total interest penalty due (from page 3, line 9) ......................................................................

Please include pages 1, 2 and 3 when you fi le your Ohio income tax return. If you use the “annualized income” method (see worksheets

on pages 4-10), you must also include (i) the completed worksheet and (ii) the annualized income tax worksheet you prepared for IRS

form 2210.

Federal Privacy Act Notice

Because we require you to provide us with a Social Security number, the Federal Privacy Act of

1974 requires us to inform you that providing us with your Social Security number is mandatory.

Ohio Revised Code sections 5703.05, 5703.057 and 5747.08 authorize us to request this informa-

tion. We need your Social Security number in order to administer this tax.

- 1 -

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14