Schedule M1h - Health Insurance Subtraction For Self-Employed - Minnesota Department Of Revenue - 2002

ADVERTISEMENT

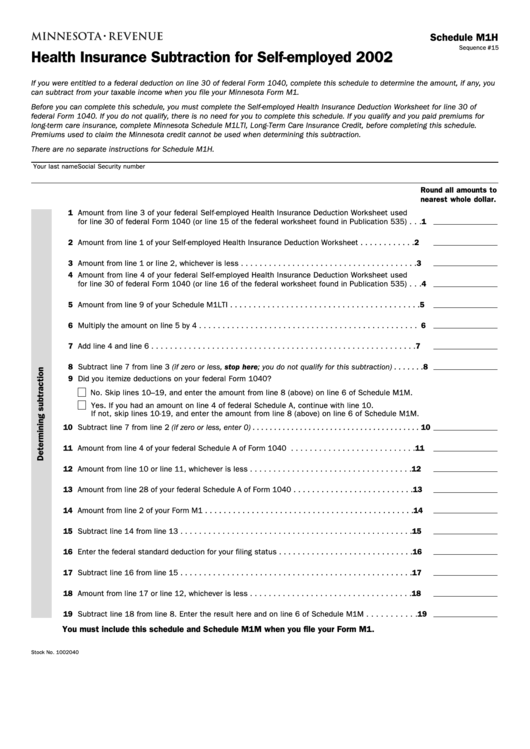

Schedule M1H

Sequence #15

Health Insurance Subtraction for Self-employed 2002

If you were entitled to a federal deduction on line 30 of federal Form 1040, complete this schedule to determine the amount, if any, you

can subtract from your taxable income when you file your Minnesota Form M1.

Before you can complete this schedule, you must complete the Self-employed Health Insurance Deduction Worksheet for line 30 of

federal Form 1040. If you do not qualify, there is no need for you to complete this schedule. If you qualify and you paid premiums for

long-term care insurance, complete Minnesota Schedule M1LTI, Long-Term Care Insurance Credit, before completing this schedule.

Premiums used to claim the Minnesota credit cannot be used when determining this subtraction.

There are no separate instructions for Schedule M1H.

Your last name

Social Security number

Round all amounts to

nearest whole dollar.

1 Amount from line 3 of your federal Self-employed Health Insurance Deduction Worksheet used

for line 30 of federal Form 1040 (or line 15 of the federal worksheet found in Publication 535) . . . 1

2 Amount from line 1 of your Self-employed Health Insurance Deduction Worksheet . . . . . . . . . . . . 2

3 Amount from line 1 or line 2, whichever is less . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Amount from line 4 of your federal Self-employed Health Insurance Deduction Worksheet used

for line 30 of federal Form 1040 (or line 16 of the federal worksheet found in Publication 535) . . . 4

5 Amount from line 9 of your Schedule M1LTI . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Multiply the amount on line 5 by 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Add line 4 and line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Subtract line 7 from line 3 (if zero or less, stop here; you do not qualify for this subtraction) . . . . . . . 8

9 Did you itemize deductions on your federal Form 1040?

No. Skip lines 10–19, and enter the amount from line 8 (above) on line 6 of Schedule M1M.

Yes. If you had an amount on line 4 of federal Schedule A, continue with line 10.

If not, skip lines 10-19, and enter the amount from line 8 (above) on line 6 of Schedule M1M.

10 Subtract line 7 from line 2 (if zero or less, enter 0) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Amount from line 4 of your federal Schedule A of Form 1040 . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Amount from line 10 or line 11, whichever is less . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Amount from line 28 of your federal Schedule A of Form 1040 . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Amount from line 2 of your Form M1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Subtract line 14 from line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Enter the federal standard deduction for your filing status . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Subtract line 16 from line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Amount from line 17 or line 12, whichever is less . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Subtract line 18 from line 8. Enter the result here and on line 6 of Schedule M1M . . . . . . . . . . . 19

You must include this schedule and Schedule M1M when you file your Form M1.

Stock No. 1002040

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1